Prayers for the tens of thousands who have died, as well as the many refugees, disaster survivors and their families affected by the conflict in Israel and the Occupied Territories. The humanitarian situation there is desperate and, like the word in this picture of a famed Jerusalem olive garden, we ask for peace.

==========

More than 2.3M, or 31%, of Washingtonians live in a community governed by a Homeowners Association. That’s the fourth-highest number of residents of any state and it’s only expected to grow as HOAs become increasingly common.

Roughly 84% of newly built, single-family homes sold in 2022 were part of an association, according to U.S. Census data. The figure was 70% only 10 years ago.

These private, rule-setting associations – of which there are more than 350,000 in the nation – are growing in number but they should also be a waving caution flag to Fair Housing watchdogs.

We can look back to post-World War II when HOAs helped to create the initial segregation of the suburbs with planned developments – such as Levittown in New York – and gated communities. Essentially, white residents used these associations to prevent Blacks from moving into their neighborhoods through explicit race-based covenant language written into property deeds.

Only recently have states taken action to remove the language from these registered documents. While having no basis in law since the passing of the 1968 Fair Housing Act, the covenants were ugly reminders about our past in King County and elsewhere. In addition, our state is establishing the Covenant Homeownership Program, which aims to help people who faced discrimination to receive financial assistance with their closing costs or down payment. There is also a new proposal by a King County Council member to consider reparations for those impacted by discriminatory real estate practices.

Even today, white and Asian residents disproportionately inhabit HOAs compared with non-HOA areas. This may be because “demand for HOAs is driven at least in part by a desire for exclusion,” as University of Illinois-Chicago scholar Evan McKenzie wrote in his 1994 book, Privatopia: Homeowner Associations and the Rise of Residential Private Government.

Knowingly or not, associations can discriminate against potential home buyers by enforcing a community’s established rules that have the potential to limit people of certain classifications from purchasing a property. It can be particularly true when the HOA is managed without outside oversight from property management companies.

Largely unregulated, associations overseeing condos, co-operatives and townhome communities may seek to conduct credit or background checks as part of their screening process – very questionable behavior no matter how nice the neighbors appear. Or they may charge high monthly dues or move-in fees to financially limit some from making an offer on a home that they otherwise could afford.

Even “Last Week Tonight” host John Oliver scrutinized the financial activities of HOAs and their property management companies. In a colorful April 2023 segment, Oliver said: “When you introduce for-profit companies to find problems in your neighborhood, things can change fast. Many of these management companies have people whose job it is to drive around neighborhoods looking for infractions. … [and] at worst, they are glorified debt collectors.”

As Seattle and most of Washington face hard questions about increasing housing density, the government is often exempting communities with established association rules and bylaws. This is not to suggest we are spiraling back decades to segregated housing. It is simply an early wake-up call to state and local leaders exploring more zoning changes that communities and buyers may be gearing up for a fight if they feel shunned from where they want to live.

Clarence Stone, from American Political Science Review, offered this after reading Privatopia: “For those genuinely concerned with the moral fiber of modern America, they might well heed McKenzie’s warning about uncritically accepting the privatization of citizenship in an income-segregated society.”

BENEFITS OF BUYING NEW

Are you thinking of buying a home but can’t afford the high-interest payments? New home builders have an answer. It’s called a buydown. That’s when the building developer offers to “buy down” the mortgage interest rate as part of a promotion to keep homes selling in this less-than-friendly housing environment.

It’s working well for both builders and buyers. Six out of 10 builders in the U.S. are offering the buydown, which can lower the mortgage interest by about one or two percentage points for lengths ranging from one year to the full term of the loan. A third of those builders offering the promotion are giving full-term buydowns, according to a recent survey by John Burns Research and Consulting.

Buyers must qualify for the mortgage at the highest rate in the offer. The deal varies for each builder and the amount of the buyer’s down payment.

The builder prepays the interest due to the mortgage company, which is typically a bank or credit union partnering with the construction company on the project. John Burns reports some builders are spending 6.5% or more of the home’s sales price to help incentivize buyers to purchase.

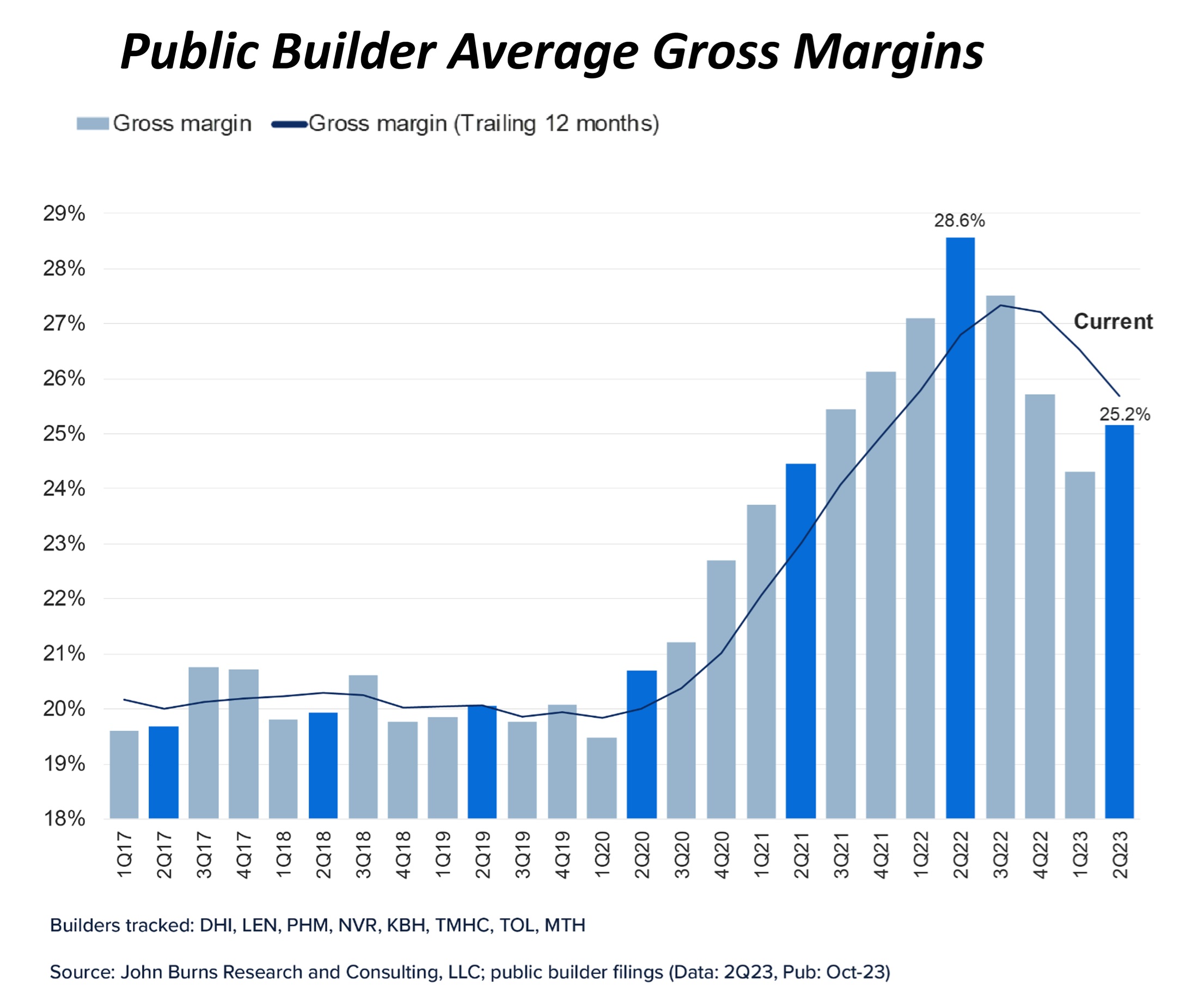

Don’t feel sorry for the builder. Many of the bigger companies are publicly traded giants and do quite well when tallying up the score. Below is a summary of gross margins – 25% in Q2 – from the top eight national home builders, such as D.R. Horton, Lennar and Toll Brothers:

National builders comprise 41% of the new home market; D.R. Horton leads the way with a 12% share. The overall total was only 19% in 2000. Locally, Horton has 11% of new home sales and Lennar is at 9%.

This helps explain why new home sales have taken a bigger slice of the pie this year. While existing home sales across the U.S. are down 15% year-on-year, new home sales are up 34% since September 2022. New homes represent 19% of total sales across the U.S. today.

SEATTLE HOUSING LEVY

Voters in Seattle delivered a strong message this month when they overwhelmingly showed support for a measure to further address our housing crisis. With 69% approval, the Seattle Housing Levy will boost funding for initiatives to help the unsheltered get off the streets and into a home.

Proposition 1, starting in 2024, will tax property owners approximately 45 cents per $1,000 of assessed value. Seniors, veterans with disabilities and some others would be exempt from paying the tax.

The levy hopes to raise about $970M over seven years and create or preserve about 3500 affordable homes throughout Seattle. It will cost the owner of an $800,000 home in Seattle about $360 in 2024, or more than triple the expiring housing levy of $115.

The 3500 homes are only a fraction of what is needed. The King County Council estimates Seattle will need roughly 112,000 additional places to live over the next 20 years, including 44,000 for people making less than 30% of the region’s median income.

BY THE NUMBERS

>> Seattle metro is near the top of yet another survey – this one for full-time parents raising children. CoworkingCafe ranked U.S. cities with more than 200K residents based on education, work, share of remote-eligible jobs and other factors. Our market earned a score of 57.1, third best in the nation behind Washington, D.C. (64.5), and Arlington, Va. (59.4). More than a fifth of the population in the Puget Sound area works remotely, the third-highest region in the country, and we have the fifth-highest rating of workplaces that allow hybrid work (79%).

>> The Emerald City ranks 7th among the top 200 cities for the most relaxed places to live. That’s according to research by LawnStarter, which reviewed 42 stress factors and stress relievers – like depression rates, the average length of a workday, and access to spas and massage therapists – to develop the scores. Sunnyvale, Calif. (68.83), was ranked the most-chill city followed by San Francisco (68.36). Bellevue, Wash., came in at No. 9.

>> Seattle ranks 6th out of 182 U.S. cities for best places to live for women, according to WalletHub, which compared data on 15 key metrics to determine its list. Our city came in at No. 1 for “women’s preventive health care” and within the top 31 cities for six more categories. Columbia, Md., came out No. 1 overall. Tacoma ranked 31st.

>> Redmond, Wash., received top marks in the annual survey of best small cities to live in from WalletHub. The Eastside city earned a 68.63 score to finish within the top 1% of the 1300+ cities with populations between 25,000 and 100,000. It finished 3rd in the U.S. for best “economic health.” Only 12 other cities scored higher overall, with Carmel, Ind., at the top (71.16). Sammamish had the second-highest score among Washington cities (66.67).

>> The portion of average wages required for major homeowner expenses stands at 48% for residential owners in King County, according to a Q3 report from ATTOM Data Solutions. The latest number is considered unaffordable by common lending standards, which call for a 28% debt-to-income ratio. The report said year-on-year median home prices grew a barely noticeable 0.6% ($800K), as of Oct. 1, while annual wages were unchanged at $115.8K.

>> Seattle has the smallest home-flipping rate as a portion of all home sales among U.S. metros, according to ATTOM. Only 3.7% of Seattle area sales were flipped in Q2, followed by Santa Rose, Calif. (4.0%), with the second-fewest. Eight percent of all sales were flipped nationally in the quarter, led by Macon, Ga. (17%), and Columbus, Ga. (15%).

NOVEMBER HOUSING UPDATE

From health-care and auto workers – even Hollywood actors – Americans hit the picket lines in greater numbers in 2023. At least 453,000 workers participated in strikes in the first nine months of the year, according to one tracker. Beyond labor strife, America’s home buyers and sellers appear to be on strike as well.

Worsening affordability issues and lower-than-usual inventory have prompted many consumers to watch this housing market from the sidelines – without the picket lines. Compounding the financial squeeze, home prices have risen in many cities outside Seattle.

October figures from the Northwest Multiple Listing Service (MLS) strongly suggest prospective buyers and sellers are taking a wait-and-see approach. Sales activity across the county is at historic lows; no October has experienced fewer listings in King County – not even close – since at least 1992 when records were first archived online.

Read a detailed assessment of our housing market in my most recent blog post: Affordability Woes Prompt Historic Housing Slowdown

Condo prices (mapped below) are mostly higher year-on-year. Median prices in Shoreline and Kirkland are 20% or more above this time last year but they are down 7.0% in Redmond.

This graphic – which you can click to expand – is presented every month, rotating among three pricing groups. Next month, we will look at the median prices of single-family and condo homes combined by city.

CONDO NEWS

The City of Seattle this month approved temporary occupancy of Graystone as the First Hill high-rise moves toward its grand opening. The 31-story, 271-unit luxury condo is now being fitted out with model homes, common area furnishings and artwork.

Buyers will likely begin taking occupancy in December/January. They have been patiently awaiting the opening of this special community along leafy 8th Avenue and Columbia Street. Like other construction projects that started around the beginning of the Covid outbreak, Graystone faced many obstacles – supply-chain issues, concrete workers strike and changes in contractors – before getting to the finish line.

Glancing at new Seattle condos listed on the MLS, Graystone represents about half of them priced below $550K even while the median market list price is $847.5K. Homes at Graystone start at $419.9K, or about $669/sq. ft., according to a press release from the building’s sales team.

Need an incentive to buy? Anyone who contracts to purchase by the end of November will receive a bonus of between $10K and $30K toward the new home (depending on the number of bedrooms). Buyers, for example, can choose to use the bonus to reduce financing costs.

Want to take a tour? Contact me to schedule a time to visit the only new high-rise condo to hit the city this year.

The Graystone release also shared some interesting data points about Seattle’s condo scene:

There were four new projects introduced to our city between 2019 and 2022 – Nexus, The Emerald, KODA and Spire – totaling 1194 units. So far, 930 of them, or 78%, have been sold to happy buyers.

Only two buildings are coming online in the next several months – Graystone and First Light – representing 730 units, of which 346 have been presold to pending buyers. That leaves about 648 unsold new construction condo units for the 100K+ residents in the greater downtown area of Seattle.

First Light recently completed pouring concrete on its 48th and final story. The top-off on Oct. 18 of the 459-unit, ultra-luxe condo marks the next important step toward completion in 2024. The community – at 3rd Avenue and Virginia Street – is 80% sold and features three floors of amenity space as well as a cantilevered pool on its rooftop garden.

The Veil will be installed by the end of November on the 3rd Street façade. The art piece will be comprised of about 10,000 individual glass discs, strung vertically to wrap the building’s podium levels.

Contact me if you are interested in learning more about any of these great new residences.

LUXURY LIVING

The luxury housing season is still going strong – a bit of a surprise when a seasonal wind-down is more common in October/November. Here is a look at some of the newer high-priced homes on the market in our area.

Check out this 5-bedroom, 4.5-bathroom, 6390 sq. ft., 2-story home (plus a 1-bedroom accessory dwelling unit) in the Lakemont section of Bellevue. Completed in 1996, this custom-built Craftsman offers traditional space for living and dining, as well as a fresh-looking kitchen and baths, office and theater. The spacious veranda delivers dramatic views of treetops in the distance. A lot of home – perfect for a big family. List price: $3.89M ($610/sq. ft.).

Our region offers thousands of mid-century modern homes but not many as spectacular as this Clyde Hill gem. It’s a 5-bed, 3.75-bath, 4250 sq. ft., 1-story home (with basement) built in 1967. The open-plan layout provides plenty of room for versatile use. The wall of windows offers peeks of the Seattle skyline in a room with a Scandinavian feel. List: $4.98M ($1172/sq. ft.).

Or how about this Lake Sammamish stunner? It’s a 4-bed, 4-bath, 4680 sq. ft., 2-story home with 81 ft. of private waterfront. The ceilings are standouts – some vaulted, some with slatted wood for a farmhouse feel, and others featuring skylights. The deck faces west and includes a fire pit and outstanding views. Such a warm feeling throughout. List: $6.5M ($1389/sq. ft.).

We cap our monthly rundown with a tour of this waterfront opportunity in Fauntleroy/West Seattle. Two homes share adjacent parcels totaling one acre. The main home, built in 1905, rests on a bluff and includes 3-beds, 1.5-baths and 2170 sq. ft. on 1 ½-stories (with basement). A beach house includes 65 ft. of waterfront. Admittedly, the homes have seen better days … but think of the possibilities! List: $2.8M ($1290/sq. ft.), recently cut from $3M.

What else is happening in and around your Seattle?

Auto Show, Nov. 16-19

See hundreds of the latest cars and trucks – plus rare classics – at the Seattle International Auto Show. The annual event takes place at Lumen Field Event Center (800 Occidental Ave. S.). Thursday, 12-9pm; Friday, 10am-9pm; Saturday, 10am-9pm; and, Sunday, 10am-6pm.

Christmas Tree Displays, from Nov. 18

Is it that time of year?! Oh yes! Let’s start with the Festival of Trees in the lobby and driveway of the Fairmont Olympic Hotel (411 University St., Seattle). The tree lighting on Nov. 24 up the road at Westlake Park (401 Pine St.) is also family fun, starting at 3pm with entertainment, followed by the lighting of the tree and giant star at 5pm, and capped by a post-show concert. Other holiday-lighting celebrations (times vary):

- Nov. 24 – Bellevue at Bellevue Square

- Nov. 25 – Seattle at Phinney Center and Pike Place Market

- Dec. 1 – Kenmore at City Hall

- Dec. 1 – Renton at Gene Coulon Park

- Dec. 1 – SeaTac at Community Center

- Dec. 1 – Mercer Island at Mercerdale Park

- Dec. 2 – Auburn at City Hall

- Dec. 2 – Ballard at Marvin’s Garden Park

- Dec. 2 – Bellevue at Kelsey Creek Park

- Dec. 2 – Kent at Town Square Park

- Dec. 2 – Kirkland at Marina Park

- Dec. 2 – Snoqualmie at Railroad Park

- Dec. 2 – Woodinville in DeYoung Park

- Dec. 9 – West Seattle at West Seattle Junction

- Dec. 15 – Sammamish at Central Washington University-Sammamish

Thanksgiving Run/Walk, Nov. 18, 23

Burn calories before that big turkey feast by participating in a special run or walk event. There are many to choose from (various times):

- Nov. 18 – Fairwood Turkey Trot at Fairwood Firs Park, Renton

- Nov. 18 – Tacky Turkey Sweater at Green Lake, Seattle

- Nov. 18 – Trailhead Trot at Brooks Trailhead, Fremont, Seattle

- Nov. 23 – Auburn Turkey Trot at Sunset Park

- Nov. 23 – Issaquah Turkey Trot at Front Street Shopping Center, Issaquah

- Nov. 23 – Thanksgiving Day in Magnuson Park, Seattle

- Nov. 23 – Montlake Turkey Trot around Washington Park Arboretum, Seattle

- Nov. 23 – Thanksgiving Day Apple Cup at Green Lake, Seattle

The Nutcracker, Nov. 19-Dec. 27

The timeless ballet, The Nutcracker, takes us on a Christmas story between young Marie and her enchanted prince as they journey through a magical realm filled with wondrous characters. Perfect for the whole family … and available to see nearly everywhere (times vary):

- Nov. 19 The Paramount Theatre, downtown Seattle

- Nov. 24-Dec. 27 Pacific Northwest Ballet, Seattle Center

- Dec. 1-3 Ensemble Ballet Theatre, Renton

- Dec. 1-28 Cabaret Nutcracker, downtown Seattle

- Dec. 2 ARC School of Ballet, Seattle Center

- Dec. 2 Momentum Dance, Burien

- Dec. 8-10 ARC School of Ballet, Crown Hill, Seattle

- Dec. 8-10 Evergreen City Ballet, Auburn

- Dec. 8-23 International Ballet Theatre, Meydenbauer Theatre, Bellevue

- Dec. 15-17 Evergreen City Ballet, Renton

- Dec. 16 ARC School of Ballet, Shoreline

- Dec. 22-23 Body Language Studio, Renton

Holiday Lights, Nov. 24-Dec. 31

Brighten the night with holiday festivals of music, lights, food, warm drinks and … possibly … a Santa sighting. More than a half-million colorful lights will be on display at Garden d’Lights in Bellevue Botanical Garden (12001 Main St.) starting on Nov. 25. Enjoy a 20-minute show of lights, falling snow, young dancers and drummers on Snowflake Lane (Bellevue Way Northeast, between Northeast 4th and NE 8th streets, Bellevue). Redmond Lights comes to Downtown Park (16101 Redmond Way) starting on Dec. 2. And, Seattleites can rely on Winterfest to provide top entertainment – musicians, model trains, ice sculptors and lights – in and around the Armory at Seattle Center (305 Harrison St.) beginning on Nov. 24. Various times.

Craft Market, Dec. 1-2

Support great causes by shopping from more than two dozen gift vendors at Giving Marketplace, with craft-making and live music. Check it out at the Bill & Melinda Gates Foundation Discovery Center (440 5th Avenue North, Seattle). 10am-5pm.

New Year’s Eve Concert, Dec. 31

Ring in 2024 with Beethoven’s Ninth Symphony and enjoy the splendor of the “Ode to Joy” chorus with the Seattle Symphony at Benaroya Hall (200 University Street). The night includes a countdown to midnight and post-concert party with dancing and champagne. Tickets. 9pm-till

Events are subject to change. Please check with venues to confirm times and health-safety recommendations.

In case you missed it….

This was the year of housing for state lawmakers. Olympia passed dozens of bills that address housing affordability and shortages, including laws to increase accessory dwelling units on parcels that were once exclusively zoned for single-family homes.

My Living the Dream blog dove deep into the topic: Washington ADU Laws Aim to Open New Doors to Housing. On the affordability front, I shared details about down payment assistance programs: 3 Payment-Assistance Avenues Available on Path to Homeownership.

I love my Seattle! In fact, that’s a hashtag I use often on my Instagram feed to showcase fun places to visit. It’s no different on my blog, where I recently shared a video story on our city’s history with street clocks and a historic anniversary for Historic Seattle.

CORRECTION: In last month’s newsletter, we incorrectly stated Bellevue had a 35,000 housing-unit shortfall to make up by 2024. The correct target is 2044.

Thanks for reading and Happy Thanksgiving!

Will