Investor Sentiments Predict Tight Inventory, Inflation into 2022

Appraisal Buzz

FEBRUARY 7, 2022

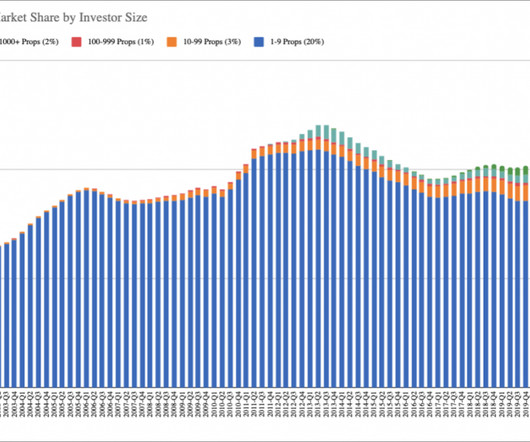

The latest edition of the RealtyTrac Investor Sentiment Survey has confirmed something many investors already knew: the real estate market is in a worse place than it was a year ago. The post Investor Sentiments Predict Tight Inventory, Inflation into 2022 appeared first on Appraisal Buzz.

Let's personalize your content