The housing market is 6.5 million units short: Realtor.com

Housing Wire

MARCH 8, 2023

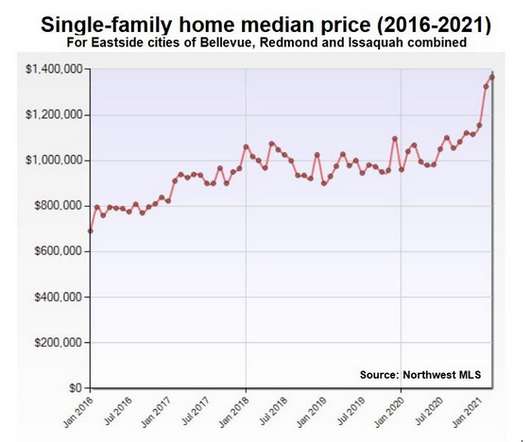

It is no secret that the housing market is suffering from an ongoing inventory drought. Existing housing inventory fell by 11,021 homes week over week for the week ending March 6, according to data from Altos Research. This resulted in the gap between single family home construction and household formation growing to 6.5

Let's personalize your content