Housing Market Tracker: Mortgage rates drop almost 1%

Housing Wire

APRIL 9, 2023

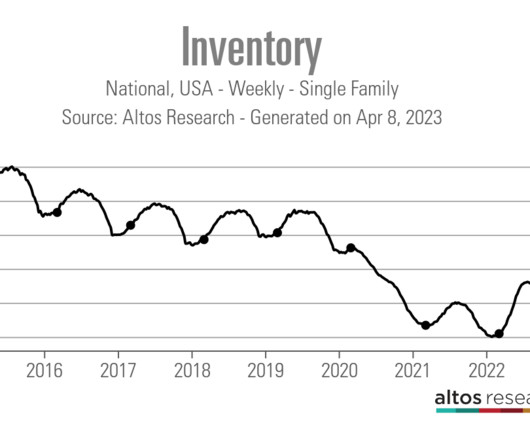

The housing market welcomed the news of lower mortgage rates last week after four reports showed that the labor market isn’t as tight as it seems and that the fear of 1970s-entrenched inflation was a lousy narrative. Active inventory rose by 823 single-family homes and new listing data is trending at all-time lows.

Let's personalize your content