Comparing this housing market recession to 2008

Housing Wire

DECEMBER 29, 2022

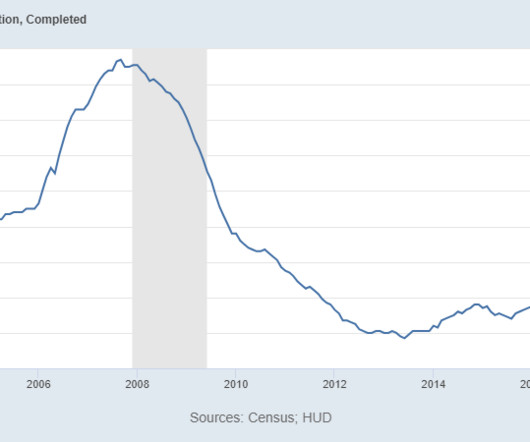

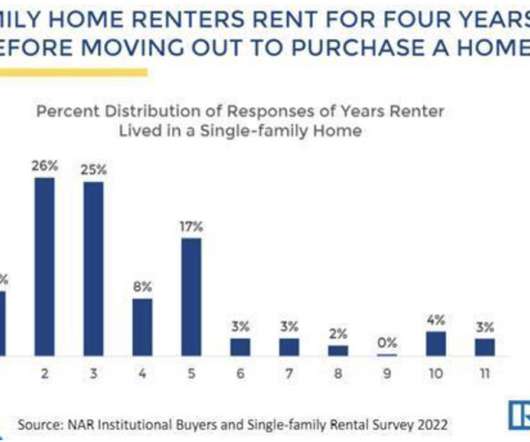

There are similarities and significant differences between the housing recession we’ve seen this year versus 2008, and looking at specific factors in both timeframes gives us an idea of what to expect in 2023. Let’s look at the recessionary factors we see now versus 2008. First, we must define what we mean by recession.

Let's personalize your content