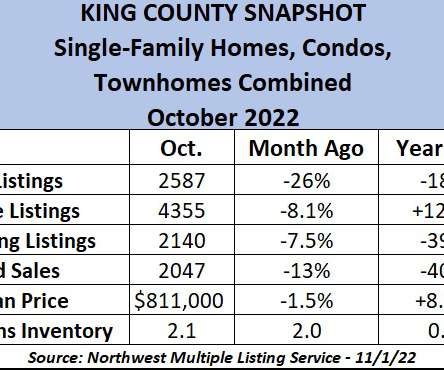

Housing inventory falls under 1M again as sales collapse

Housing Wire

JANUARY 20, 2023

During that period, we saw new listing data decline. However, in 2020 new listing data came back, and we don’t want to see the new listings continue to decline this year — that would be a double negative for the housing market. So the fact that we are back to an average of 26 days on market makes me happier.

Let's personalize your content