The 2023 housing market bent, but didn’t break

Housing Wire

DECEMBER 23, 2023

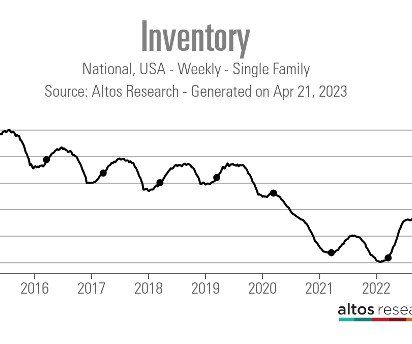

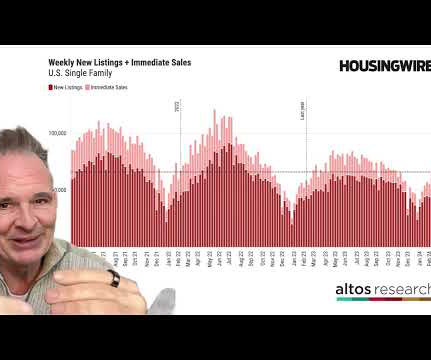

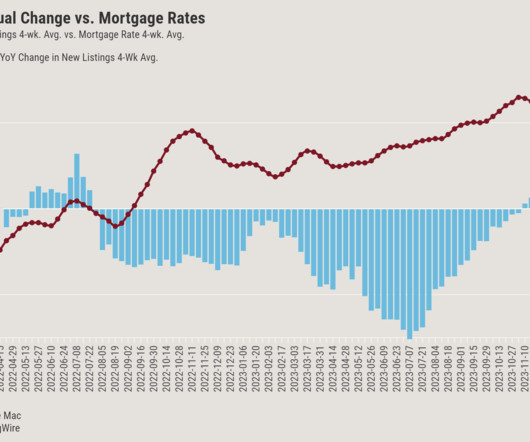

housing market and that they need to be pro-housing again. Even with all the drama we have dealt with in 2022-2023, the housing market stayed intact and never broke. However, one thing is sure: from 2020 to 2023 we never saw credit-stressed home sellers. Weekly inventory change : (Dec.15-22)

Let's personalize your content