How home-price growth has damaged the housing market

Housing Wire

JUNE 28, 2022

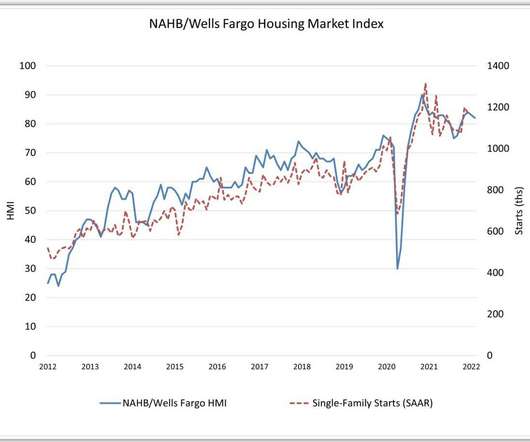

growth for its top 20 city composite, and now you know why my most significant concern for housing was home prices overheating , not crashing like people have warned about from 2012-2021. This data line lags the current housing market as it’s a few months old. Imagine if mortgage rates didn’t rise this year.

Let's personalize your content