When considering housing affordability, the focus often falls on the upfront expenses of buying a home. However, in today’s market, the overlooked costs of running a household have taken center stage, demanding attention and strategic planning from homeowners and prospective buyers alike.

The soaring cost of insurance and energy have dealt a two-pronged blow to homeowners’ wallets, with no relief in sight. What was once a mere detail has now become a significant financial burden in some cases, casting shadows over the dreams of aspiring homeowners and adding strain to the budgets of current owners.

Nationwide, home insurance premiums have surged by an average of 21% year-on-year, as of May 2023, equating to an annual increase of $244 per household. The situation is no better in our state, where premiums have jumped 18% in a year, marking the second-highest rise in the nation. Recent reports paint an even bleaker picture, revealing a nationwide premium surge of 23% in the past year.

Yet, securing insurance coverage is proving to be an increasingly daunting task. Major insurers like State Farm, The Hartford and Allstate are among many withdrawing from markets like California due to escalating risks such as landslides and wildfires. A survey revealed that nine in 10 consumers are anxious about escalating homeowners insurance costs, with 27% contemplating relocation to escape the financial strain. Some are even considering forgoing insurance altogether, risking their financial security once mandated by mortgage lenders.

A myriad of factors contributes to this crisis, including the intensifying impact of severe weather events and the scourge of insurance fraud. Inflation exacerbates the issue further, driving up costs for home replacement and repairs, leaving owners vulnerable to being underinsured.

This predicament is particularly acute in our state and others grappling with escalating risks of earthquakes and rising sea levels. Homeowners must engage in thoughtful discussions with their insurance agents to assess whether additional protection is warranted.

In response to mounting concerns, the state enacted measures in 2023 to enhance transparency in premium increases and grant policyholders more time to adjust. Starting mid-2027, insurers operating in Washington will be mandated to furnish written notices to policyholders facing premium hikes of 10% or more and explain the primary factors driving the change.

The cost to use electricity in a home runs about $104/month in Washington compared to the national average of $131. A typical Washington household spends $79/month on natural gas, which is a dollar less than the national average. (Source) Locally, Puget Sound Energy raised electric rates by 1.7% at the start of 2024 after increasing them by 8.7% last year, and Seattle City Light increased rates by 5.7% this fiscal year after a 4.5% rise in 2022-2023.

For today’s homebuyers, the importance of holistic financial planning cannot be overstated. Beyond the allure of the offer price, it’s imperative to factor in the long-term cost of maintaining a property. This includes diligent inquiries into the current insurance and utility expenses from sellers, alongside documenting the age and expected lifespan of crucial home components, from plumbing and electrical systems to major appliances and roofs.

In the face of mounting challenges, knowledge is power. By embracing a comprehensive understanding of the true cost of homeownership, individuals can navigate the turbulent waters of the housing market with confidence, ensuring a secure and sustainable future for themselves and their families.

ELECTION YEAR EFFECT?

Prospective home sellers are smart people. They sometimes ask questions that have no easy answer … and I don’t like saying “It depends” but that can be the best response.

The question bounding about these days is what effect the presidential elections will have on the economy. I am no economist (hardly!) but I know of a few who are often available for insights.

One, Marci Rossell, offered her thoughts on the impact on our economy in a presidential year. The noted economist has been plying her trade for nearly 30 years, so she has seen a few presidents come and go.

“We want to give a president more credit for the economy than they deserve, and we also want to give them more blame for the economy than they really deserve. The economy does what it’s going to do and it is much bigger than any single actor,” Rossell said.

“What matters for most people’s real economic livelihood is what happens at the local level, which is much less about Republicans and Democrats.”

I don’t have evidence to back this up, but I have heard some – prospective buyers and sellers, as well as real estate industry pros – tell me that the housing market may slow down this fall as we wait and watch the outcome of the Nov. 5 vote (and ballot count the days after). On the whole, people should continue to buy and sell when they need and not be guided by who is in the White House come 2025.

I don’t have evidence to back this up, but I have heard some – prospective buyers and sellers, as well as real estate industry pros – tell me that the housing market may slow down this fall as we wait and watch the outcome of the Nov. 5 vote (and ballot count the days after). On the whole, people should continue to buy and sell when they need and not be guided by who is in the White House come 2025.

OLYMPIA HOUSING UPDATE

Despite a short session this year, lawmakers in Olympia were successful in passing 11 known pieces of legislation that serve to help home buyers and sellers as well as landlords and tenants.

Possibly the most notable bill to reach Gov. Inslee’s desk for his signature was a measure that reintroduces into the state a form of co-living housing that was popular here a century or more ago – boarding houses. The new legislation aims to prohibit local government from restricting this form of rental housing while generating more options for people struggling to afford a place to live.

What might be even more newsworthy is the lack of breakthrough legislation to address the shortage of homes overall and affordable ones at that. At least 48 pieces of housing-related legislation passed either the state House or Senate but most of them stalled in the other side of the chamber – in most cases by simply running out of time.

Read more on this year’s legislative session in a blog post, to be published on March 19: Washington Legislators Drive Home More Real Estate Measures in 2024

BY THE NUMBERS

>> Residents in Seattle metro (King and Pierce counties) need to earn $215K a year to afford a typical home, Axios reports. That’s an 18% increase from the previous year and about $100K more than the U.S. average. The median household income here is $107K. Our area ranks 8th in the nation for highest earnings/affordability requirements, with California cities representing the top seven led by San Francisco ($404K).

>> A full 42M U.S. households were cost-burdened in 2022, paying more than one-third of their income for housing, according to research released in January by Harvard’s Joint Center for Housing Studies. This is an increase of 1.5M households from 2021. The result: Nearly one-third of all households are cost-burdened, the highest rate since 2015.

>> Seattle metro has benefitted from 6138 new apartment units in 2023, according to data compiled by John Burns Research and Consulting, which forecasts another 25,687 units in development. The overall total ranks 15th in the U.S., with Dallas metro at No. 1 with a combined 75,274 units newly completed or being developed. The consultancy noted: “Seattle [area] multifamily permits are down 46% YOY.”

>> Seattle metro enjoyed one of the highest gross profits for 2023 U.S. home sales – an average of $325K per residential transaction – according to an analysis by ATTOM Data Solutions. That’s the highest gross profit outside of California, where San Diego led four of the state’s cities with an average profit of $698K. Overall, the nation experienced a rare year-on-year decrease in average gross profit – down $1.6K to $121K.

>> The portion of Washington homeowners considered equity-rich is decreasing, according to new info from ATTOM. Equity-rich is defined as the combined estimated amount of loan balances secured by property owners that are no more than half of their estimated market value. Our state’s mortgage holders with at least half of their home equity fell from 56.7% in Q3 to 53.5% in Q4. That’s the fourth-sharpest decline of any state, with Missouri suffering the steepest drop (from 41.9% in Q3 to 37.3%).

MARCH HOUSING UPDATE

Mixed economic numbers have turned that smile upside down among interest-rate watchers, as inflation persists and employment stays healthy. This divergence of data put the mortgage market on its heels over the past several weeks and essentially reset rates after trending lower in December and January.

As a result, home buyers and sellers across Seattle/King County saw a mixed bag of activity in February, according to the Northwest Multiple Listing Service. Home sales figures were little changed in the county as a whole year-on-year (YoY) but varied widely by city, while home prices reached double digits amid growing demand.

This return of buyers follows a sluggish late 2023. About two-thirds of all King County listings sold last month at the list price or above, signaling a competitive environment and extending this long-running sellers’ market.

Read a detailed assessment of our housing market in my most recent blog post: Seattle/King County Activity, Prices Show a Monthly Jump

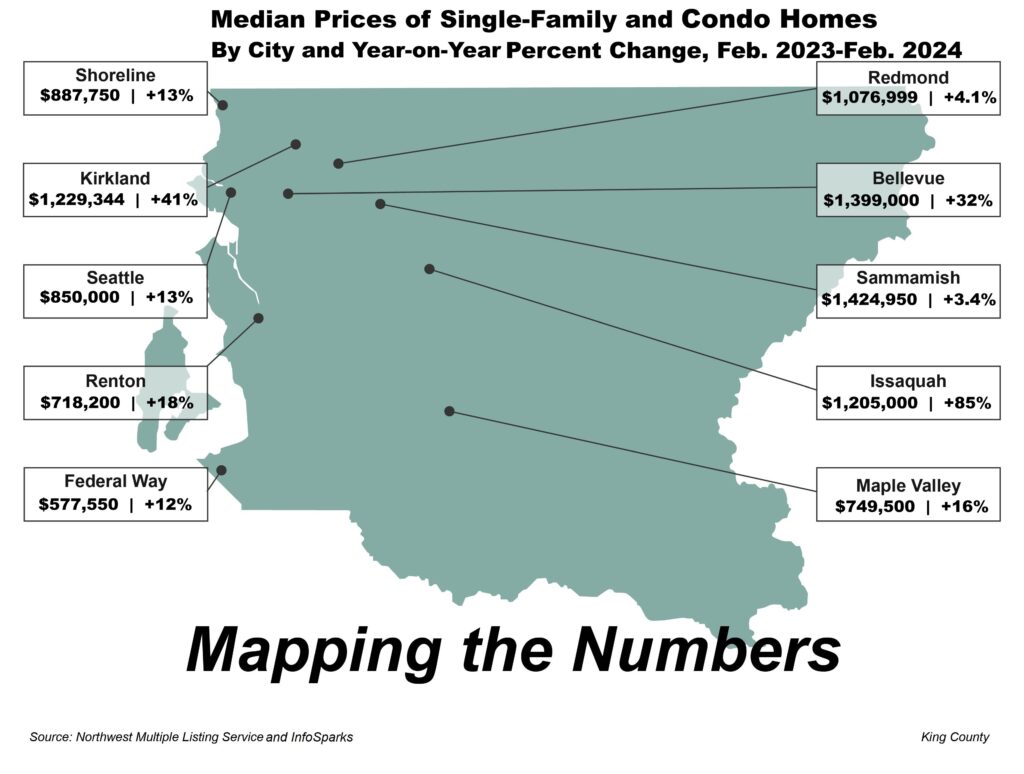

You may want to sit down before browsing this month’s map. Home prices are sharply higher YoY, led by a stupefying 85% surge in Issaquah and a blistering 41% climb in Kirkland. (Figures as of 3/1/24)

This graphic – which you can click to expand – is presented every month, rotating among three home groups. Next month, we will look at single-family-home prices by city.

CONDO NEWS

Great news from Graystone, the newest Seattle high-rise to open its doors. The sales team reports busy opening months, including five closings in January. Another 11 sales were expected to close by the end of February. What a start to the year!

The 31-story, 271-unit, First Hill condo opened in November and is picking up steam. There is more than 20,000 sq. ft. of amenity space, including a top-floor indoor lounge with kitchen and private dining, and an outdoor escape known as the Zen garden.

— — —

Progress on Seattle’s other major condo high-rise project appears to have slowed down a bit. First Light is aiming to complete its epic 48-story, mixed-use luxury tower in lower Belltown sometime in the second half of this year. A report last October quoted developer Westbank as saying the 459-unit, ultra-luxe condo would be ready to open early this year.

Good things come to those who wait! The final set of top-floor windows should be in place by the end of the month.

Inventory is slowly declining, with less than a third of the homes remaining on the market after much fanfare when the project was unveiled in 2018. Like many other construction projects, First Light confidently confronted issues ranging from the pandemic, supply-chain delays, change in the general contractor and concrete workers’ strike.

The amenities in this glass-and-steel beauty are top-of-the-line, starting on the rooftop – a cantilevered, outdoor, heated infinity pool with spa tub. They also include a wellness/fitness center, residents’ lounge, meeting space, screening room and much more.

Contact me to schedule a tour of the much-discussed Graystone or a hard-hat visit for qualified buyers to First Light. I’m ready to help!

LUXURY LIVING

If you smell hints of Frappuccino in the air of a certain home on the market, I can explain. Bill Moore, the man who played a significant role in the creation and development of the original coffee beverage that first made a splash in 1995 is selling his Eastside home. (Fun fact: Starbucks employee George Howell invented the signature drink but Moore recognized the global appeal!) Moore and his wife Abby have a beautiful 4-bedroom, 3.25-bathroom, 5566 sq. ft., 2004-built home in the West of Market section of Kirkland, with moorage along 60 ft. of Lake Washington. The wine cellar can hold up to 500 bottles, the kitchen has three ovens, and semi-enclosed terraces provide stunning views of Seattle in the distance. Perfection in every sense of the word. (I love the light fixtures.) Have a look! List price: $14.8M ($2675/sq. ft.).

Born and raised in Seattle, Ralph Anderson became a premier architect of modernist design for mostly residential buildings. That includes this outstanding work in Issaquah: a 5-bed, 5.5-bath, 11,412 sq. ft. marvel that rests on a plateau within the property’s 10 acres. From ceiling to floor, there is a lot of wood in this Northwest contemporary home built in 1993. The craftsmanship makes the space feel extraordinary and blends well with the Squak Mountain surroundings. You will have a difficult time finding another estate with better mountain views. List: $7.5M ($663/sq. ft.) – a “steal” for high luxury.

Jan Peters – a one-time CEO of MediaOne (which evolved out of US West and Continental Cablevision) – and husband Mike (a former MediaOne exec) are offering their modern Medina manse for sale. This 4-bed, 4.5-bath, 6950 sq. ft., custom-built home (2021) is adjacent to the famed Overlake Golf and Country Club and offers front-row seats to the second hole. The home goes above and beyond with an in-ground pool and spa tub, elevator, smart-tech installations, three fireplaces, and a stunning kitchen (with butler’s pantry) that would make Julia Child proud. Timeless living – a home of a lifetime. List: $13.9M ($2000/sq. ft.). Annual property taxes are, gulp!, about $67K. Oh, and the home is a block East of another notable estate – that of Bill Gates – where he and his former wife Melinda raised their family.

What else is happening in and around your Seattle?

Cherry Blossoms, starting soon

What a magical time to be out in search of cherry trees in full bloom. The peak season varies from year to year and from Seattle neighborhood to Seattle neighborhood – usually sometime between late March and early April – depending on the effects of winter on the growth of the blossoms. The photo atop this month’s newsletter showcases the trees in full bloom (sometime in the past) on the University of Washington campus. You can monitor the live webcam or stop by to catch the beauty. In addition, the Seattle Armory and Fisher Pavilion in Seattle Center (near 2nd Ave. N. and Lenny Wilkens Way) will host the Cherry Blossom & Japanese Cultural Festival, April 12-14.

Variety at Its Best, Mar. 21-Apr. 14

It’s billed – probably inaccurately so – as the world’s largest comedy variety festival. (I think the folks in Melbourne, Australia would disagree.) The Moisture Festival presents 40 shows at Broadway Performance Hall (1625 Broadway, Seattle). We understand the 3pm and 7:30pm shows are for all ages and burlesque and late-night performances are for people 18 and older. Tickets.

Teen Spirit, Mar. 23

Picture this: Dozens of organizations looking to inspire teenagers to make a difference in their lives and their communities. That’s the aim behind the Teen Action Fair, which includes performing artists, activities and games at the Gates Foundation Discovery Center (440 5th Ave. N., Seattle). Free. 10am-3pm

Seattle Mariners home opener, Mar. 28

The Mariners are seeking to avenge a difficult end to last season and seek their second visit to the playoffs in the last three campaigns. But first things first! They have to play well, starting with their home series opener against the Boston Red Sox (Mar. 28-31). Seattle also hosts the Guardians, Cubs, Reds, Diamondbacks and Braves in April. T-Mobile Park (1250 1st Ave. S.) Tickets.

Easter Egg Hunts, Mar. 28-30

Is it Easter already? Apparently so! Children can enjoy running about in search of prizes in the annual egg-hunt tradition. Look for one near you in Seattle and elsewhere. Registration is required in some locations.

Dancing Delight, Mar. 29-Apr. 7

Dance is the language of the soul, spoken through movement. Enjoy the movement, motion and magic at its best during the Seattle International Dance Festival Winter Mini-fest. See the Khambatta Dance Company and Newport Contemporary Ballet of Rhode Island among others perform over the week-plus experience at Erickson Theatre (1524 Harvard Ave., Seattle). Tickets.

The Great Goodall, Mar. 30

Anthropologist Dr. Jane Goodall speaks about her groundbreaking research on chimpanzees in a lecture “inspiring people to take action for a sustainable and compassionate world” at The Moore Theatre (1932 2nd Ave., Seattle). Tickets. 7:30pm.

Tiptoe Through the Tulips, Apr. 1-30

A kaleidoscope of vibrant colors and fragrant dreams await all month at the Skagit Valley Tulip Festival in and around Mt. Vernon. Tulips, daffodils and other early season blooms are on vivid display. It is one of the most awe-inspiring sights one can imagine – row after row of beauty. Also, come for the free Tulip Festival Street Fair (Apr. 19-21).

State Fair, Apr. 11-14, 18-21

It’s time again to do the Puyallup! The Spring Fair is nearly here at the Washington State Fair Events Center (110 9th Ave. SW, Puyallup) So many different events, food vendors and amusement rides; it’s fun for the entire family.

Events are subject to change. Please check with venues to confirm times and health-safety recommendations.

In case you missed it….

I was fascinated – and admittedly quite concerned – by what I uncovered in researching the latest attempts by cybercriminals to damage the names and bank accounts of home buyers and sellers. The advent of artificial intelligence has changed the landscape in real estate – and not generally in a good way. Check out my blog post on how sophisticated fraudsters are using AI and other methods to make your life a living H-E-you-know-what.

In my Living the Dream blog, I also offer a look at discrimination in Seattle’s real estate past (and some may argue present). I also published a story in February that offers tips to keep your roof in good shape and avoid paying for a new one so soon.

Interested in a different real estate topic and want to learn more? Let me know! I will consider researching and writing about it for a future story.

Thanks for reading and for all of your referrals – an indispensable part of my business!