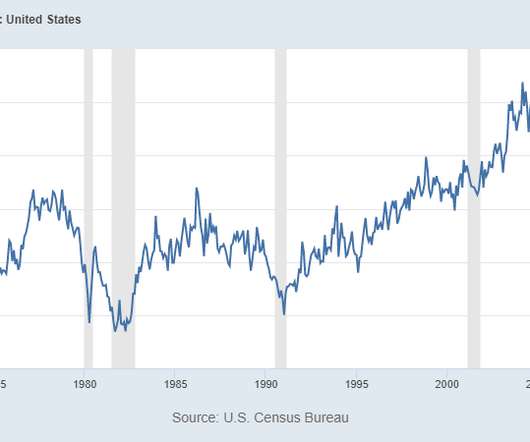

Home-price index gains the most since 2018

Housing Wire

SEPTEMBER 29, 2020

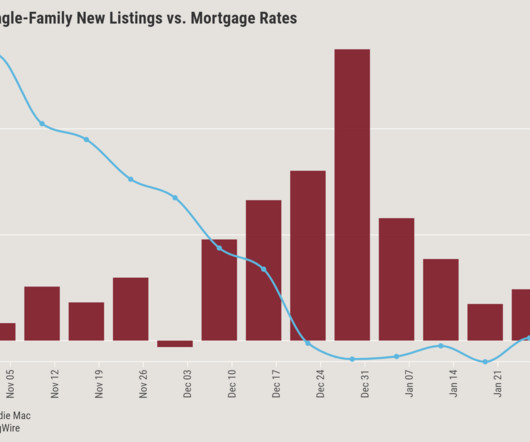

in July from a year ago, the biggest advance since 2018, as rock-bottom mortgage rates made it possible for people to bid higher for properties. advance in the prior month, and it was the largest annual gain since December 2018. The post Home-price index gains the most since 2018 appeared first on HousingWire.

Let's personalize your content