Homeowners may choose to refinance for many reasons. Refinancing could potentially lower your monthly payments, allow you to consolidate debt, speed up the payoff process for your mortgage, eliminate your private mortgage insurance (PMI) and put more cash in your pocket. If you have equity in your home, you may be able to leverage it through a refinance.

Topics Covered

- Tax Deductions and Refinancing

- Cash-Out Refinancing and Taxes

- Home Improvements or Repairs That May Not Qualify for a Deduction

- Paying off Debts and Refinancing

- Mortgage Interest and Itemizing Deductions

- Home Equity

- Does Refinancing Affect Property Taxes?

- How to Get Started on Refinancing

Your home is likely your largest asset and most long-term investment, and refinancing your mortgage may allow you to get the most out of your investment. When you refinance, you can use the cash for:

- Family expenses: Your family expenses may have changed recently if you started a family or your child is heading to college. This may leave you needing more cash each month, and if you choose to refinance, this can help you adapt to these life changes.

- Home improvements: With a cash-out refinance, you can finally tackle those home improvements. No matter whether you want to put a new roof on your home or build an addition, when you refinance, you can free up more cash that can be put toward these renovations.

- Cost of living: Your cost of living may have changed since you purchased your home, particularly if you have taken a new job or your family has grown. Refinancing can make your mortgage more affordable and help you meet your financial obligations.

- Cash in your pocket: You may want more cash in your pocket to put toward investing or saving.

Before you take the next steps toward refinancing, you may be wondering about the tax implications of refinancing a mortgage. At Assurance Financial, we have developed this guide to refinance tax implications to help you determine whether a mortgage refinance may be the right option for you.

Tax Deductions and Refinancing

Are refinancing costs tax deductible? The IRS allows homeowners to deduct some of the interest paid on their mortgage debt on a primary home, secondary home or both. If you have a $650,000 mortgage on your primary home, for example, and $350,000 on a vacation home, you may be able to deduct all of your mortgage interest.

When it comes to refinance tax deductions, the same rule applies. If you choose to refinance one or even both of your mortgages, you may be able to deduct all of your mortgage interest as long as your combined mortgage principal does not exceed the limit of $1 million for married couples and $500,000 if filing separately or as a single filer.

However, there are certain requirements for what your refinance cash can be used for to be eligible for a deduction. We cover these requirements in greater detail below.

Cash-Out Refinancing and Taxes

There is a particular requirement to qualify for a tax deduction with a cash-out refinance. For your cash-out refinance to be tax deductible, you must be using the money to purchase, build or improve your house. If you use the cash for another purpose, you may not be able to take a deduction on your taxes. The following are a few examples of how you can use the refinance money to ensure it is tax deductible:

Add a Home Office

A home office can be a great, tax-deductible investment, particularly if you are self-employed or a small business owner. If you choose to add a home office to your house, you may be able to claim this as a deduction on your taxes.

With this deduction, you can claim a percentage of what you have paid on the mortgage as a business expense. When you are calculating your tax liability, you may select the regulation deduction or the simplified deduction. The deduction you will take depends on the size of your home office.

For a home office to be eligible for a home office deduction, it must meet certain requirements, including:

- Primary place of business: To claim a deduction, you should use your home office as the principal place for conducting business. Though you can conduct business from other places, your home office may need to be the place where you work the most.

- Frequent and exclusive use: If you want to claim a home office deduction, you may have to use it for business purposes only. This means you and your clients use the office space only for your business. If you use your home office as a guest room as well, you may not be able to claim a deduction.

Make a Capital Home Improvement

The part of your mortgage that you refinance and pay interest on can be deducted if you use the money for a capital improvement on your property. This means the improvement should increase the home’s value, add longevity to the property or adapt the property to a different market. Common capital improvements include:

- Fixing the roof so it is more durable

- Building an addition or new bedroom

- Installing a fence for aesthetic or privacy purposes

- Adding a spa, jacuzzi or swimming pool to your yard

A capital home improvement does not necessarily have to be a big-ticket item. You can make smaller improvements as well, such as:

- Installing a home security system

- Adding a central heating or air-conditioning system

- Replacing your windows with storm windows, especially if you live in an area prone to heavy storms

When you increase your property’s value, you may also receive more money when it is time to sell your home. These improvements may also reduce your liability for capital gains tax. Keep your receipts and careful records. This will help you remember how much money you spent and when you performed the renovations.

Improve a Rental Property

If you own a rental property, you may want to use your cash-out refinance money to repair or enhance the property. You may be able to deduct the expenses of a repair or improvement from your taxes.

You may be able to claim a deduction for a rental property because the IRS considers money you earn from a rental property as personal income. Further, you may be able to deduct interest, insurance and closing costs paid on a rental property from your income taxes as business expenses.

Home Improvements or Repairs That May Not Qualify for a Deduction

For tax purposes, if you use your cash-out refinance funds for something other than home improvement or repairs, this is considered a home equity loan. Some home repairs may not qualify you for an interest deduction, especially if they do not improve your property’s baseline value. The following are some repairs that may not qualify for an interest deduction:

- Replacing a cracked or broken window

- Repairing your HVAC system

- Painting a room

While a home equity loan may still be tax deductible, the limit for how much of your interest you can deduct is much lower than for a refinance. For example, if you are a single homeowner who owes $100,000 on your mortgage and you take a cash-out refinance for $160,000, you can use this extra $60,000 to make renovations or repairs. Since you are using the cash to purchase, build or improve your home and you are under the limit of $500,000, you may be able to deduct all of your mortgage interest.

If you instead use that $60,000 to put your child through college, you may only be able to deduct a portion of this new debt according to the limits set for home equity loans.

Paying off Debts and Refinancing

Can you use a refinance to pay off other debts? While the interest you pay on your mortgage may be tax deductible, you may not be able to deduct the interest you pay on other debts. If you want to convert the interest you pay on a credit card, for example, you may be able to roll this debt into your mortgage through a cash-out refinance. The rate for a mortgage is often lower than rates for other types of debt.

If you use a cash-out refinance to pay other debts, then for tax purposes, the funds you borrow are considered a home equity loan. This means the funds are subjected to the limits of a home equity loan in terms of how much you can deduct.

Mortgage Interest and Itemizing Deductions

Keep in mind that if you refinance your mortgage, this may decrease your total tax deductions significantly. When you are able to refinance to a lower rate, you may pay less interest, meaning you will have less mortgage interest that can be deducted at tax time.

Your interest costs can reduce substantially if you switch to a 15-year mortgage with a 3% interest rate from a 30-year mortgage with a 5% interest rate. Along with a lower rate, a shorter term can mean your interest costs fall faster over the coming years, also decreasing the amount you can deduct.

For many homeowners, their mortgage interest deduction is the factor that leads them to itemize deductions. Unless your deductions can exceed what you would receive from the standard deduction, there may be no point in itemizing. Revised benchmarks for deductions may decrease the chance that you will gain tax savings from a refinance when you itemize deductions. A tax preparer can help you determine whether itemizing or taking the standard deduction is a better financial option for you.

Overall, you may be saving money by reducing your interest costs, regardless of whether you can deduct your costs at tax time. However, you may want to anticipate that if you refinance, your deduction may be a smaller amount than you expected.

Home Equity

When you make payments on your mortgage, you will slowly build equity in your home. Equity is essentially the part of your house that is truly your own, as it is the portion of your home that you have paid off. When you have equity, you can use it to your advantage.

Previously, homeowners were able to deduct interest paid on a home equity loan for a reason other than home renovation, such as college tuition costs. However, this deduction has recently been eliminated. Now you must use the money for improving your home to qualify for a deduction.

Before it’s time to file your taxes, you may receive a Mortgage Interest Statement or an IRS Form 1098 from your lender. This shows the interest you paid on your home equity loan or mortgage the previous year. If you want to deduct the interest you paid, you may need this form. If you don’t receive this form, contact your lender. You may also want to contact your lender if you need help understanding the form.

APPLY TODAYDoes Refinancing Affect Property Taxes?

Homeowners in the U.S. are subject to property taxes. How much you’ll pay in property taxes is determined by your taxing jurisdiction at the city or county level. These taxes are typically used to fund public safety, roadwork and school systems.

Your tax rate and your assessment are used to calculate the amount you pay in property taxes every year. For example, if your property is assessed at $200,000 and your tax rate is 4%, you will pay $8,000 each year in property taxes. Your property taxes may increase if your assessment or rate increases. Refinancing your home doesn’t impact these numbers.

When you finalize your cash-out refinance near or on the date your property taxes are due, you could end up paying these taxes when you close on the loan. If this is the case, on your next tax return, you may be able to deduct what you paid on property taxes during the refinance.

Keep in mind that only the property tax payments you made during the year may be tax deductible. If you put cash into escrow to be used on future property tax payments, you may not be able to deduct this money.

How to Get Started on Refinancing

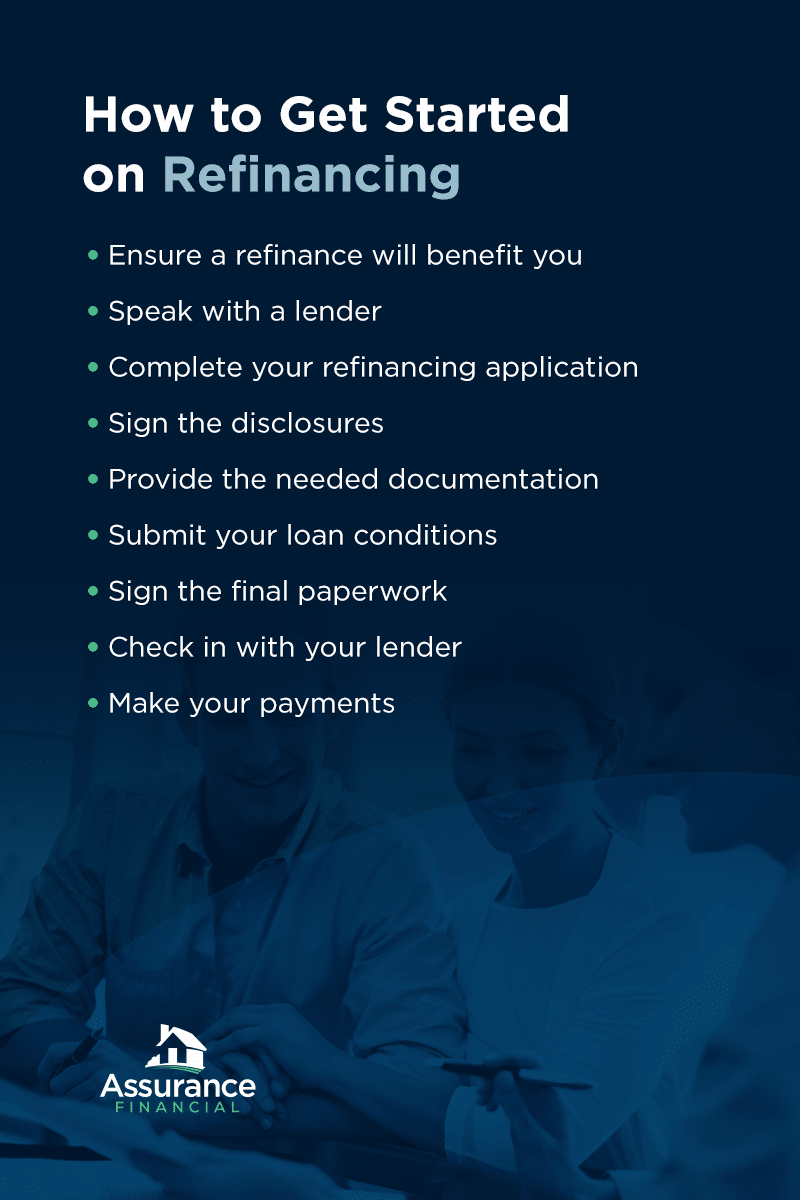

The tax implications of a refinance can be complicated. Before you choose to refinance, you may want to discuss your plan with a tax professional and a mortgage loan expert. Follow the steps below to get started on refinancing.

- Ensure a refinance will benefit you: Figure out what your goal is and whether refinancing can help you achieve it. Will this decision save you money? Are the current rates low enough? If you choose a cash-out refinance, ensure that having this money now outweighs the additional years of debt. Only you can determine what the right decision is for you, but our mortgage advisors can help you weigh your options.

- Speak with a lender: For decades, Assurance Financial has been servicing mortgages to customers. We aim to make the process of refinancing fast and simple. You may be able to get pre-qualified for a refinance in just 15 minutes with a free, no-obligation quote. As an independent lender, we offer every loan type available, and we will handle the entire process in-house.

- Complete your refinancing application: When you are ready to refinance, you can apply with us online or with one of our loan advisors. We can help you through the steps and answer any questions you may have.

- Sign the disclosures: After you complete your application, we will send you your disclosures. You’ll sign these, and if you choose, you can verify your loan terms and make sure you are accomplishing your goal of cashing out or lowering your rate.

- Provide the needed documentation: Once you sign, you will submit your documentation to us at Assurance Financial, including your income verification and asset verification.

- Submit your loan conditions: Then an in-house underwriter at Assurance Financial will receive your paperwork. The underwriter handling your paperwork will let us know if there are any other items that may be needed.

- Sign the final paperwork: After you have been approved for your refinance, you will meet with a notary to sign your final paperwork.

- Make your payments: At this point, you have completed the refinancing process. After 30 to 60 days, you can begin making your payments on the new mortgage. If you obtained a cash-out refinance, you can use your cash for your home renovations.

While the refinancing process can initially feel overwhelming, it doesn’t have to be. When you choose to work with us at Assurance Financial, we aim to ensure your journey to refinancing your mortgage is easy and stress-free as possible.

Refinance With Assurance Financial

At Assurance Financial, we know our customers are busy. Our licensed loan officers can help you determine whether a refinance makes sense for you and assist you in navigating the process. When you choose to work with us, we’ll bring our experience and knowledge to the process and help you find an optimal deal.

[download_section]

When you work with us, we’ll provide personalized attention. Whether you are looking to refinance or obtain a new loan, we can offer the loan type that’s right for you, such as:

- Conventional loan: A conventional loan may be the right choice for you if you have a stable income, good credit and a down payment.

- FHA loan: If you don’t have a sizable down payment to secure a mortgage loan, there’s good news — you may be eligible for an FHA loan. This loan type can be an attractive alternative to conventional financing due to its lower down payment and flexible credit requirements.

- Jumbo loan: Sometimes your dream home exceeds the limits of conforming loans. Maybe you live in an expensive housing market or maybe you just want a large, beautiful home. Whatever the case, a jumbo loan can help you finance the home of your dreams.

- Construction loan: If you are looking to build a new home or renovate your property, you may want to apply for a construction loan. Our construction loan programs offer flexible draw schedules and competitive rates and fees.

- USDA RD loan: If you live in a designated suburban or rural area, you may be eligible for a USDA RD loan. Moderate-income and low-income borrowers may benefit most from this type of loan, as it doesn’t require a down payment and may offer affordable rates.

- VA loan: If you are a veteran or active service member, you may be eligible for a VA loan. This loan type requires little or no down payment and limits closing costs. There is also no monthly mortgage insurance or pre-payment penalties.

Take just a few minutes to start your application with Abby or find a loan officer today to learn more about how to refinance a mortgage.

Sources

- https://assurancemortgage.com/refinance-your-home/

- https://www.irs.gov/publications/p936

- https://assurancemortgage.com/four-signs-you-should-refinance-your-mortgage/#section12

- https://assurancemortgage.com/conventional-loans/

- https://assurancemortgage.com/construction-loans/

- https://assurancemortgage.com/jumbo-loans/

- https://assurancemortgage.com/usda-loans/

- https://assurancemortgage.com/fha-loans/

- https://assurancemortgage.com/va-loans/

- https://assurancemortgage.com/apply/

- https://assurancemortgage.com/contact-us/