Second-home mortgage market slumped in 2023: Redfin

Housing Wire

MAY 13, 2024

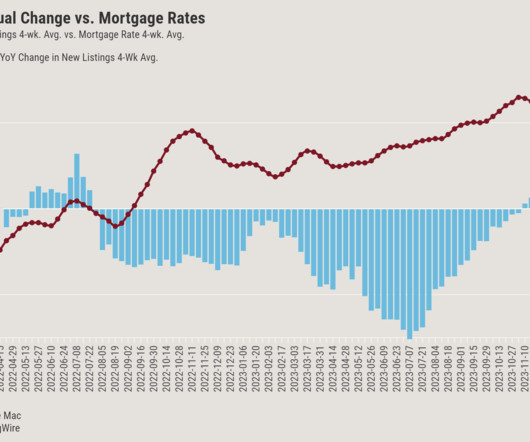

In 2023, home purchases slowed across the board due to low levels of inventory, high mortgage rates and soaring home prices. Nationwide, 90,772 mortgages for second homes were originated in 2023, down 40% from a year earlier and down 65% from the height of the post-pandemic housing boom in 2021, according to a new report from Redfin.

Let's personalize your content