Why mortgage lending standards will ease in 2021

Housing Wire

FEBRUARY 3, 2021

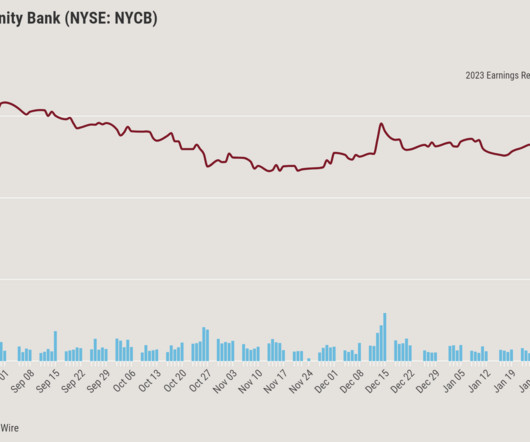

Economists and housing experts say mortgage lending standards will likely loosen in 2021, despite the increased risk of delinquencies ahead. The post Why mortgage lending standards will ease in 2021 appeared first on HousingWire. Such a scenario illustrates the growing disparities in the U.S.

Let's personalize your content