First, prayers go to the millions of people displaced, disrupted or worse by the tragic events unfolding in Ukraine (the global leader in sunflower production, until now). Never did I expect to be writing in this darkest of decades – only 2-plus years in – about a pandemic followed by war.

Here we are asking ourselves how Russia’s invasion of a sovereign nation – sending Europe into heightened uncertainty not seen since World War II – may impact our lives thousands of miles away. This is in no way an effort to downplay the unfolding tragedy or appear tone deaf, but it is a fair question: Will residents in our region face economic challenges so severe that it will affect the real estate market?

The answer is “very likely, yes.”

The supply chain, already strained, may come under renewed pressure with threats to shipping lines and air travel. Similar fears exist for the energy supply, equity markets, currencies, electric and internet grids, and defense of nations aligned against Russia. There is so much at play – and at stake.

Most home buyers focus on the direction of interest rates. Until the start of this conflict, rates were expected to rise steadily through 2022 with anywhere from three to five Federal Reserve-generated hikes to stem the rapid rate of inflation – now at 7.9% annualized, the highest level in 40 years. However, as the news from Europe worsens many investors are shifting money into safer havens such as bonds, which helps provide temporary relief on rates.

Interest rates on a 30-year mortgage have slipped fractionally since the start of the conflict, now averaging 3.85% in the U.S., off their 2022 high of 3.92% (the highest level since May 2019). Seattle-area lenders are quoting mortgage rates of around 4% (plus or minus one-eighth of a point), depending on individual circumstances. Rates tend to fall as money flows into Treasurys.

“Things can’t get much more volatile than Russia’s invasion of Ukraine, and predictably we’ve seen a flight to safety and lower bond yields and interest rates,” said Rick Sharga, Executive Vice President at RealtyTrac, a real estate research firm. “It’s very likely that these reductions are temporary, but since they’re happening as the spring home-buying season is kicking off, they provide a bit of a financial cushion for buyers – especially first-time buyers.”

To purchase a home, many buyers withdraw funds from stock and cryptocurrency markets as well as retirement accounts. Their values have mostly taken a hit in recent weeks, prompting buyers and lenders to re-evaluate their positions.

“It’s all bad for the economy and housing. … It’s just a matter of how bad,” says Mark Zandi, chief economist at Moody’s Analytics. “There’s a number of different ways in which Russia’s actions will hurt housing.”

The greatest impact should be on energy prices, with Russia being one of the top exporters of oil and gas – now blocked from making deliveries to the U.S. As war rages, prices at the pump soar, further accelerating the rate of inflation – hurting renters, buyers and builders – as well as possibly increasing buyer demand for homes with shorter commutes.

As one Atlanta-based economist shared recently, the best hedge against inflation may be a fixed-rate, low-interest mortgage and a Costco membership. His point: Finding a mortgage under 4% today as homes appreciate 8%+ a year, while paying for discounted gas at warehouse stores, can help stave off the effects of broad-based inflation.

Marci Rossell, chief economist at Luxury Portfolio International (of which John L. Scott Real Estate is a founding member), believes energy prices – with U.S. crude oil futures trading at about $100 a barrel, up from $66 a year ago – will impact consumers for “at least the next three months.“

“Things are going to be a little bit tough, mainly for lower income U.S. consumers who still consume a lot of gas as a percentage of income,” she notes. “I think the hit from higher inflation [impacts] your lower-income consumers most directly.”

Oil-producing areas of the U.S. are expected to help backfill the loss of Russian energy imports. States like Texas, North Dakota, New Mexico and Alaska may experience a boost to their local economies as workers increase production and possibly provide a lift for home buyers there.

Rossell, speaking this month to real estate industry insiders, concluded ominously: “It appears as if [Russian President] Putin is saying, ‘If I can’t have Ukraine, then no one can.’ And I think there’s concern that he will burn down the house completely before he will capitulate.”

—

If you would like to donate to help those affected by the conflict, please consider options that include the International Committee of the Red Cross, UNICEF, and Doctors Without Borders.

REMODEL UPSURGE

Thank goodness for Millennials. This generation is leading the charge in remodeling homes, particularly aging structures that could have been near the end of their lifespan. Without their spirit to rebuild, our thinning housing inventory would be more dire than it is today.

The home remodeling industry is a $368B business, according to Harvard researchers, and is expected to reach $432B by the end of this year. Soaring costs of labor and construction materials is certainly contributing to the rising figure but there is evidence of a sharp increase in home improvements since the start of the pandemic.

A 2021 survey showed nearly half of U.S. homeowners plan to upgrade or remodel their homes, including 63% of Millennial homeowners (25-34 years old). Most owners will contract work out for major renovation projects while doing DIY work on replacing flooring, painting or improving outdoor space, the survey from LendingHome showed.

Amid limited housing supply and rising prices, buyers will need to anticipate touring homes that will need some TLC as housing stock ages. Developers can build only so many new homes at a time!

“New construction is not likely to keep up with demand and bring that median age [of a home] down. That points to a lot of continued activity in remodeling in terms of replacement projects,” says Abbe Will, researcher at the Joint Center for Housing Studies at Harvard.

OLYMPIA LEGISLATIVE RECAP

Five pieces of Washington real estate and housing legislation passed both houses of the state Legislature and are with the governor.

Most notable, Senate Bill 5713 provides a property tax exemption until Jan. 1, 2033 for limited equity cooperative housing, when the property uses at least 95% for housing or other non-commercial purposes and that 85% of its occupants/owners are among a lower-income group.

Also, SB 5818 will promote housing construction in cities through more than two dozen amendments to boost affordable housing. Most amendments would not be subject to environmental or judicial review under the Growth Management Act or administrative or judicial appeals.

Another five pieces of legislation only passed one chamber of the Legislature before the short session ended last week. The most-watched proposal, House Bill 1782, would have permitted detached accessory dwelling units in areas with populations of at least 20,000 but it never got out of the first chamber.

Lawmakers approved about $800M to help reduce homelessness. Otherwise, it was a mostly disappointing year for advocates of affordable housing and low-income housing in our state.

NEW WAVE OF RESIDENTS?

Two years after the Great Shutdown, followed by the Great Resignation, we have the Great Conundrum. Businesses here and across the country are issuing new office-work rules that are taking effect through the spring.

Companies are being careful to time the shift to office work as well as address the concerns of their employees – or potentially face another stream of resignations. Hence, the conundrum for employers and employees alike.

Expedia, Microsoft, Google and others have introduced hybrid office work rules that are determined, mostly, on a department and manager level. Some service industries will require higher levels of in-person presence while other business sectors will do fine with a hybrid model. (Zillow is among a few companies to no longer require working in the office.)

The pandemic did not slow hiring within the tech sector, though companies mostly asked new workers to stay in place – whether it be in London, Conn., or London, U.K. – until in-office rules were announced. It is the expectation among real estate insiders that a new wave of residents will hit our shores this year looking for a place to live.

Hopefully they will be ready for the housing sticker shock.

BY THE NUMBERS

>> A survey of a thousand Millennials who plan to buy in the next year showed that 90% would purchase a home sight unseen in the right circumstances, including a great price point (56%), new construction (56%) and seller concessions (49%). Those considering it said they would first need to see photos, a virtual tour or have a trusted friend view the home in person on their behalf, according to the survey from Clever Real Estate.

>> Seattle was among the top cities for Millennials seeking a mortgage in 2021. In research from LendingTree, 61% of its mortgage offers in our city were to Millennial homebuyers, second in the U.S. behind Denver (64%).

>> Owners selling across the U.S. in 2021 profited an average of $94,092, or a return on investment of 45% compared to the original purchase price, according to ATTOM Data Solutions. In addition, average profit increased a whopping 45% in one year ($64,900) and 71% since 2019. Last year’s gain in ROI – up more than 11 percentage points – was the biggest annual increase since 2013.

>> Washington is among the leading states in the U.S. with equity-rich property owners, according to ATTOM. The state ranks fourth in this category, with 59% of all residential owners having paid at least half of their mortgage. Idaho is No. 1 at 67%. Spokane (64%) is fourth for equity-rich properties among U.S. cities with populations of at least 500,000, with Austin topping the list (71%).

>> About one-fifth (19%) of all U.S. home transactions are paid with cash, according to research conducted by John Burns Real Estate Consulting. The survey of more than 4000 real estate professionals also showed that Florida leads the way with cash purchases at 38% of all homes sold.

>> The share of potential buyers actively trying to find a home is shrinking, according to research from the National Association of Home Builders. In its quarterly survey, NAHB’s Housing Trends Report showed 52% of potential buyers say they can pursue a home in today’s market, a figure that dropped each quarter last year (57% in Q3 2021) and for six consecutive quarters.

>> In 2020, the share of adults aged 25-34 living at home grew to the highest percentage since 1960: 17.8%. The number declined to 17% in 2021 – still the second-highest share recorded. Some young adults have moved back home amid growing flexibility of remote work and to avoid paying high rents.

>> The number of workers to have returned to downtown Seattle offices since the start of the pandemic stands at 25%, as of Feb. 20, according to data compiled by the Downtown Seattle Association. Hotel occupancy rates stood at 67% at the end of February, down from 92% at Christmas week but up sharply from a year ago (26%), according to Visit Seattle.

MARCH HOUSING UPDATE

I wrote here last month of a rare market correction for single-family home prices in Seattle. Median prices fell 14% from May 2021 to this January. Well, those days of corrections ended with a thud in February.

Prices in Seattle and most of King County returned to the usual skyward trajectory last month. The housing environment is back to its normal self, with brisk home sales and accelerated prices.

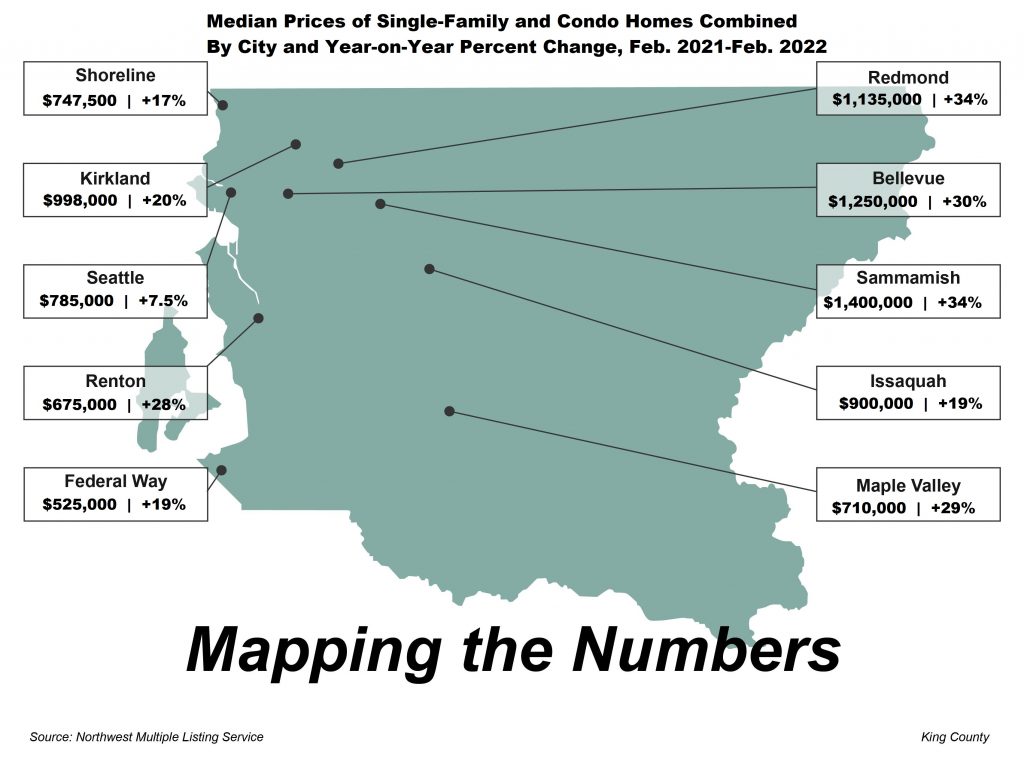

The county experienced a 5.5% price appreciation on all homes sold over the past reporting month and a 12% increase year-on-year (YoY) to $759,735. Seattle led the way with a 4.3% increase since January and up 7.0% YoY to $760,000.

Single-family-home prices across King added 11% in ONE MONTH and 14% YoY to $857,750. Again, Seattle led the way with an astronomical 17% increase since January ($925,000), including a 34% month-to-month surge in Magnolia and Queen Anne ($1.3M), followed by a 22% monthly rise in Ballard/Green Lake ($953,000). Home prices in Redmond and east surged 58% month-to-month ($1.36M) but that was based on only 19 sales in February.

Condo prices are right there with single-family homes. They rose a whopping 18% for the month across the county ($535,000) and 9.8% in Seattle ($549,154). However, the Eastside saw condo prices slip, down 1.7% ($633,745), including a 28% decline in Bellevue east of I-405 ($735,000).

Prices have gone through the roof, assuming we still have a roof over our heads.

On closer examination, in the past year we have witnessed outrageous home-price appreciation for single-family homes in portions of the Eastside. It was recently described by The Seattle Times as a “once-in-a-generation shock event.”

In February 2021, the difference in median prices for a single-family home in pricier Bellevue and Seattle was $630,000. Today, with the median price of a Bellevue single-family home at $2,110,609, the differential between the two cities has widened to $1,210,609 – nearly double the price gap in ONE YEAR.

Housing supply improved slightly in the past month but remains quite low. There are 0.6 months’ supply among all home types in King County and 0.5 months’ for single-family homes. Both the Eastside and Seattle have 0.6 months’ supply of single-family homes, with the exclusive area of Bellevue west of I-405, including Clyde Hill and Medina, as one outlier (2.4 months).

Condo inventory is not much better. There is 0.6 months’ supply across the county, including 0.3 on the Eastside and 0.9 in Seattle – all figures that are slightly lower than a month ago.

The time for a listing to go under contract remains low, with homes on the market averaging 19 days in Seattle and 13 in Bellevue. The national average is 35 days on market, down from 55 a year ago.

In addition to King County’s strong 5.5% month-to-month median price increase on all homes ($759,735), Kitsap experienced a sharp 3.7% jump from January to February ($525,000). Pierce added 2.1% on its media price since January ($526,000), while Snohomish gained 2.0% ($700,250). Single-family home prices in King soared 11% in a month ($857,750), as noted above, followed by Snohomish up 4.3% ($745,725), Kitsap up 3.2% ($525,000) and Pierce 1.9% ($535,000). Year-to-year, single-family median prices continued to climb in our region, led by a 21% jump in Kitsap, 19% in Snohomish, 16% in Pierce and 14% in King.

In a nutshell, it’s a strong housing market but not a healthy one.

Click here for the full monthly report.

CONDO NEWS

Residential construction is not immune to the vagaries of the business and housing world. Take, for example, the next great Seattle condo unveiling at Infinity Shore Club Residences.

Plans were for a March curtain-raising on the 37-home luxury condo at Alki Point, however delays caused by supply-chain issues and the continuing concrete workers’ strike have put a pinch in those plans. The sales team, which recently announced it has sold 12 residences in the last six months, acknowledged the building will more likely open in the summer.

That’s ideal for pool lovers, as this condo features a stunning, outdoor infinity pool that looks directly out at Elliott Bay and summer sunsets. Think about the pool parties!

The amenities are outstanding. They include a two-story residence lounge that is part of a glassed-in courtyard with sundeck, pool, hot tub, firepits and BBQs. The building also features a gym and outdoor yoga area, a great room/residents lounge, as well as bike storage, pet spa and kayak/paddleboard wash station. All residences come with an electric-vehicle parking spot and larger homes include two parking spaces.

You’ll hear more from me about Infinity Shore Club as work heads toward the finish line. Hard-hat tours are available for serious buyers. Prices start at $1.2M. Contact me with your questions.

———-

For the third time in less than a year, a Seattle condo project has been halted before doors were about to open and switched to apartments amid continued challenges in our city’s pandemic-squeezing economy.

The Goodwin, which we touted last summer, abruptly switched gears in recent weeks and plans to unveil its apartment leasing office this month. There is an expectation that the building will be renamed Volta, the moniker held for about 10 years when the building was, you guessed it, an apartment.

The Goodwin, located in Belltown, joins Encore in Columbia City and The Shoresmith in South Lake Union as condo-to-apartment swaps since September. About 240 units are affected in the three buildings and the news signals weaker-than-expected interest in urban condos.

———

On its website, Gridiron is promoting a $25,000 credit toward the purchase of a new home. This is at the 11-story, 107-unit condo in the shadows of Lumen Field.

The offer, which runs through March 30, sounds too good to be true. Attempts to obtain details on the promotion went unanswered by the sales team.

LUXURY LIVING

An extremely rare swath of land – about 22 acres along Lake Washington in the Laurelhurst neighborhood of Seattle – is expected to hit the market this year. The property just south of Northeast 50th Street is owned by the Missionary Sisters of the Sacred Heart of Jesus. It’s zoned for single-family homes and early estimates claim roughly 100 luxury homes – selling at about $1.5M-$2M a pop – could comfortably fit into the area, according to The Seattle Times.

Perhaps the city will want to rezone the property to open the possibilities to commercial/retail and multi-family buildings in an effort to increase the number of residents. It’s a once-in-a-lifetime opportunity to boost housing in a mostly exclusive part of the city.

—

When a home comes on the market in Yarrow Point, it’s big news. After all, the 1000 residents in the town just about know each other and when one plans to leave, there is a buzz. That is likely the case today, with the listing of a 4-bedroom, 3.5-bath, 5218 sq. ft., 1-story with finished basement on the tiny peninsula with 70 feet of private waterfront just east of Hunts Point. Built in 2018 for the homeowners, this contemporary classic includes massive glass openings on every wall and door, steel, marble, stained wood and glorious west-facing views across Cozy Cove, a large kitchen with butler’s pantry, as well as detached guest quarters – and, yes, much more. The couple living there is moving to Arizona, where the husband has reportedly shifted the headquarters of his investment company. List: $21.75M ($3717/sq. ft.)

—

It’s likely the sale would be private and take some time to complete, but it is a good bet that Russell Wilson will off-load his Eastside home now that he has become a Denver Bronco. Using a Bellevue-based LLC as the buyer, the star NFL quarterback purchased the 7-bedroom, 6.75-bath, 10740 sq. ft., 2-story mansion with 84 feet of waterfront along Meydenbauer Bay in 2015 for $6.7M ($624/sq. ft.). The county today assesses the 2008-built home on two-thirds of an acre at $13.85M, double Russ’ investment, with annual property taxes of, gulp!, $113,619.

—-

When it opens in 2023, First Light will be considered one of the most luxurious condos in the region. It is believed to be the only residential tower in the U.S. with a heated rooftop infinity pool (according to the First Light sales team) and offer outstanding views in the 48-story, 459-unit community at 3rd Avenue and Virginia Street. The building, which includes a balcony for every unit, is already about 70% presold. The last remaining penthouse came on the market this month – a 3-bed, 3.25-bath, 1841 sq. ft. stunner on the 45th floor. List price: $5,101,677 ($2771/sq. ft.)

—

Hold your breath, as we go to Lake Union for a 1-bed, 1.5-bath, 1425 sq. ft. houseboat with a $3M+ price tag. (I don’t get it, either!) The listing agent notes this is the second-largest houseboat to ever appear on the MLS. Yes, the listing photography is stunning. Okay, the views are amazing. And, the pedigree – designed by renowned architect Norman Sandler – is outstanding. Yet, the price – is out of this world: $3.3M ($2316/sq. ft.).

What else is happening in and around your Seattle?

Moisture Festival, Mar. 17-Apr. 10

It’s billed as the world’s largest comedy/variety festival. (I guess they haven’t been to Edinburgh in August.) No matter, Moisture Festival has about 40 shows at venues in Fremont and Capitol Hill. Many are for all ages … and some are late-night events for adults. Here’s a glimpse at some of this year’s performers. Various times.

Taste of Scotland, Mar. 19

Speaking of Scotland, Puyallup will host a big ceilidh (or dance event) at the Washington State Fair Events Center. Hear the Scottish pipes & drums, enjoy a wee dram of whisky and the stirring sounds at the 57th Tartan Ball that celebrates all things Braveheart, William Wallace and time-honored culture. 6:30pm-midnight

Tulip Festival, Apr. 1-30

The fields may be more than an hour away but visiting Skagit County to take in a sea of tulips is well worth the trip. Walk the farms, see the tulips standing at attention and breathe in the floral fragrance as another spring takes shape. Or check out the Tulip Festival Street Fair, April 15-17 in Mt. Vernon. Smiles are guaranteed.

Cherry Blossom Festival, Apr. 8-10

There is nothing better than to see the cherry blossoms in full bloom and filling a courtyard or lining our Seattle streets. It was in 1976 that Japan gifted a thousand cherry trees to the city as a gesture of friendship. The gift of blossoms every spring marks that continuing friendship. Join in the celebration at Seattle Center for the Cherry Blossom & Japanese Festival. Details are still developing.

Science Fiction Convention, Apr. 14-17

Norwescon is the Pacific Northwest’s premier science fiction and fantasy convention. While maintaining a primarily literary focus, the event is large enough to provide a chance for fans of comics, costuming, art, gaming and science to enjoy scores of guest talks and writing seminars. Organizers are limiting attendance to 1,000 at the SeaTac venue.

Seattle International Film Festival, Apr. 14-24

The 48th SIFF is scheduled to be a hybrid event this year, with films screened at the traditional event venues in Uptown, Capitol Hill, Ballard and elsewhere, as well as virtually on an exclusive digital channel. Details are taking shape and can be found here.

Richard Powers, Apr. 19

American novelist Richard Powers will be featured in the Seattle Arts & Lectures series. Powers won the National Book Award (The Echo Maker) and the Pulitzer Prize (The Overstory) for his works of fiction. He will be in the spotlight at Benaroya Hall in-person and online. Learn more. 7:30pm

Events subject to change. Please check with venues to confirm times, as well as vaccination-status and masking requirements.

In case you missed it….

This past month’s stories on my Living the Dream blog focused on buyers. After all, they need the most guidance in a challenging sellers’ market.

We discussed key steps to getting on the property ladder and important questions to ask when interviewing a mortgage lender.

We also covered two hot-button topics today: the intricacies of the offer review date in residential real estate and the increased risks buyers face when thinking of allowing sellers to stay in the home beyond the closing date.

Thanks for reading!

Will