If living or working in an urban area, how much is a parking space worth to you?

As we prepare to mark Earth Day with greater purpose and celebrate the actions by owners at Climate Pledge Arena (pictured) and others, the question on my mind is straightforward: Do we need all the parking spaces allocated to residential and commercial areas? Sure, parking at Sea-Tac airport and around the stadiums in Sodo seems to be in shorter supply – but what about downtown or Bellevue?

With each stall in a commercial garage costing tens of thousands of dollars to build, parking requirements can impose significant costs on property developers, owners and renters. These requirements often end up forcing people who buy or lease to pay for parking regardless of their needs.

State and local lawmakers are inching in the right direction. As they loosen regulations on the addition of accessory dwelling units (aka mother-in-laws), so too are municipalities dropping requirements for off-street parking within walking distance of a transit hub. But shouldn’t we incentivize us all to separate the need for parking in urban areas when other options exist?

Many people today already rely on public bus service, an increasing number of bike lanes, the uptick in electric scooters and our love of rideshares, making demand for vehicle parking far less necesary in urban areas.

A report issued last month by the Downtown Seattle Association noted “the majority of workers still plan to use public transit once the pandemic is no longer a serious threat.” Workers will take the ever-expanding Link light rail and increasing number of express bus routes to get around. Plus, there is the prospect for completion of the First Avenue streetcar that will connect downtown/Belltown with existing service in South Lake Union, Pioneer Square, International District and Capitol Hill.

One-size-fits-all parking requirements can lead to excess land dedicated to parking that might otherwise be used for housing. Parking stalls in the Puget Sound region increased by 13% from 2013 to 2018, while the population increased by 9% and housing rose by only 6%, according to local data sources. And a King County parking study found that, on average, multifamily buildings supply 40% more parking than is utilized.

Rather than allocating parking that goes unused, developers could propose sharing available space in nearby buildings. That’s what the people behind The Emerald condo did when it opened in 2020. Built with only 64 parking spaces for 262 units, the building’s developers partnered with Thompson Seattle Hotel next door to provide parking when needed, in addition to the condo’s small fleet of electric vehicles for short-term lease.

A builder could also agree to install more bike storage or pay a fee-in-lieu to fund public parking and transportation infrastructure that serves the entire neighborhood. The conditions of such an agreement may not ever be triggered, reducing car dependency and vehicle miles traveled as well as improving our carbon footprint.

Last summer, we experienced record-high temperatures – and hundreds of fatalities – across the PNW. One of the causes of scorching urban temperatures was the effects of asphalt patches of surface parking that absorb heat for longer periods. Increasing tree canopy can help keep temperatures down but how many trees do you see in a parking lot?

It is high time we reverse our lust for personal vehicles and excessive parking or the results will likely be more costly and more deadly.

THE IMPACT OF SURGING RATES

The spring housing market will include a trio of indicators – all rising. This year’s buying and selling campaign will be marked by increasing inventory (good!), soaring interest rates (bad!) and rising home prices (still!).

Mortgage rates have now risen by about 1.9 percentage points since the start of the year and 1.55 points in the last three months. They are now quoted by Freddie Mac at 5.0% – the highest since 2011 and the sharpest three-month rise in nearly 28 years (+1.56 points, Feb.-May of 1994) – and locally around 5.25% or higher (depending on an applicant’s personal circumstances). The figures represent roughly the rate a borrower with strong credit and a 20% down payment can expect to see when applying for a mortgage. More concerning is that there does not appear to be a ceiling.

“Rates have a small chance to top out [at] 5% and a good chance of topping out before hitting 6%,” Matthew Graham, chief operating officer at Mortgage News Daily, said before the latest bump in rates this week. “It is a rapidly moving target in this environment, where we legitimately and unexpectedly find ourselves needing to be concerned with inflation for the first time since the 1980s.”

What does it mean to buyers? An $800,000 mortgage last year at 3% would require a monthly payment of about $3373. At a 5% interest rate, that payment jumps to roughly $4295. Put another way, for every percentage point increase in mortgage rates, monthly payments rise roughly 13%.

The impact is greatest on first-time buyers and lower-income households, which recently prompted housing advocates to urge the White House for further help on the issue of affordability.

“If rates rise above 5% you will price buyers out of the market,” Devyn Bachman, vice president of research at John Burns Real Estate Consulting, told Fortune. “The higher rates could also discourage investor activity, which accounts for a large portion of home sales today.”

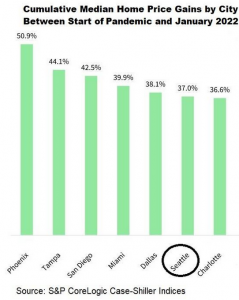

Median home prices have risen steadily, particularly since the start of the pandemic. The median price of a single-family home in King County was $720,400 in March 2020; it is now $930,000, or 29% higher. Median prices on the Eastside for a single-family home have surged 64% in the same period and Seattle prices added 23%. Nationally, home prices have soared 27% since Covid-19 was officially declared a pandemic amid a whopping 62% decline in available homes for sale in the last two years. The accompanying chart shows where Seattle metro compares to other cities over the period between March 2020 and January 2022. (Tap on chart for a larger version.)

Median home prices have risen steadily, particularly since the start of the pandemic. The median price of a single-family home in King County was $720,400 in March 2020; it is now $930,000, or 29% higher. Median prices on the Eastside for a single-family home have surged 64% in the same period and Seattle prices added 23%. Nationally, home prices have soared 27% since Covid-19 was officially declared a pandemic amid a whopping 62% decline in available homes for sale in the last two years. The accompanying chart shows where Seattle metro compares to other cities over the period between March 2020 and January 2022. (Tap on chart for a larger version.)

The costs of buying the same home this year compared to just one year ago have risen by 40% from a combined impact of higher home prices and soaring mortgage rates, according to Lawrence Yun, chief economist for the National Association of Realtors® (NAR). He expects an inevitable sales slowdown, likely of about 7% year-on-year by the end of 2022.

We have yet to see a significant slowdown locally. Prices in King County continue to climb and single-family homes come on and off the market in a median of 5 days (or an average of 11 days).

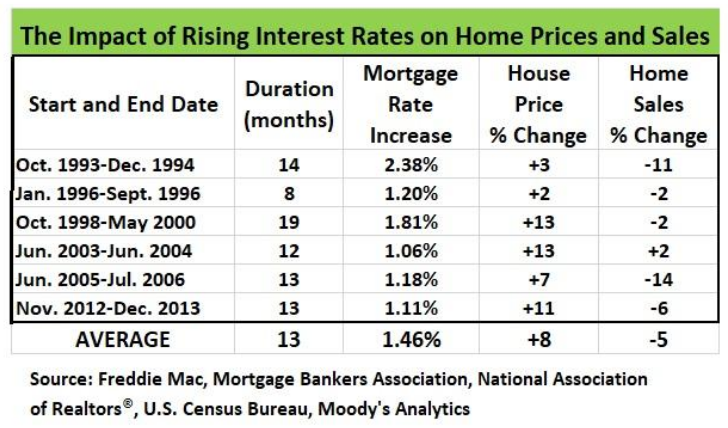

Doug Duncan, Chief Economist at Fannie Mae, noted: “What I will caution against is making the inference that interest rates have a direct impact on house prices. That is not true.”

He’s right. In some of the more recent instances where mortgage rates climbed more than one percentage point in about a year, home prices still rose and sales usually fell.

Yun offers a silver lining: “I expect the pace of price appreciation to slow as demand cools and as supply improves somewhat due to more home construction.”

For buyers, they can only hope.

BY THE NUMBERS

>> 201 Main Street is the most popular residential address in the U.S. ATTOM Data Solutions reports there are 406 instances of that address across the country. It said “Main Street” was also the most common street with nearly 485,000 home addresses in the U.S. with that street name, more than double the second-most-popular choice, “2nd Street.” Nearly 80 million residential addresses are unique – one and done, according to ATTOM.

>> Investor purchases of residential property jumped 12% year-on-year, according to Q3 2021 data from ATTOM. Arizona led the way with 27% of all home purchases by investors, followed by Georgia (25%) and Arkansas (24%). Washington was 40th among U.S. states with 9.7% of all homes purchased by investors, with Vermont (0.5%) last.

>> Researchers at Harvard forecast a 14% year-on-year increase by the end of 2022 in owner-occupied home improvement spending. In a study of 48 metro markets, Tucson, Ariz., was expected to be the busiest with a forecast 23% increase from December 2021 to December 2022. Seattle-Tacoma-Bellevue was in the middle of the national pack with a forecast increase of 13% YoY in home improvement spending. The researchers said, “record-breaking home price appreciation, solid home sales and high incomes are all contributing to stronger remodeling activity.”

>> U.S. homeownership jumped 1.3% between 2019 and 2020 – the largest annual increase on record – to 65.5%, according to a report released by NAR. More Americans own a home now than during any year since the Great Recession. While whites own a growing number of homes (72.1%), Black ownership continues to slip, now at 43.4% from 44.2% in 2010. The rate of homeownership among Asian (61.7%) and Hispanic Americans (51.1%) continued to climb, the report said.

>> The largest commercial property deal in the PNW in 2021 was 300 Pine, the former Macy’s building in downtown Seattle, purchased for nearly $580M by the Urban Renaissance Group. In a close second was West 8th, an Amazon-leased building bought by Kilroy Realty for nearly $490M million, according to data compiled by CommercialCafe.

>> The area encompassing Tacoma and Seattle was among the leading metros in the U.S for middle-income home sales in the 2010s, according to data from NAR. Specifically, our region sold 31,284 homes to middle-income households. That’s ninth in the nation, with our neighbors, Portland, eighth overall (34,373 homes) and Phoenix tops (103,690). Sadly, the homeownership rate among middle-income households has plummeted to 69.7% from 78.1% since the Great Recession.

>> Between South Lake Union and Sodo and Capitol Hill/First Hill to the waterfront, there are 1167 condos under construction as of March 2022, compared to 7241 apartments, according to the Downtown Seattle Association.

APRIL HOUSING UPDATE

There are no signs of a market slowdown or bursting bubble in our housing market. None.

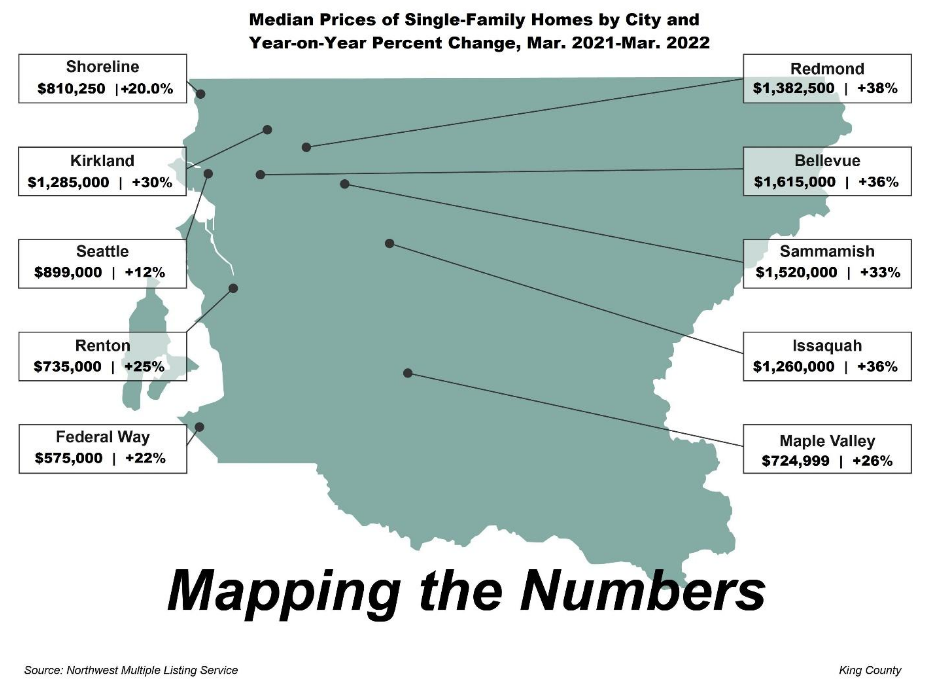

Case in point: Single-family home prices for King County hit an all-time high of $930,000 in March, up 8.4% from February and 13% a year ago. The annual gain is the greatest since 2017 (15%). Median prices on the Eastside took a break from February, effectively unchanged at $1.7M, a figure that is still 26% above this time last year.

New and month-end (existing) single-family-home listings rose in King by about 48% from February but the totals remain at bare-cupboard levels. Only 284 homes are for sale in Seattle, down 43% from a year ago. For context, the 5-year running average for March (excluding 2022) is 581 listed homes in Seattle. Across the county, 973 are on the market as of April 1 vs. 1903 homes for sale on average for each March 2017-2021.

If no additional homes hit the market, it would take 14 days to exhaust the entire single-family-home supply in King, 16 days on the Eastside and only 12 in Seattle. The thought that early spring would produce more, longer-lasting inventory has yet to materialize.

Condo prices, while mostly flat month-to-month on the Eastside ($630,000) and in the county overall ($540,000), fell a sharp 7.1% in Seattle from February ($510,025). Inventories for condos were little changed from month to month, standing at 0.6 months in King, 1.0 in Seattle and a paltry 0.3 on the Eastside (including 0.1 in an area that includes Factoria and Issaquah).

Total inventory – including single-family, condo and townhomes – rose 43% month to month but is off 21% year-to-year. The same is true across the U.S. overall, where housing inventory rose 2.4% from January to February (latest data) but is still down 16% from a year ago.

King County experienced an incredible 10% median price jump from February for all home types, to $838,753. Elsewhere, Snohomish County saw the second-sharpest jump – a rise of 8.3% from February ($758,707). Pierce added 4.6% on its median price in the past month ($550,000), while Kitsap gained 1.9% ($534,997). Single-family home prices in King jumped 8.4% in a month ($930,000 – an all-time high), followed by Snohomish (up 7.3% to $800,000), Pierce (up 4.1% to $557,000) and Kitsap (plus 2.6% to $538,500). Year-to-year, single-family median prices jumped 25% in Snohomish, 20% in Kitsap, 16% in Pierce and 13% in King.

Northwest Multiple Listing Service data also show prices for all home types in the four-county region combined have surged 39%, just shy of $200K, since March 2020, jumping from a median price of about $520K to nearly $720K.

“As for where home prices may go from here, that depends on several factors,” noted Danielle Hale, chief economist, realtor.com. “First, even though construction is starting to catch up, we have a huge 5.8 million home deficit to build out of. For context, that would be five-plus years of construction at the recent pace, so that’s a long-term issue.”

In other words, the sluggish pace of new construction might continue to keep home prices high. Plus, homebuyers have benefited from a hot employment market, in which there are two available jobs for every person looking for work. Buyers might have the extra cash to afford higher-priced homes – for now. As U.S. wages rise at a hefty 6.8% annually, inflation is running at an even hotter 8.5%.

Click here for the full monthly report.

CONDO NEWS

Our region was just digging out of the Great Recession and housing bust when Bosa Development decided to build a 41-story condo on the eastern edge of Belltown – not exactly a hot spot to live in then nor a great time to embark on such a grand project.

One real estate analyst at the time was quoted by local media as describing the plan to add about 350 new homes to a flooded – and wary – marketplace as “an extraordinarily bold move” given the timing.

But in mid-2015, five-plus years after breaking ground, the south tower of Insignia at 588 Bell Street was finished. And, after a surprisingly good response from buyers, the north tower at 583 Battery Street sprung from the ground about a year later.

Well, Vancouver, B.C.-based Bosa is at it again.

As we come through the other end of a devastating pandemic and ride the rising wave of interest rates and inflation, Bosa is preparing for its next gutsy endeavor. In March, the developer and City of Seattle announced plans to begin construction this month on a 57-story, 422-unit, mixed-use condo tower in a full city block between 3rd and 4th avenues and Cherry and James streets, just west of City Hall.

This would become the tallest condo building in the city and second-tallest residential tower. The just-opened Rainier Square Tower stands at 59 stories and includes luxury apartments, office and retail space.

Highlights for the still-unnamed condo high-rise include a rooftop pool and fountain-lined public plaza. The opening is targeted for 2026.

In addition to Insignia Towers, Bosa has constructed a beautiful boutique condo in Bellevue, One88, which opened in 2020, as well as the REN apartments in Seattle (opening this year). Bosa is also planning a pair of apartments in downtown Bellevue with tentative plans for openings in about two years.

—–

News out of Denny Triangle, where Nexus reportedly has 43 unsold homes from its original inventory of 389 units. More notable is that eight penthouses apparently remain among the unsold.

“We expect to sell 30 to 35 of the remaining units this year and the handful that remain in 2023,” Puget Sound Business Journal quoted Nexus sales/marketing team Erik Mehr & Associates.

Nexus opened on the corner of Minor Avenue and Howell Street in February 2020, just as the pandemic was beginning. At 41 stories, it was the first high-rise condo to open in Seattle in about a decade. Another three major projects have since opened in the city.

—–

The unveiling of next year’s only new condo high-rise in Seattle is delayed further. The continuing concrete workers’ strike has pushed the opening of Graystone to the summer of 2023, according to the team helping to market the project. The building was aiming for an early ‘23 opening until the strike hit last November, halting concrete pours with only five floors to go on the 31-story structure.

Interior work continues on lower floors and the sales team expects to begin closing on contracts within the month. Buyers only need to put $5000 down for now to get a piece of the action.

Update: As we prepared to publish this month’s newsletter, the union representing some 300 concrete workers in our area agreed to return to work without a new contract. Great news for the Graystone development, as well as Link light rail expansion and the Washington State Convention Center addition.

—–

Just blocks away, the Archdiocese of Seattle in late March sold four significant parcels to Westbank. They are the developers of the First Light condo project in Belltown, two apartment towers under construction tentatively named WB1200 in Denny Triangle and the forthcoming Museum House luxury apartments on First Hill.

The land is located near St. James Cathedral and includes its Pastoral Outreach Center at 907 Columbia Street and buildings at 710 9th Avenue, 907 Terry Ave. and 1107 Spring Street. The agreement includes the preservation of the historic Connolly House at the Spring St. address.

While it is noteworthy that Westbank will develop some 1300 homes across four towers – likely apartments and affordable-housing units instead of condos – the real buzz is over plans to partner with Swedish Health Services nearby to modernize its HVAC system that will divert excess heat from the medical facilities’ First Hill campus to an energy-sharing platform that will help heat the new Westbank buildings, all with an aim to make the Swedish infrastructure carbon negative by 2030.

“St. James [Cathedral] has been part of the history of First Hill since 1905,” noted the archdiocese in making the announcement. “We are excited to be part of shaping the First Hill of the future and ensuring that St. James Cathedral, as well as neighboring O’Dea High School, remain at its heart.”

LUXURY LIVING

We start this month’s glance at amazing properties on the market in the equally amazing part of King County, Issaquah. That is where you will find a 5-bedroom, 5.5-bath, 7000 sq. ft., 1 ½-story, mid-century modern custom home in the foothills of Cougar Mountain. Philanthropist Susan Armstrong, whose late husband Tom owned Ridgeway Packaging, is selling the property after a quarter-century. The gorgeous manse sits on just-shy 7 acres and includes eight(!) fireplaces, timber beams, and an open plan main floor with views of Lake Sammamish in the distance. List price: $5.198M, or $743/sq. ft.

We speculated last month on the likely sale of Russell Wilson’s Lake Washington home in Bellevue and it is already moving forward. The 1.9-acre, 2-parcel estate (image above) hit the market on Tuesday and is listed as a 6-bedroom, 5.25-bath, 11,104 sq. ft. home with 270 feet of shoreline along Meydenbauer Bay. The 2-story house with finished basement was built in 2007 and updated after the former Seahawks QB bought the place in 2015 for $6.7M. The property features a 20-foot-high rotunda entry to the home, chef’s kitchen, theater, game room, recording studio, fitness and yoga areas, five fireplaces and 3-level elevator, as well as a 2-story, spiral-staircase treehouse(!), sport courts, dock for three slips and two jet-ski lifts. List price for both parcels: $36M ($3242/sq. ft.) – the highest-priced home on the market in Washington – or $28M ($2522/sq. ft.) for the one lot with home and 164 feet of waterfront.

Or, how about a taste of the high life – as in 19 stories high. This 2-bed, 2-bath, 1932 sq. ft. home stands out for its amazing Southwest-facing views within the south building of Bellevue Towers. The walls of glass make you feel like you’re floating in space. I particularly like the Brazilian cherry hardwood floors. List: $2.325M, $1203/sq. ft.

Not high enough in the clouds, you say? Then, I offer you this 2-bed, 2.5-bath, 2903 sq. ft. home on the 32nd floor of Continental Place, one of the first purpose-built condos in Seattle (1981). The westerly views in this penthouse are some of the best in the city. The sellers, who reportedly include a New York Times multi-best-selling author, are offering the home at a huge discount. Originally listed in May 2019 at $4.995M, the price was trimmed last month to $2.995M, $1032/sq. ft.

For something a little more fun and contemporary, check out this 3-bed, 3.25-bath, 3036 sq. ft. sub-penthouse a few blocks north in The Concord. The layout is perfect, with picturesque views of Elliott Bay and Magnolia to the north and the Space Needle from the main bedroom to the East. The office is raised slightly to look out onto the bay. Outstanding detail throughout! List: $4M, $1318/sq. ft.

Looking for something bigger, welcoming and brand new? This is the one: a 7-bed, 6.25-bath, 6252 sq. ft., 2-story with basement in Enatai, West Bellevue. Let’s call it what it is: farmhouse chic! In addition to all the bedrooms, the home includes an office, media room, fitness room, bonus room and wine cellar (my favorite room!). HOA dues of $1400 a year include access to a community pool and sport courts. List: $9.295M, $1487/sq. ft.