How housing credit is shaping housing inventory

Housing Wire

MAY 8, 2024

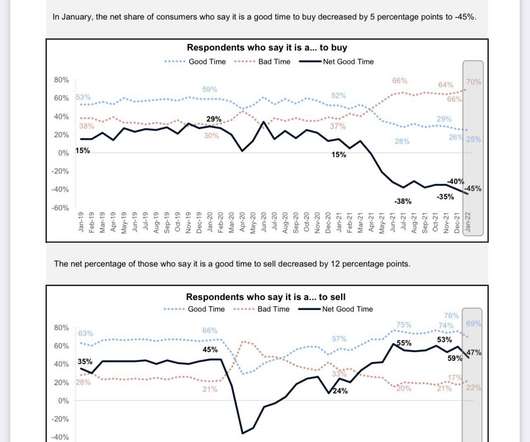

After 2010, qualified mortgage laws were in place, meaning everyone getting a mortgage has to be able to repay the loan. Since most sellers are buyers, inventory should be stable if demand is stable. This is what happened post 2010: The millennials started to buy homes in 2013 and they finance 90% of those homes.

Let's personalize your content