The Similarities Between 2007 and Today

Appraisal Buzz

MAY 17, 2021

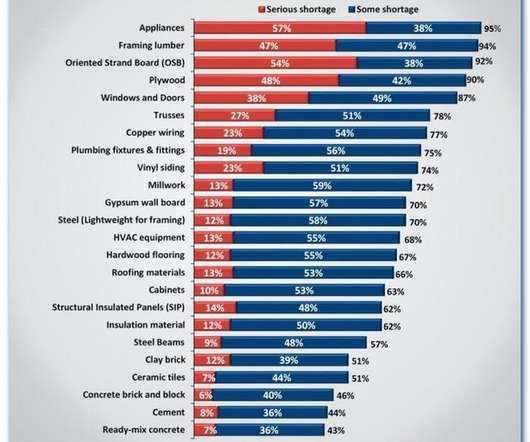

During the 2007-10 mortgage default meltdown, appraisals were a target of complaints and allegations by lenders, the GSEs, some state appraisal boards, and a few unscrupulous entrepreneurs. Between 2002-2005 in many markets, the real estate market was scorching, much like it is today. We are seeing that as a profession again.

Let's personalize your content