Opinion: The end of seller speculation in US housing market

Housing Wire

JULY 29, 2022

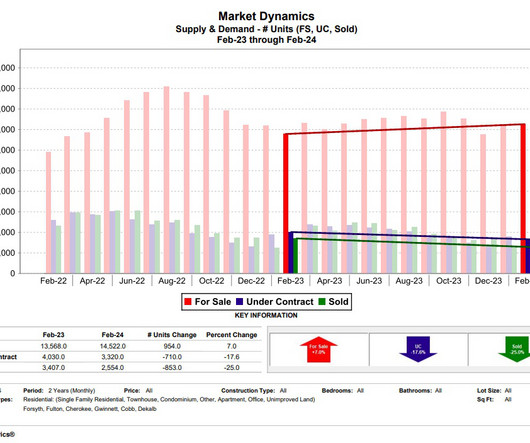

metropolitan areas in February 2022, based on year-over-year growth in median listing price according to the residential real estate listing website, Realtor.com. Table 1: 10 Hottest Housing Markets out of the Top 250 Metro Areas, February 2022. Table 2: 10 Hottest Housing Markets out of the Top 250 Metro Areas, June 2022.

Let's personalize your content