The top 10 reverse mortgage lenders of 2023

Housing Wire

JANUARY 22, 2024

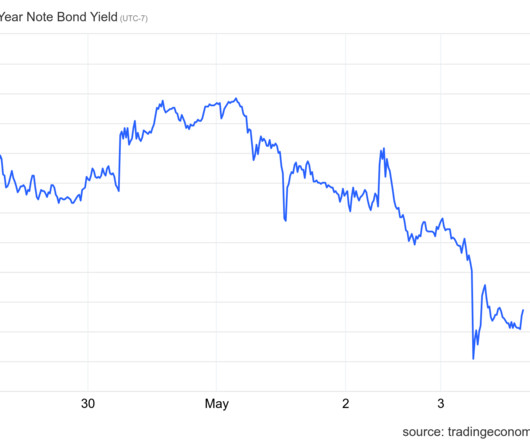

After a year of challenge in the reverse mortgage industry, the major lenders in the industry look a bit different for calendar year 2023 when compared with recent years past. Reduced volume, a challenging mortgage rate environment and industry consolidation has contributed to some of the broader changes.

Let's personalize your content