Home prices are overheating, mortgage rates are inching up from the start of the year and the supply of homes is in an unseasonable valley – far from its Mt. Rainier-esque peak of a decade past! It’s both fascinating and frustrating to watch. Amid the challengers for buyers, there is an expectation for housing activity to continue puffing its Thomas the Tank Engine without a misfire – at least through early summer – before possibly lowering a gear.

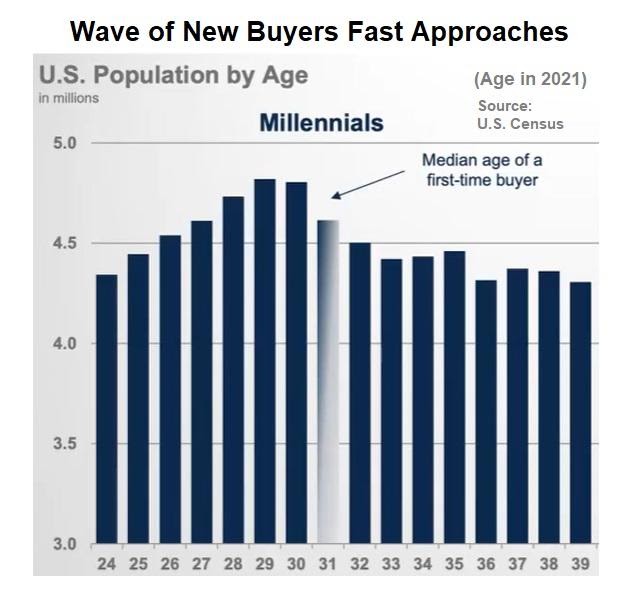

One of the reasons for the continued home-sales intensity – in any season – is a key group of “new” buyers. Thank you, Millennials!

This segment of America, born from about 1980 to 1998 and the largest living adult generation in U.S. history, continues its march into prime home-buying years at a rate of more than 4.5 million individuals annually. Roughly 20 million Millennials will be entering their 30s, typically the time they purchase their first home, between now and 2024. Today, 37% of all buyers are Millennials and they comprise about 54% of all mortgage applications. A full 48% of all homeowners are now Millennials, up eight percentage points from only three years ago.

The 2010s saw a surge in Millennials arriving to our area, helping to make Seattle the fastest growing big city of the last decade. In fact, 36% of all Seattleites are Millennials. The narrow area known as Westlake, just west of Lake Union (and, notably, close to Facebook, Google and Amazon offices), has seen the number of people aged 25-34 double from 2010 to 2019 and now comprise 52% of its residents.

To be sure, the number of Millennials buying homes is at a slower pace than their contemporaries. At age 30, 41% of Millennials own homes, compared to 48% of Gen Xers and 51% of Baby Boomers when they hit their thirties. But the gap between Millennial and Gen X ownership has narrowed, from 9.5 percentage points at age 30 to only 4.8 points at 34.

Often burdened by lingering student loans, younger generations are putting down less to buy a place and absorbing more debt to take advantage of still-favorable mortgage rates. Three-quarters of respondents to a survey last summer said that low interest rates would enable them to start their home search sooner. But rates are trending higher, now around 3.125% from about 2.75% on Jan. 1, and there could come an affordability tipping point, as I noted earlier.

Warns Danielle Hale, chief economist with realtor.com: “While younger Millennial and Gen Z buyers are expected to play a growing role in the housing market, fast-rising prices will create a bigger barrier to entry for the many first-time buyers in these generations who don’t have existing home equity to tap for down payment savings.”

Still, we have seen many consumers – including Millennials – save their money over the past year-plus while dining out and travel were not available or advisable. With a larger nest egg, and support from down-payment assistance programs, Millennials are seeing the timing is favorable for seeking out their first homes.

3-D PRINTED WHAT??

I don’t usually tout the work on my Living the Dream blog except for a brief mention at the bottom of each newsletter in the “In case you missed it …” section. This month, I am making an exception.

One blog post has been on my radar since last summer, and I was finally able to pull together enough detail and visuals to tell the story right. It’s about a Texas-based company and its ingenious founder that make homes with a 3-D printer. Homes of about 800 sq. ft. are “printed” in 24 hours for about $4,000 (plus windows, doors and a roof). Icon is on a mission to change the way we house the homeless and others.

While the words from the article tell a compelling story on their one, the visuals add the needed icing on the cake:

BY THE NUMBERS

The U.S. housing market needs 3.8 million single-family homes to meet current demand, according to an analysis by Freddie Mac. That’s 52% higher than 2018, when Freddie first began looking at housing shortages.

“This is what you get when you under-build for 10 years,” Sam Khater, Freddie’s chief economist, told The Wall Street Journal.

Now, home builders would need to construct as many as 1.2 million single-family homes per year to meet long-term demand, the chief economist for the National Association of Home Builders (NAHB) told the Journal.

We are on the right track. Housing starts – the number of units builders would begin if development kept pace for the next 12 months – increased 19% nationally to a seasonally adjusted annual rate of 1.7 million units. This was the fastest pace for combined single-family and multi-family construction since June 2006. Starts were surprisingly 14% lower in the West.

>> The lack of inventory to keep real estate moving is confirmed with the latest data on U.S. existing home sales. They have declined for two consecutive months, according to the National Association of Realtors®. The completed transactions for single-family homes, townhomes, condos and co-ops fell 3.7% from February to March – continuing a troubling trend. It’s worse out West, where our region saw existing sales fall 8% month-to-month. The median price in the West was $493,300, up 17% from March 2020.

>> A quarter of all U.S. households are thinking of selling their homes in the next three years. That’s according to an exclusive survey of 4,000 homeowners conducted by realtor.com. Among that group, 10% of current owners plan to put their homes on the market in 2021, translating into about 1.5 million more home listings across the U.S. this year.

>> NAHB reported an estimated 15% of all new-construction home sales in the U.S. are classified as “second homes” for buyers – people who plan to use the place as a vacation home, investment property or purpose other than primary residence. This is disproportionate to the overall national number of about 5.5% of all homes that are categorized as a second home.

>> Not to sound like a broken record, but housing affordability is a prime topic of concern both in the Puget Sound region and across the nation. An insurance company offered a good example of just how bad it has gotten. Its data show home prices have far outpaced incomes since 2012. In fact, Washington state has the fourth-widest gap (89.8%) between the two figures over the eight years measured. In a separate metric, the dollar increase in housing costs and wages in Washington is third highest in the nation behind Hawaii ($605,898) and California, as this chart shows:

>> Only 4.5% of all mortgage holders in King County are deemed “underwater,” or facing the prospect of foreclosure, according to a Q1 survey of the top 552 U.S. counties by ATTOM Data Solutions. The real estate research firm said that figure places King among the five least at-risk counties in the country, along with Chittenden County (Burlington), Vt. (3.3% of mortgages underwater); Multnomah County (Portland), Ore. (4.4% underwater); Marion County (Salem), Ore. (4.5%); and, Washington County (near Portland), Ore. (4.6%). Nationwide, 11.2% of mortgages fell into the underwater category in Q1, with Kankakee County (outside Chicago), Ill., at the top (38.4%), followed by Escambia County (Pensacola), Fla. (31%) and Caddo Parish (Shreveport), La. (27.7%).

>> We’ve talked about soaring construction costs since the start of the pandemic and their impact on housing prices. Well, NAHB reported in late April that lumber prices have more than doubled over the past 12 months, causing the price of an average new single-family home to increase by $35,872 on average. The price of framing lumber is now running about $1200 per thousand board feet – up 243% since April 2020 when the price was roughly $350.

SUPPLY-DEMAND IMBALANCE

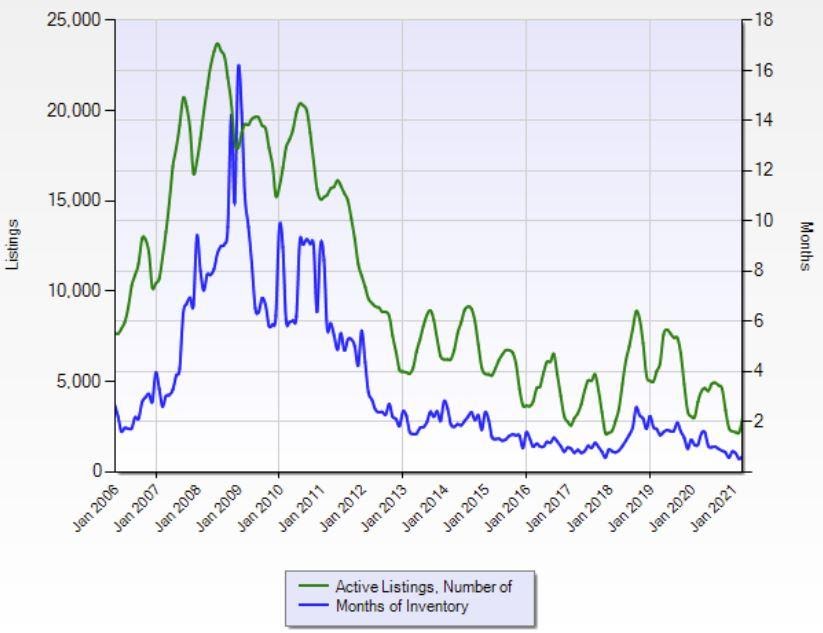

The lack of housing – or “sticks and bricks,” as some in our industry call it – has apparently been around for several decades, according to one economist.

“The excess of inventory that occurred in 2007, 2008 and ’09, was an anomaly,” said Marci Rossell, former chief economist for CNBC. “This inventory issue is long-term and if my memory serves me correct, that’s been true since 1980 that the amount of building relative to the population has been declining.”

There was plenty of excess in our region too, with about 23,700 listings (comprising all home types) across King and Snohomish counties in July 2008 (green). Compare that to the end-April total of 4551 Active listings for the two counties, as well as 0.6 month total inventory (blue):

Reasons for the lack of homes today are varied and often cited in this newsletter. They range from restrictive zoning (NIMBY) laws, the high cost of building in an urban area and a depleted labor force. The construction industry has relied heavily on migrant and immigrant workers, however as the sector dried up during the recession many workers either returned to their native countries or moved on to different lines of work.

So, what is the answer to help unlock the housing shortage? More people, says Rossell.

“We simply have a country where the birth rates have, for most groups, flattened out. Our population is not growing,” Rossell explains. “Either we have to ‘buy’ it from a country where the labor force is growing – like China or India – or we have to find a way to grow the labor force in the United States. And the only way to do that is through immigration.

“We have got to get people from somewhere else and figure out politically how we can do that in a way that’s not polarizing and doesn’t rip at our social fabric.”

The Master Builders Association of King and Snohomish County added their voice to the growing concern by writing an open letter to county leaders. In it, the MBA (the oldest and largest association of its kind) said county leadership has not successfully addressed the housing supply-demand imbalance, stating:

“If the median income household cannot afford the median priced house, there is an imbalance that adds pressure at every income level, and too often is devasting for households with incomes below the median.”

The MBA urged local leadership to take several actions, including:

- Ensure zoned density, once established, can be built

- Recommit to Growth Management Act housing targets and recognize those targets are more than the minimums

- Increase zoned density through multi-family housing in neighborhood commercial districts and along key arterials

- Allow and encourage accessory dwelling units and detached ADUs in single-family zones

- Ensure that policies and regulatory environment do not add cost and delays that have the contradictory effect of increasing housing costs

- Maximize heights and zoned densities in Sound Transit station areas to leverage our region’s $60 billion public investment in transportation infrastructure.

Many of these steps are being taken but it is also true that a greater commitment to maxing out these actions will go a long way to help increase the number of homes available.

STATE LEGISLATION

An update to last month’s newsletter: The state House and Senate passed legislation last month that aims to ease restrictions on ADUs, accessory dwelling units, in hopes of adding more housing. The law (once signed by the governor) will lift limits on the number of unrelated people living in an ADU. It will also remove rules that require homeowners live on-site in some circumstances. But, in speaking to a political-affairs lobbyist for Washington Realtors®, the bill became “watered down.” For example, House lawmakers added a provision late in the drafting process that allows local governments to indefinitely retain owner-occupancy requirements on properties with an ADU if the municipalities hold two public meetings and demonstrate a need.

Also from Olympia, the governor is expected to sign into law an initiative to right a terrible wrong that aims to remove racist language from property-ownership records. These historic covenants banned certain people – based on race, religion or ethnicity – from living in parts of the state, including neighborhoods right here in Seattle. The restrictive covenants have been illegal since the 1960s but the language remains on some titles and deeds. The state will now empower a team dedicated to notifying affected homeowners and provide guidance to redact the language from ownership documents. John L. Scott Real Estate testified before lawmakers about the issue and has since opened a resource desk to help guide homeowners through the remediation process. (The Seattle Times also covered this topic recently.)

These laws take effect in July.

APRIL HOUSING UPDATE

“I would say that this is definitely the first time we’ve seen properties sell as quickly as they have in our data history,” said Danielle Hale, chief economist at realtor.com. “It’s pretty historic.”

——-

“The time between coming on the market and going off the market is the shortest I’ve seen in the last 40 years,” said Dick Beeson, a Tacoma-area broker.

——-

Those comments – both nationally and locally – paint a picture of high-intensity buying and selling this spring. Yes, the market around King County remains hot but there are hints of cooling (okay, from 90 degrees to maybe 88).

The county saw new listings and end-month Active listings rise but Pending sales slip, suggesting buyers are no longer snatching every listing on the Northwest MLS as they become available. Median sales prices were mixed, up slightly for single-family homes and down for condos across the county. Total inventories were little changed from March to April.

The most promising figure – 25% – was the increase in total Active listings in King for single-family homes and condos combined from March (1769) to April (2212). Even better, there were 41% more Active single-family homes listed on May 1 from April 1 in the county – but only 1380, or about 43% fewer than a year ago. Yes, this market has a long way to go to return to balanced.

The surge in Active single-family-home listings came from Southeast King, with a jump of 69% more For Sale signs (266) at the end of April from end of March. Seattle experienced a 23% rise in end-month Active single-family listings (613). That explains the mixed report on Pending sales for the month, down 1.5% in Southeast King, up 2.8% in Seattle and down 3.2% on the Eastside. This should translate to a slower rate of sales in next month’s report.

April single-family closed sales jumped 16% from March to a median price of $830,000, or a 1.0% rise from the previous month’s sales price and a 16% climb from a year ago. Southwest King County (29%) drove the month-to-month rise in sales, with help from Southeast King (23%), the Eastside (21%) and Seattle (7.0%).

Median prices on single-family homes were also a mixed bag. Prices were down from March to April on the Eastside by 3.7% ($1,300,000), led by a 23% decline in the area located West of I-405, including Medina, Clyde Hill and parts of downtown Bellevue ($2,700,000). Prices rose 6.1% from March in Seattle ($875,000), driven by a 25% surge in Magnolia/Queen Anne ($1,367,500) and an 11% gain in SODO/Beacon Hill ($687,000).

The county’s condo market showed a similar pattern, with prices falling 9.6% on the Eastside ($520,000) but soaring 38% in North King ($433,500) and 24% in North Seattle ($379,750). Seattle condo prices dropped 1.0% to $490,000. Overall, new (6.7%) and Active (4.9%) listings were on the rise from March, with Pendings down 3.6%.

Total inventory levels for the county were little changed (0.7 month from 0.6), with single-family homes rising to 0.5 from 0.4 and condos remaining unchanged (1.1). Seattle single-family home inventory rose to 0.7 month from 0.6, with the largest number of available homes on Capitol Hill and in the Central District (1.1 months). Condo inventory in Seattle slipped to 1.7 month from 2.0 in March, with downtown/Belltown holding the largest share (2.7).

The median number of days all listings sit For Sale in King County is 6, down from 13 at the start of the year. It’s only 5 days on market in Pierce County and 6 in Snohomish and Kitsap.

In addition to King County’s 1.4% median price month-to-month increase on all home types, to $750,000, Kitsap (7.8%; $485,000), Pierce (4.3%; $490,000) and Snohomish (3.7%; $630,000) saw significant gains in the past month. Single-family home prices in Snohomish have appreciated the most in our region this past year, rising 29% ($675,000), with Pierce (23%; $500,000) and Kitsap (23%; $490,500) right behind, and King at 16% ($830,000) above April 2020.

Click here for the full monthly report.

CONDO NEWS

Sales are improving at Nexus after facing a few challenges in early months of operation.

We reported on the gleaming, 41-story building in Denny Triangle upon opening its doors in February 2020. Then the pandemic hit, quickly followed by the recession. This caused a good deal of uncertainty for all of us, including those new condo owners, many of whom attempted to back out of their contracts, put just-purchased homes on the market or listed them for rent.

Another issue: New condo buyers must declare in writing at closing how they intend to use the home – as a primary or secondary residence or as a rental property. Many owners-to-be had originally committed to residing in the 389-unit building but then reversed course because of world events, and some others were unaware of the declaration until the day they were asked to sign.

There was a lot of “confusion,” as one industry insider told me.

Some buyers decided to walk away from the closing table, losing thousands of dollars in deposits. It also led to a surge in both resales and rentals on the new property. By my unofficial tally, 30 homes were listed on the resale market last summer and another 65 were up for rent.

The newly formed Homeowners Association quickly tried to limit the number of rental units to no more than 49% of the building. Since then, the HOA reversed course, lifting the rental cap, and Nexus is at about 51% owner occupancy.

This is a number worth watching. Lenders tend to shy away from offering traditional mortgage loans to applicants seeking a home in a condo building that is less than half owner-occupied (a topic I recently covered). Fannie Mae requires condos be majority owner-occupied to qualify for a mortgage.

The picture is brighter today. The building is nearly 80% sold, with roughly 80 homes still available for sale. So far this year, at least 16 units have closed and five more are Pending (mutual acceptance).

Prices start in the high $300,000s (420 sq. ft.) and are on the high side for the unit size, with a median price per square foot of roughly $1045 from a sampling of active listings.

——-

Facing a sales slump for about a year, the owners of luxury condo Spire have announced price changes. California developer Laconia unveiled a discount of about 10% on select 1- and 2-bedroom homes in the 41-story structure on 6th Avenue at Denny Way.

The 343-unit tower has been hovering around the 30% pre-sold mark for most of 2020. Sales intensity has improved since the limited-time offer was launched in March and the building is about 33% pre-sold. Prices start in the high $400,000s.

Spire is scheduled to open this summer – by far, the city’s biggest condo curtain-raising this year.

Contact me to schedule a tour of the sales gallery and to learn about other offers available for Spire today.

——-

Apple opened its doors in April to a new building on Dexter Avenue North, site of the former KING-TV studios. About a thousand employees are planning to move in this year and the two, 12-story buildings reportedly can hold up to 3,000 workers – which begs the question, “Which developer will stake out some ‘dirt’ for a new condo high-rise to accommodate the new arrivals?”

South Lake Union is home to few condos – I counted six, including the three-building community known as 2200 Westlake above Whole Foods. There are plenty of apartment units in the area but only roughly 500 condo homes within SLU, with less than a handful on the market today.

An announcement of a new condo tower for the immediate area only makes sense and is something to watch for in a year or two.

LUXURY LIVING

Nothing beats a West-facing Lake Washington waterfront property. One is on the market for the first time in 18 years – a 5-bedroom, 3-bath, 4450 sq. ft., 2-story Mercer Island jaw-dropper. The owners spent two years – and presumably hundreds of thousands of dollars – to renovate the place about 15 years ago, featuring a Chef’s kitchen with two islands, double-oven and walk-in pantry. Add the wine cellar, wet bar and full gym in the detached four-car garage and you may never leave. Skylights and a lake-facing balcony highlight the top floor. Capping off the property is the 119 feet of shoreline dedicated to unobstructed sunsets and boat moorage. Asking price: $9.85M, or $2213/sq. ft. (One offer was accepted after two days on the market but the buyer backed out.)

I often refer to penthouse condos as having a wall of windows. Well, take a look at this home and its nothing-but-windows façade. This 3-bed, 2.25-bath, 2753 sq. ft., 2-story (with basement) in Lower Kennydale is a beauty. Facing West and overlooking the south end of Lake Washington, this glass-and-steel jewel box offers 180-degree views with seven sliding doors on two levels to make it ideal for indoor/outdoor living. This is one of my Top 10 all-time faves in our area. Listed at $1,995,000 ($725/sq. ft.), the home is currently a contingent sale, meaning the buyers must await the sale of their home to pay for the new one. Sellers typically ask for back-up buyers. Yes, I’m saying there’s still a chance for you!

Sometimes when you hear a home is a “mid-century modern” you think of the Brady Bunch house – stuck in a certain period. While there may be truth to seeing some home listings looking like that today, this one in Seattle’s Blue Ridge neighborhood is certainly something Mike and Carol Brady would approve of now. It has 5-beds, 2-baths within 2690 sq. ft. on one story (with basement). There is something uniquely timeless – red-brick fireplace and ceiling-to-floor windows – that captures my heart. How about yours? List price: $1.825M ($678/sq. ft.).

Want to live in a home that was once owned by a former presidential candidate and one-time top Starbucks exec? I got one of those too! This 3-bed, 3.25-bath, 4044 sq. ft. penthouse on the 20th floor of the Millennium Tower in downtown was sold in 2017 as an unfinished shell by Howard Schultz for $7.5M. The current owners are seeking $9.5M ($2349/sq. ft.) for this piece of modern Seattle history (with outstanding views, by the way). Seattle Met did a nice write-up on the home.

If you’re familiar with the roof at the newly named Climate Pledge Arena, you know of its pyramid shape and overhang-edged design. This home offers some similar lines – a 4-bed, 2.5-bath, 4450 sq. ft., 1-story home (with basement) on Mercer Island. As you walk in, look up and you’ll see a dramatic tongue-and-groove ceiling with four massive beams that is just breathtaking. So stunning for its time (built 1965), the structure was named home of the month by The American Institute of Architects and Seattle Times. Stroll the near-half-acre grounds and you will find a welcoming foot bridge over a pond and waterfall. There is so much to love. The sellers are asking for $2.1M ($472/sq. ft.) Update: The home is now under contract after 18 days on the market.

Whether it’s a luxury home or your first-time-buyer condo, let me help open new doors for you.