How housing credit is shaping housing inventory

Housing Wire

MAY 8, 2024

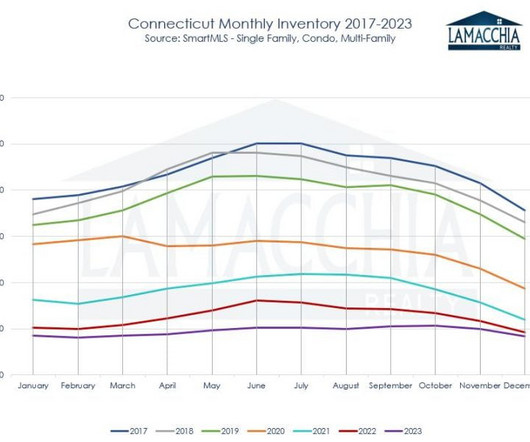

Since most sellers are buyers, inventory should be stable if demand is stable. So you can see why we have so few stressed sellers. A perfect example is that the last few years, new listings have been trending between 30,000 and 90,000 per week. Demographics also play a role here.

Let's personalize your content