Nobody said house-hunting was fair or fun. It can often be trying and tiring.

The affordability question is becoming more difficult to justify too, as home prices and interest rates rise amid other challenges facing buyers.

“That’s a triple whammy hitting potential homebuyers,” notes Len Kiefer, deputy chief economist at Freddie Mac, which buys many of our mortgage loans from lenders. “People are looking at higher prices, there’s slim pickings in inventory and now we have higher mortgage rates.”

Freddie Mac reported last week that interest on a 30-year fixed mortgage averaged 3.69%, climbing 58 basis points (or 0.58) since the start of the year and nearly a full percentage point from this time in 2021 to their highest levels since the emergence of the pandemic. There are expectations now that rate hikes will continue through the year. (Rates vary by region, lender, personal financial circumstances and other factors.)

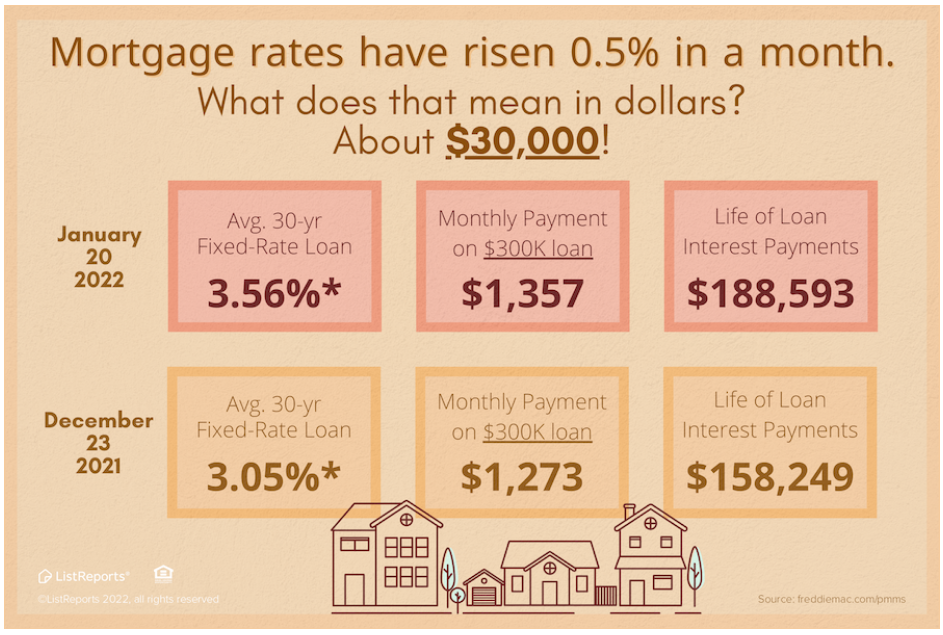

A small move in mortgage rates can make a big difference in life-of-loan interest payments. Take this example, courtesy ListReports, based on a conservative $300,000 loan and when the interest-rate difference was a half percentage point:

A typical mortgage in King County could easily be double the amount in the above example, and the Mortgage Bankers Association reports the average new mortgage is a record-high $446,100.

Plus, there are plans from the government agency that backs most mortgages to increase fees (known as Loan Level Pricing Adjustments) to certain applicants, including second-home properties, high-balance loans (locally between $647,201 and $891,250) and cash-out refinances. The new fees will take effect on April 1.

“As a result of higher mortgage rates, purchase demand [for a loan] has modestly waned in advance of the spring home-buying season,” said George Ratiu, realtor.com Manager of Economic Research. “However, supply remains near historically tight levels and home prices remain high, keeping the market competitive.”

The clock is ticking and many consumers looking for a home are feeling a sense of urgency – or fear of missing out – to find a place now rather than wait for rates to climb further and make homes less affordable. Buyers with the deepest pockets may wait, however.

“While home buyers may have FOMO because of rising rates, they may not want to succumb to the fear of better options,” said Mark Fleming, chief economist for First American Financial Corp. “There may be a better home option or options when there’s more homes for sale [this spring], even if it means they may pay more.”

‘MISSING MIDDLE’ LEGISLATION – UPDATE

Lawmakers in Olympia are juggling about two dozen proposals to address our state’s many housing issues, particularly the lack of affordable homes. We covered this topic of “missing middle” housing last month, and state legislators appear serious about enacting laws that will encourage more building of high-density homes in urban, transit-friendly areas of the state.

The Legislature (within the Capitol building pictured atop this newsletter) is reviewing a proposal drafted by House lawmakers that could, among other things, eliminate certain single-family-zoned areas of a city. House Bill 1782 would call upon cities with populations of at least 20,000 to permit multi-family structures (notably duplexes and triplexes) as well as detached accessory dwelling units (known as DADUs or mother-in-laws) in lots of 4500 sq. ft. or more that are located within a half-mile of a transit hub. The bill has the backing of developer and Realtor® lobbyists, Seattle Metro Chamber, Habitat for Humanity and environmental groups, according to The Seattle Times.

Among other bills in the works tied to affordable housing:

- House Bill 1660 addresses the housing crisis by reducing regulatory barriers for homeowners to build affordable housing in their backyards. The bill would remove maximum floor area limits on certain DADUs and remove or reduce impact fees on constructing the smaller dwellings on a lot of at least 4500 sq. ft. in a zoning district that permits such units, as well as lift owner-occupancy and off-street parking requirements on the property.

- HB 1908 relates to the conversion of surplus public property to affordable housing.

- Senate Bill 5713 would provide a property tax exemption for limited equity cooperative housing, when the property uses at least 95% for housing or other non-commercial purposes and that 85% of its occupants/owners are among a lower-income group.

- SB 5755 would aim to stimulate the redevelopment of vacant or underdeveloped property in targeted urban areas through a limited sales and use tax deferral program. This program would help owners of vacant or undeveloped property achieve the highest and best use of land and enable cities to fully realize their planning goals, thereby increasing affordable housing.

In an unrelated measure, the House passed HB 2059 and moved to the Senate a prohibition on so-called love letters. The proposal describes these as an “unfair practice letter” defined as a “written communication or image” from a buyer intended to persuade a seller. The ban on this type of communication would apply after a seller makes a written request. There is no mention of audio love letters in the prohibition, nor is the word “video” included in the bill.

Watch for a recap of this short legislative session in next month’s newsletter.

BY THE NUMBERS

>> Median-priced, single-family homes in the U.S. are less affordable compared to historical averages in 77% of the counties reporting, reaching the highest rate of unaffordability since the Great Recession. The median home price rose 17% in 2021 to a record $317,500, according to a report from ATTOM Data Solutions. This has resulted in major ownership costs on a typical home consuming 25% of the average national wage of $65,546, still within the 28% standard lenders prefer for homeowner expenditures (mortgage, home insurance and property taxes).

>> Seattle metro experienced the greatest inflationary pressure than any major U.S. market in the last decade, reported FilterBuy.com. The company, using data from the U.S. Bureau of Economic Analysis, claimed the cost of living for Seattle-Tacoma-Bellevue rose 23.2% between 2010 and 2020 to edge out Denver (22.9%) and Portland, Ore.-Vancouver, Wash. (22.0%) for the dubious honor. Seven Washington towns and cities – from Kennewick (22.8%) to Bremerton (19.0%) – were among the top 20 smaller markets across the U.S. to register the highest cost-of-living pressures in the 10 years. The official Seattle-area inflation rate was a whopping 7.6% at the end of 2021, second-highest among big U.S. metros, led by a 43% surge in gasoline prices.

>> A total of 10,493 homes sold for at least $1M in 2021 across King County, with the majority occurring on the Eastside (5933 sales, 57%). That’s a 61% jump from 2020 million-dollar sales and a 113% climb from 2017, according to the Northwest Multiple Listing Service (MLS).

>> The median down payment is 13% among all U.S. home buyers. That includes 7% down from first-time buyers and 17% on average by repeat buyers, according to data from the National Association of Realtors® (NAR). The survey also said that among sellers in the 12 months ending mid-2021, 46% went on to purchase a larger home.

>> The U.S. rental-vacancy rate dropped to 5.8% as of Q3 of 2021 to its lowest level since the mid-1980s, according to a Harvard study that pointed to a wave of demand in year two of the pandemic. Rent prices surged 11% year-on-year (YoY), led by a 14% jump for units in “higher-quality” buildings. The study says rents in Seattle rose 9.3% YoY to an average of $2131/month (September 2021).

>> Apparently one needs to make at least $186,063 a year to be considered “rich” in Seattle, or the top 20% of the city’s income earners. That’s according to a report by GoBankingRates. Seattle ranks No. 4 nationally among the highest earners, behind Washington, D.C., San Jose, Calif., and No. 1 San Francisco. The average annual tech-worker salary in Seattle metro is $158,000, second in the nation behind the Bay Area, according to Hired.com.

>> Seattle office vacancies continue to rise, according to data from commercial property brokerage Broderick Group. After hitting a low of 4.6% in 2019, the amount of vacant office space has grown each quarter to finish 2021 at 11.6% (excluding available sub-lease space), a level not seen in the city since 2012. Office rental rates ended the year at $45.80/sq. ft., down 5.5% from the end of 2020.

>> The chart below, courtesy of the MLS, shows breathtaking price appreciation in our region in recent years. These are average prices – not median, as we typically report – for all home types (condos, townhomes, detached single-family), capped off by stunning highs in 2021 for King ($943,739), Snohomish ($697,892) and Pierce ($546,318) counties.

FEBRUARY HOUSING UPDATE

My background as a business journalist for 15 years in New York taught me many lessons in economics and trend mapping. One of those teachings is that when a market keeps rising steadily for an extended period there comes a time when expectations for some type of a correction weaves its way into the conversation.

For our housing market, it’s time to have that talk.

Yes, buyers and sellers, we are in a rare price correction period for single-family home sales in King County. Median prices (not average prices) for single-family homes have fallen in six of the last eight months, including a sharp one-month drop of 4.3% in January to $775,000. They reached a 2021 peak of $869,975 in May and finished the year up 9.5% YoY in the county.

Examining the period between May and today, median single-family prices have fallen 11%, including price drops in five of the last six months. A correction is generally agreed to be a 10%-20% drop in value from a recent peak, making (in theory) for an especially juicy opportunity for real estate buyers to grab a home now before prices rebound.

Remember the spring of 2021? It was a bonkers time to sell, with sales prices soaring by 20%, 30%, 40% or more as a backlog of pandemic-hibernated buyers came out of the woodwork to make zany offers on a bigger, better home.

So where are the prices falling? Seattle and … Seattle. The total volume of transactions – and falling sales prices – in the Emerald City has contributed to pulling down the entire county’s median numbers. Seattle has experienced a 14% decline in median single-family prices since May ($919,000 vs. $790,000 today) and they are flat YoY.

More specifically, median prices have dropped 14% in Ballard/Greenwood/Phinney ($910,000 in May vs. $779,950 today) and 15% in an area that includes the University District, Ravenna and Northgate ($1M vs. $850,000). Single-family home prices in Queen Anne/Magnolia tumbled 28% ($1.35M vs. $970,000) and dropped 20% ($1.1M vs. $880,500) in the Capitol Hill/Central District neighborhoods over the last nine months, as reported by the MLS. Prices were also down 15% in West Seattle ($800,000 vs. $679,950 today) since May.

This is not to say all of King County is in market correction territory. Look at Mercer Island, where single-family prices surged 59% since May. Granted, January’s sensationally high median price of $3.53M is skewed by having only seven sales.

Also bucking the Seattle price trend: The Eastside markets of Bellevue east of I-405 (27%), Kirkland (21%), Woodinville (17%), Sammamish (14%) and Factoria/Issaquah (16%) have seen prices soar since May. Renton, too, saw prices jump, by 15% in that period. I presented a map of single-family YoY price appreciations in last month’s newsletter.

One big Eastside outlier is Redmond, where median-priced, single-family homes tumbled 35% ($1.33M in May vs. $859,342 today). I think it’s a safe bet that it is a one-off, as we can point to a severe drop in January sales (only 22, 41% fewer than the previous January), likely caused by the holiday season, poor weather and rising Omicron cases keeping people occupied.

Now, buyers who have waited it out can find prices are, well, more civilized in certain pockets since last spring – but not for long.

“Spring home-buying season should be very robust,” said Lawrence Yun, chief economist for NAR. “Maybe not matching up with last year’s intense multiple offers, but one of the best in the past 20 years.”

Rising rents, coupled with elevated inflation, should motivate more people to enter the buying market as a hedge against inflation, Yun said.

“In a rising inflationary period, particularly where it really hurts rising rents, it will motivate some of the financially well-qualified renters to consider buying a home,” said Yun. “That is why I believe that the spring home-buying season will be very robust.”

Inventory remains a big concern. The MLS estimates it would take less than two weeks to sell out supply given current demand across the four-county Puget Sound region. There are 0.4 months of single-family-home inventory in King County and on the Eastside, and 0.5 months in Seattle. The situation is most dire in an area known as Jovita (south King) and in Renton Highlands, where there are 0.2 months (6 days) of single-family inventory.

From a county level, King experienced a 3.9% month-to-month drop in median home prices (single-family, condos and townhomes combined) to $720,000. However, median prices climbed in both Kitsap (up 1.3% against December to $506,250) and Snohomish counties (1.0%, $686,792), while they were unchanged in Pierce County ($515,000). Single-family home prices in King slid 4.3% in the past month ($775,000), but rose in Snohomish (2.1%, $715,000), Kitsap (1.8%, $508,750) and Pierce (1.0%, $525,000). Over the past 12 months, single-family median prices continue to rise, led by a 20% jump in Kitsap, 19% gains in both Snohomish and Pierce, and a 6.9% increase in King.

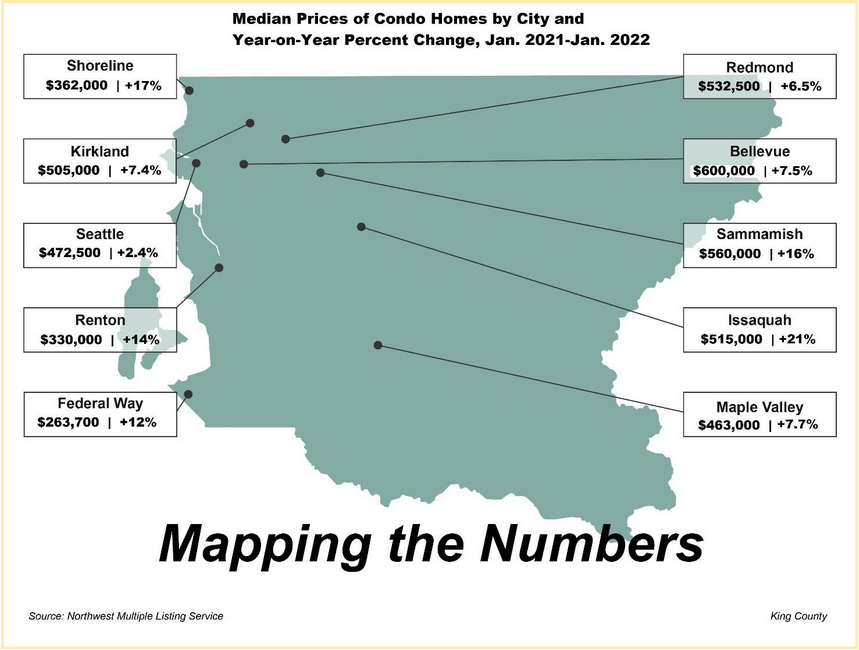

For some truly head-scratching figures, check out the local condo market. For example, Seattle enjoyed a 125% month-to-month surge in new listings in January (308) but experienced a 15% decline in active listings on Feb. 1 (210) compared to the start of 2022; a robust 330 homes went under contract last month, a 41% bump from December. Even though the Eastside condo market cheered 170 new listings in January, only 35 remained at the end of the month. Condo prices were mixed month-to-month, up 17% on the Eastside but down 3.4% in Seattle’s downtown/Belltown core. The map below shows YoY median condo prices.

Click here for the full monthly report.

CONDO NEWS

Developers of Gridiron, the warehouse conversion in Pioneer Square, have made two significant announcements this year.

The ground-floor commercial space, vacant for more than four years, has been sold for $5M and plans are to develop the 8400 sq. ft. area into a full-service restaurant and bar with outdoor seating for about 200 patrons. It’s a great location just a few hundred feet from the stadiums. (Here is a video that promoted the space for sale.)

It was also announced that prices on the remaining open-market homes in the 11-story, 107-unit condo have gone up by roughly 10%. A few additional units are earmarked for lower-income households and are priced 20% below market value. About 25 homes remain unsold.

—–

We shared previously a walk-through tour of KODA, the new high-rise in the Japantown section of the Chinatown International District. It’s located central to great food, fun and festivities.

To mark the Lunar New Year, KODA is offering a “lucky red pocket” drawing for each prospective buyer that tours the property between now and Feb. 21. (The offer started Feb. 1.) The biggest prize among all pockets is a $10,000 credit toward the purchase of a home at KODA. Wow!

Let me know if you wish to take a tour … and are feeling lucky!

—–

The Graystone is more than a month behind its latest scheduled timeline thanks largely to the ongoing concrete workers’ strike. Concrete pours on the planned 31-story First Hill high-rise were halted late last year on the 26th floor. The luxury condo was planning to open in Q1 next year but that’s less likely.

In a nod to Chinese lore, Graystone developers omitted floors numbered with a “4” as well as “13.” Four in Mandarin sounds similar to the word for “death.” Having removed five numbered floors, the structure will now go to floor “36.”

—–

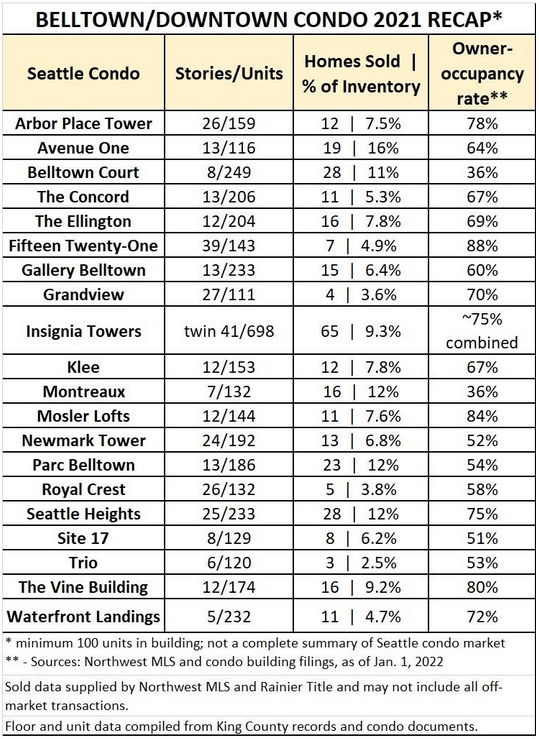

As a Seattle condo specialist, I closely track sales activity for downtown, Belltown and the surrounding area. My research shows a lot of people exchanged condo homes in 2021. A typical turnover rate – the number of homes sold against the total number of units – is about 5% but most condos in the city were above that figure. Here’s a snapshot of 2021 sales activity as well as owner-occupancy rates.

LUXURY LIVING

Speaking of condos, The Four Seasons Residences is arguably in a class by itself. There are 36 ultra-luxe homes located on the top 10 floors of the 20-story Four Seasons Hotel overlooking Elliott Bay and the busy waterfront. Only one home sold last year, for $2.16M, a little more than four months after a mega-sale in 2020 of a 15th-floor, 2-bedroom, 5281 sq. ft. residence (and 3 parking spaces) for $9.5M ($1799/sq. ft.). That’s why it is noteworthy that an owner just listed an 11th-floor, 2-bed, 3135 sq. ft. home (2 parking) for, gulp!, $9.7M ($3094/sq. ft.). Compare the two. Are they really both worth about the same despite the two-year separation and more than 2000 sq. ft. difference?

Let’s stick to properties on or near the water. This 4-bed, 4.5-bath, 6900 sq. ft. home sits on two sprawling acres along 240 ft. of Lake Washington waterfront in Leschi. The property comprises five lots and is arguably one of the few massive residential parcels available in the city. As their children grew and moved on, the couple who own this property has now retired after successful careers in tech and healthcare and are ready to downsize. Built in 1969, the brick-and-wood residence is essentially on one floor (with 670 sq. ft. above the garage) and features an open kitchen, great room and central A/C, while the fenced backyard includes a covered red-brick patio, sports court, hot tub, fruit trees and tall laurel hedges for privacy. This could be an investor’s dream if the property was subdivided. List price: $12.5M ($1812/sq. ft.). The owners are also offering to sell four of the five lots at $10.5M ($1522/sq. ft.). Think of the po$$ibilities.

Let’s stick to properties on or near the water. This 4-bed, 4.5-bath, 6900 sq. ft. home sits on two sprawling acres along 240 ft. of Lake Washington waterfront in Leschi. The property comprises five lots and is arguably one of the few massive residential parcels available in the city. As their children grew and moved on, the couple who own this property has now retired after successful careers in tech and healthcare and are ready to downsize. Built in 1969, the brick-and-wood residence is essentially on one floor (with 670 sq. ft. above the garage) and features an open kitchen, great room and central A/C, while the fenced backyard includes a covered red-brick patio, sports court, hot tub, fruit trees and tall laurel hedges for privacy. This could be an investor’s dream if the property was subdivided. List price: $12.5M ($1812/sq. ft.). The owners are also offering to sell four of the five lots at $10.5M ($1522/sq. ft.). Think of the po$$ibilities.

Further up Lake Washington, here is a newly built, 4-bed, 4.25-bath, 3930 sq. ft. multi-level home in Kirkland that is quite special – and priced to sell. From the gourmet kitchen to living area, the open plan main floor is stunning. The home sits on a hillside that boasts nothing but views. It even includes a private caretaker’s quarters. Wouldn’t it be fun to be the first to live here? List price: $3.5M ($891/sq. ft.).

Vuecrest is one of this area’s most-prized communities on the Eastside, featuring many contemporary custom homes by top local architects. Hamish Anderson Custom Homes teamed with architect Tom Kuniholm to deliver a 2018 masterpiece in this West Bellevue neighborhood that is now on the market. It’s a 3-bed, 2.75-bath, 3600 sq. ft., one-story home with finished basement, including a stunning chef’s kitchen with not one, but two islands. From the kitchen, take the stairs down and out to landscaped gardens designed by Noriko Marshall, to be enjoyed from a covered patio. All this – and incredible 240-degree views of Seattle and the Olympics in the distance – is available to a lucky buyer. The owners reportedly are two powerbrokers with backgrounds in the military, lobbying and external affairs – now retired and living on a farm. List price: $7.995M ($2221/sq. ft.).

Want something stately and traditional? How about this 4-bed, 3-bath, 4860 sq. ft., 3-story Craftsman in the Denny Blaine neighborhood of Seattle? This is a classic home that harkens to the early 20th century mansions in Madison Park or Capitol Hill, yet is only nearing the end of its second decade in existence. The former president of a wealth-management company and his wife are selling. They have lived in the home for about 10 years and are ready to begin retirement. The place comes with great comforts, including A/C, smart-home tech, backup generator and elevator. The backyard is meticulously landscaped. List price: $5.1M ($1049/sq. ft.).