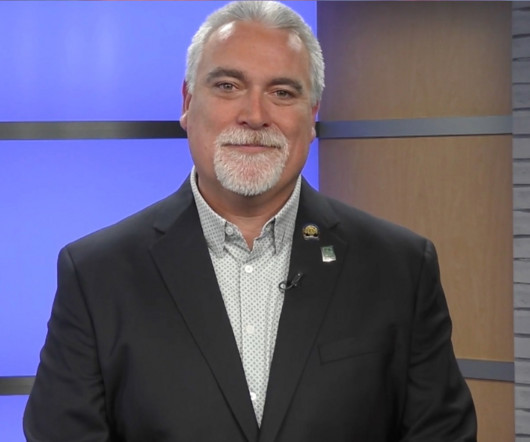

No, Wall Street investors haven’t bought 44% of homes this year

Housing Wire

DECEMBER 10, 2023

Are big Wall Street investors really buying 44% of homes this year? Housing inventory is near all-time lows, but big institutional investors like Invitation Homes or BlackRock aren’t to blame. You can see the percentage of home-buying by big investors — those with 1,000 properties or more — is tiny. of market share in Q2.

Let's personalize your content