Days on market grow despite low inventory for existing homes

Housing Wire

NOVEMBER 18, 2022

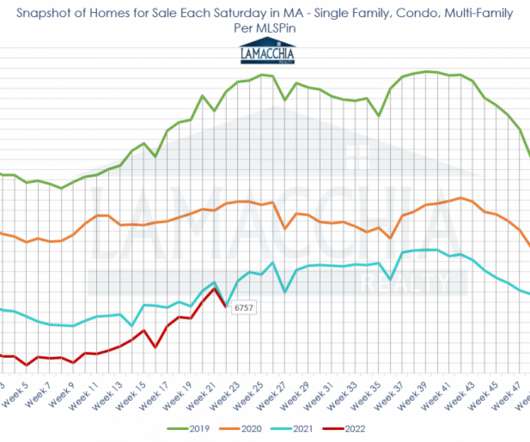

The National Association of Realtors (NAR) reported today on two trends in existing home sales that we have seen for many months now: sales are declining while total inventory data has fallen directly for the three straight months. This is another factor in driving purchase application data below 2008 levels.

Let's personalize your content