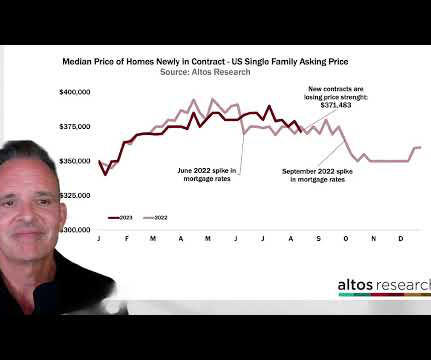

Real estate’s strong 2023 housing market finish: Altos

Housing Wire

JANUARY 2, 2024

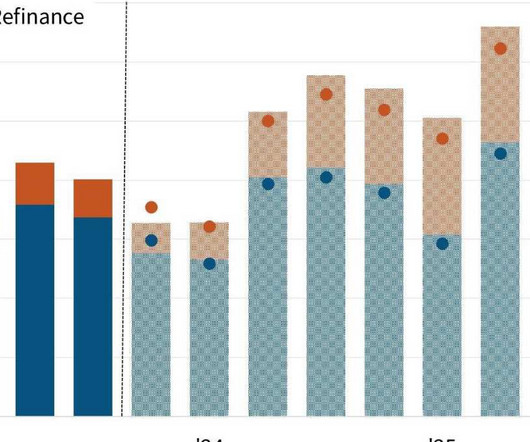

We have more homes going into contract each week now than we did a year ago — supply and demand are climbing together. This implies that there are more than enough buyers at these prices and these mortgage rates to keep activity happening in housing. Each week sellers are easing back into the market a little more than last year.

Let's personalize your content