In the commercial real estate industry there are a variety of lease types and also various names used to describe those leases. The term “single net lease” is sometimes used in commercial real estate to describe a lease where the tenant is responsible for paying one particular expense. In this article we’ll discuss the single net lease and point out several pitfalls you should consider.

What is a Single Net Lease?

First of all, what exactly is a single net lease? A single net lease is a lease structure where the tenant is responsible for paying the property taxes associated with the property. The landlord is responsible for paying all other operating expenses associated with the property.

The Spectrum of Real Estate Leases

All commercial real estate leases fall on a spectrum. On one end of the spectrum are absolute net leases, which require the tenant to pay all operating expenses for the property. On the other end of the spectrum are absolute gross leases, which require the landlord to pay all operating expenses for the property. Most commercial real estate lease agreements will fall somewhere in between these two extremes.

Why You Should Always Read the Lease

Commercial real estate leases can be complicated and nuanced. This is why the most important thing to understand about commercial real estate leases is that you must read the lease in order to understand its structure. Often there are common names given to lease types to describe which expenses the landlord and tenant are required to pay. These names include the single net lease, double net lease, triple net lease, gross lease, modified gross lease, and more. However, this lease terminology can take on different meanings depending on who you are talking to and which part of the world you are in.

Single Net Lease Example

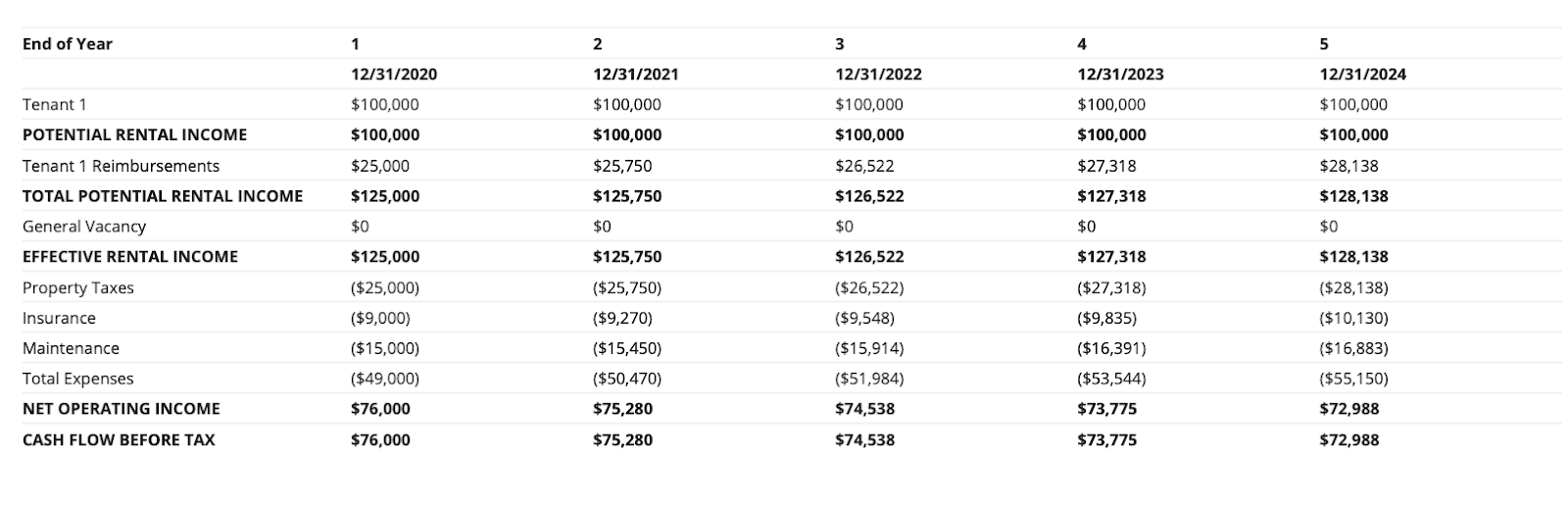

The single net lease is a fairly simple lease structure. Here is a an example of a single net lease on a real estate proforma:

As you can see in the single net lease example above, property taxes total $25,000 in year 1 and increase each year at a rate of 3%. Because the tenant is required to pay for all property taxes, you can see there is a reimbursement line item where the tenant does actually reimburse the landlord for this property tax expense each year.

This is a simple example of a proforma with a tenant that has a single net lease. Compared to other lease structures such as a modified gross lease, the single tenant lease is relatively simple to understand and simple to model. Next, let’s take a look at how the single net lease compares to other common lease structures.

Single Net Lease vs Double Net Lease

A single net lease requires the tenant to pay all property taxes associated with the property. The double net lease is similar to the single net lease, except it requires the tenant to pay two expenses instead of one. In a double net lease the tenant is typically responsible for paying both the property taxes and the insurance expense associated with the property. However, these leases are not always cut and dry, so it is important to read the lease in order to understand who is responsible for paying which expenses.

Single Net Lease vs Triple Net Lease

The single net lease is also similar to the triple net lease. While the single net lease requires the tenant to pay property taxes, and the double net lease requires the tenant to pay property taxes and insurance, the triple net lease requires the tenant to pay all operating expenses associated with the property. There is, however, a lot of nuance with the triple net lease, so it is important to understand exactly which expenses a tenant is responsible for and which expenses a landlord is responsible for paying. For example, even in a triple net lease, the tenant will almost never pay the landlords accountant and lawyer fees.

Single Net Lease vs Gross Lease

The difference between a single net lease and a gross lease (also known as a full service lease) is that a gross lease requires the landlord to pay all operating expenses associated with the property. In a single net lease the landlord pays all operating expenses except for property taxes, which are reimbursed by the tenant. However, as with all leases, the devil is in the details, so it’s important to always read the lease.

Single Net Lease vs Modified Gross Lease

The modified gross lease is often much more complicated than the single net lease. The reason why is because the modified gross lease can include any number of reimbursement structures and often get complicated. For example, a modified gross lease may require the tenant to reimburse for several expenses and have caps and/or floors on the escalation of these reimbursement from year to year.

Additionally, base stop or expense stops may be applied to individual expenses or even groups of expenses. There could even be requirements for anchor tenants to reimburse a fixed amount first before smaller tenants pay their share of what remains.

Many of these complications could in fact be included in what someone calls a single net lease. However, it is more common that the single net lease is straightforward and easy to understand. However, as mentioned several times, it is important to read the lease agreement in order to understand its structure. Common names such as the single net lease do not have the same meaning and can differ depending on who you are talking to or what part of the world you are in.

Conclusion

In this article we defined the single net lease, walked through a single net lease example, then compared the single net lease to the double net lease, triple net lease, and gross lease. The single net lease is fairly simple to understand because it required the tenant to reimburse a single expense. However, commercial real estate leases are complicated legal documents and often include a lot of nuance that a simple name like “single net lease” can capture. This is why it is critical to read a lease in order to understand it.