Housing Market Tracker: Mortgage rates and inventory fall together

Housing Wire

MARCH 26, 2023

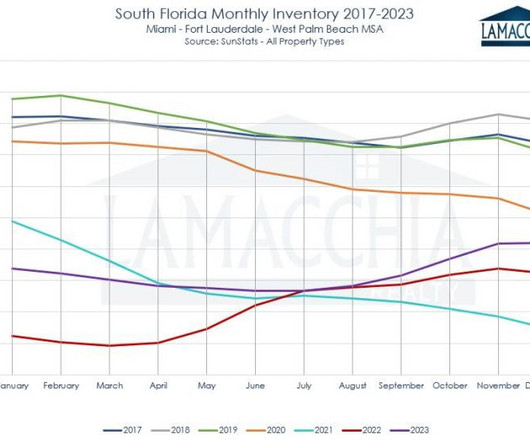

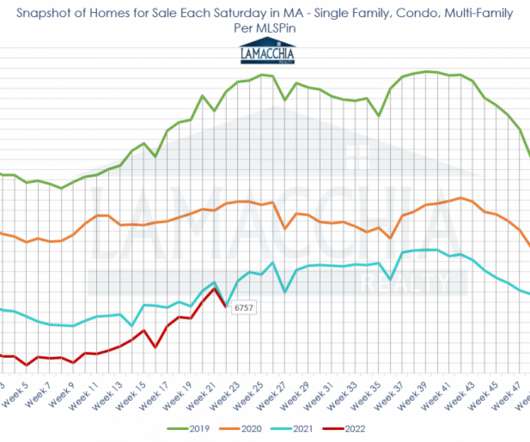

These events led to lower mortgage rates and increased purchase application data last week, but decreased housing inventory. Here’s a quick rundown of the last week: The 10-year yield had a Lord of Rings battle at a critical technical level, pushing mortgage rates lower at the end of the week with no real break in the bond market.

Let's personalize your content