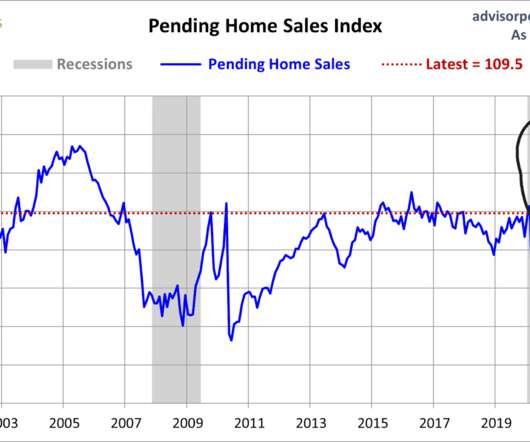

Pending home sales surged in December: NAR

Housing Wire

JANUARY 26, 2024

month over month in December, according to the newest data from the National Association of Realtors (NAR). For comparison, the index is benchmarked at a reading of 100 based on 2001 contract activity. New home sales , another measure of contract signings, rose 8% in December on the back of declining mortgage rates.

Let's personalize your content