Is housing market demand starting to weaken?

Housing Wire

MAY 21, 2021

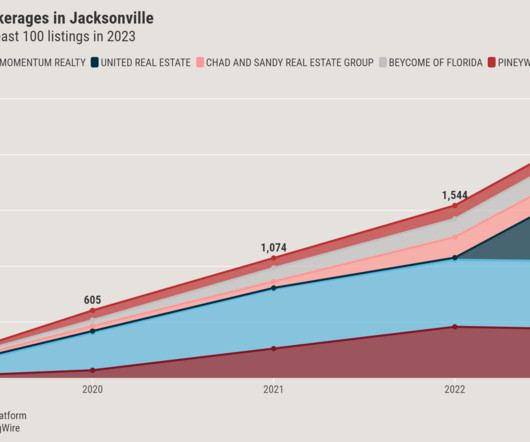

Nearly 50% of homes sold for more than their list price during the four weeks ending May 16, but there are signs that housing market demand may be reaching its peak, according to a recent study from Redfin. 2019 is being used as a reference point since 2020 data is skewed by the pandemic.). from a year ago.

Let's personalize your content