Buyers are overpaying, but are there signs of a bubble?

Housing Wire

MARCH 18, 2021

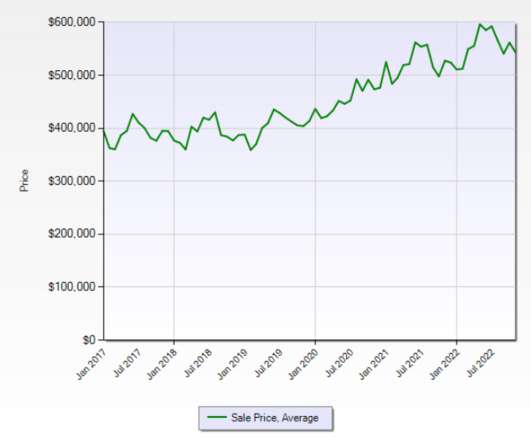

Home prices have skyrocketed in the past year, and data from Redfin backs up what buyers, sellers, and agents have known for months. Mortgage rates have also jumped to north of 3% ; at its current pace, the Mortgage Bankers Association is forecasting rates will reach nearly 3.5% by the end of 2021.

Let's personalize your content