How housing credit is shaping housing inventory

Housing Wire

MAY 8, 2024

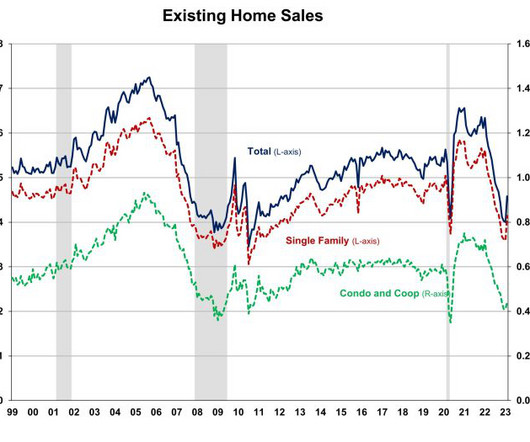

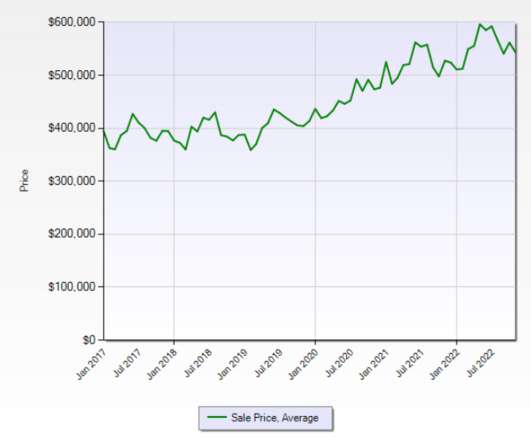

Housing credit channels directly impact housing inventory channels. Home prices escalated out of control after 2020 and when we look at why that happened, we can see that housing credit mattered more to inventory data than most people realize. This matters because inventory was already heading toward all-time lows before COVID-19.

Let's personalize your content