Experts optimistic about home sales in 2021

Housing Wire

JANUARY 29, 2021

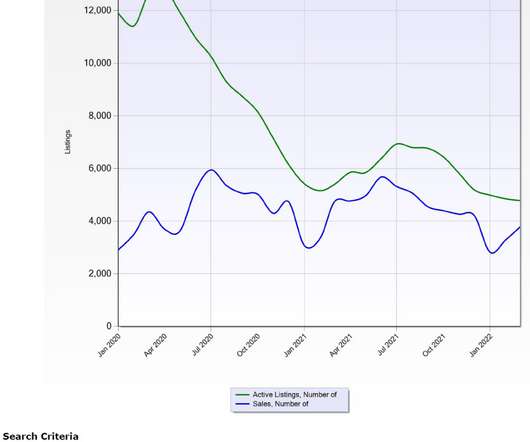

However, contract signings rose 21.4% Realtor.com’s Housing Market Recovery Index showed significant contract growth, specifically in Portland, Las Vegas, Denver, Los Angeles, and Boston. There is a high demand for housing and a great number of would-be buyers, and therefore sales should rise with more new listings,” Yun said.

Let's personalize your content