Median payment on purchase mortgage applications rises to $2,201: MBA

Housing Wire

APRIL 26, 2024

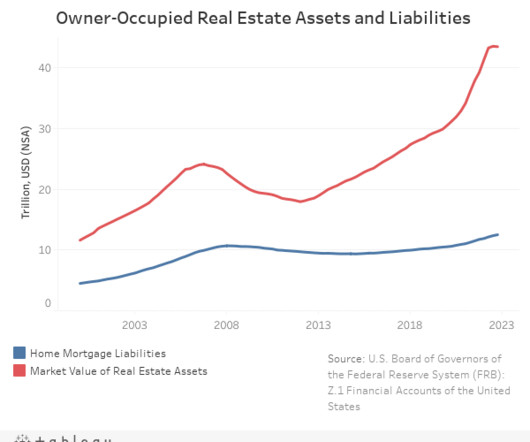

Homebuyer affordability declined in March as mortgage rates and home prices remained elevated. The national median monthly payment for purchase mortgage applicants rose to $2,201 in March, up from $2,184 in February. The index is benchmarked to 100 in March 2012. The national index increased 0.8% in March, up from 172.8

Let's personalize your content