Redfin: New Listings Continue to Increase, Bringing Some Buyers Back to Market

Appraisal Buzz

MARCH 26, 2024

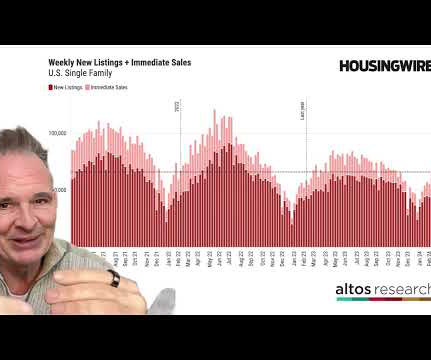

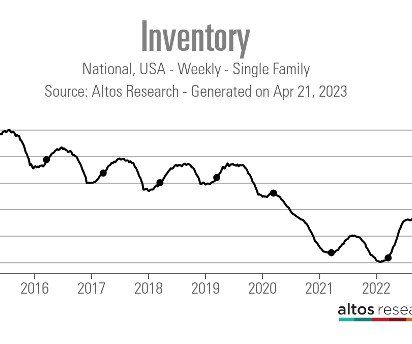

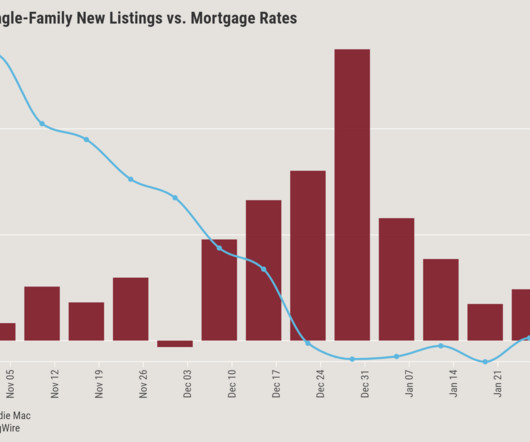

As of March 17, there were roughly 795,645 active listings. There were roughly 88,902 new listings added during that same four weeks – and increase of 15% and the biggest increase since June 2021. The surge in listings is bringing some buyers back to the market, the firm says. The median U.S.

Let's personalize your content