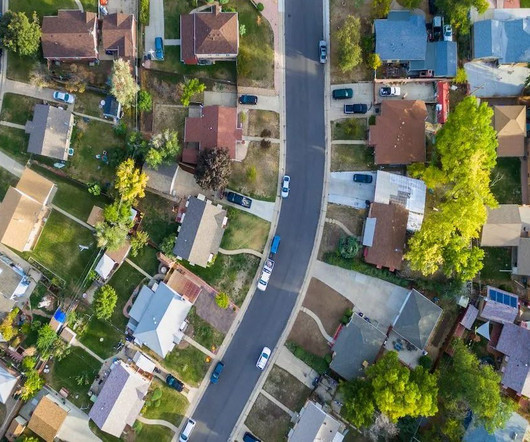

Buyers are struggling to compete in the white-hot Cincinnati market

Housing Wire

APRIL 25, 2024

“I called the listing agent and it was listed three hours ago, but it was sold,” the Cincinnati, Ohio -based eXp Realty agent said. “We There is no way you can stay on top of things unless you hire someone to watch new listings pop up every 10 minutes. Buyers are really struggling.” We couldn’t even see it.

Let's personalize your content