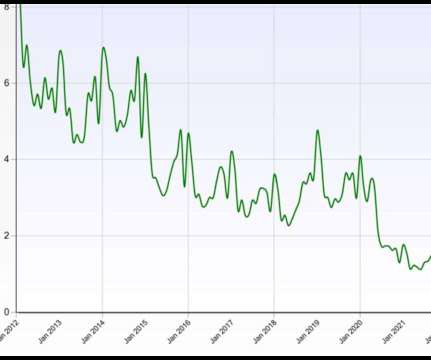

Housing inventory still near record lows

Housing Wire

APRIL 20, 2023

months’ worth of housing inventory in the U.S. NAR: First-time buyers were responsible for 28% of sales in March; Individual investors purchased 17% of homes; All-cash sales accounted for 27% of transactions; Distressed sales represented 1% of sales; Properties typically remained on the market for 29 days. We only have 2.6

Let's personalize your content