Redfin: Declining Home Affordability is Hitting America’s Low-Income Buyers Hardest

Appraisal Buzz

MAY 6, 2024

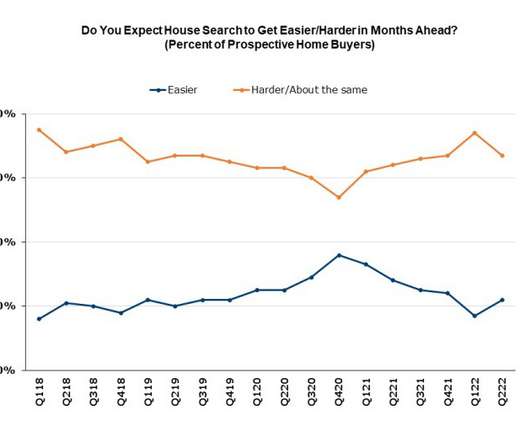

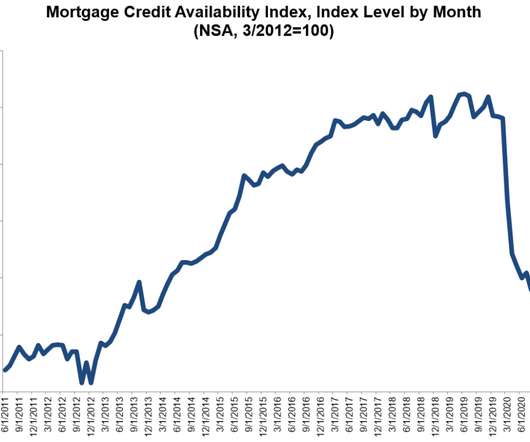

The progress that was made in providing mortgages to to a higher percentage of low-income homebuyers during the pandemic years has been reversed in the past two years due to higher mortgage rates and rising home prices, a report from Redfin shows. Low-income earners gained ground at the start of the pandemic, taking out 23.2%

Let's personalize your content