Zoning, the regulation of land use and structures, essentially dictates how and where we live – with near-unbridled discretion by local governments. Scholars have called the decades-long regulation a “straitjacket” on housing growth, an impediment to improving our personal and public economic health.

In this monthly newsletter, we have called for a generational response to the housing shortage, particularly to address the near-absence of affordable homes. And one solution to this worsening issue is an examination of our restrictive zoning laws in urban areas.

Constraints on housing creation, especially among so-called starter homes, arguably limit the number of workers who can access high-producing jobs. Economists believe that instead of increasing local employment and providing housing, strictly zoned cities push up home prices and curtail opportunities for many.

In a review of 45 years’ data, a 2019 study claims adverse zoning laws wiped out 36% of potential economic growth and negatively affected each worker by more than $8700 in annual wages. Even if one were to contest the study’s results, there is little doubt that zoning laws can adversely impact growth.

“[Zoning] dictates our economy. It dictates how we relate to each other. It dictates our personal choices, our employment opportunities, our educational opportunities and so much more,” said Sara Bronin, Professor of Planning and Law at Cornell University, who recently helped to revise zoning laws in Hartford, Conn. “Zoning is a powerful tool to enable us to improve the way that we live and interact with each other.”

Even one’s physical health can be improved by living in a community that welcomes all. A study released in September – and believed to be the first of its kind in the U.S. – shows a link between heart health and inclusionary zoning, where local governments require developers of new multifamily buildings to set aside a certain number of units for low-income housing. In those places, residents had “uniformly better” cardiovascular health outcomes, including improved blood pressure and cholesterol and lower rates of prescribed blood pressure medication. (Seattle’s zoning regulations call for inclusionary housing in multifamily construction but most developers pay penalties instead of providing affordable units. Some parts of the U.S. – for example, across most of New England – mandate inclusionary zoning.)

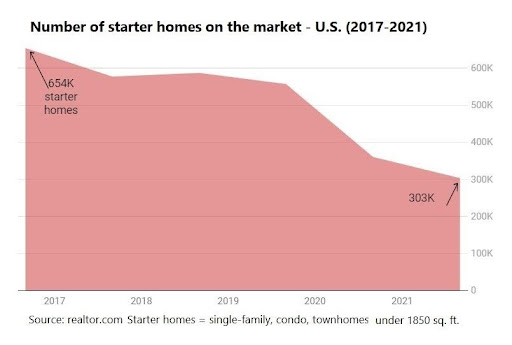

As home values rise, low-income households already on the margins of affordability are being priced out of homeownership in urban areas such as Seattle, where median prices have jumped 37% (and 52% countywide) over the past five years. In addition, data compiled by realtor.com show starter homes in the U.S. are 64% more expensive now than in 2016 and are reduced in number by more than half today:

“I expect the inventory of starter homes to remain extremely tight, especially in desirable smaller markets,” Ali Wolf, chief economist at the building consultancy Zonda, told realtor.com.

Starter homes in Seattle conservatively cost about $350,000 – only 44% of today’s median sale price of $790,000 for all home types. As of Nov. 1, there were only 60 active home listings (single-family, townhome and condos combined) in the city priced at or below $350,000, down from the 2021 high of 93 in July – woefully insufficient for a region whose population continues to grow.

One of the many reasons this issue is difficult to fix: A full 70% of residential land in Seattle is zoned exclusively for single-family homes, according to local real estate economist Mathew Gardner, who said that figure “made sense in 1937, when zoning was founded. It makes no sense now.”

The argument for zoning laws is straightforward. The regulation provides consistency across specific areas of the city, essentially eliminates the chance for industrial companies and other businesses to compete for the same land as residential property, and, therefore, generates price growth on same-use land. Unregulated growth in terms of homes, businesses and traffic can potentially harm the health and welfare of a community – concerns that would have to be addressed if (okay, let’s hope when) municipalities consider relaxing zoning laws.

To open new doors for people wishing to buy a home, Seattle and other urban hubs need to further change the zoning model that would create higher-density housing, permitting more multifamily construction – from duplexes to high-rise condos – on more land and mandate at least a portion of them as affordable. While we can stack more homes vertically, we can’t make more land!

The city of Minneapolis and the state of Oregon have already loosened the laws, and the state of California recently signed legislation that eliminates single-family zones by allowing up to four units on existing residential lots. The city of Tacoma, where 75% of its land is zoned for single-family homes, this month moved forward on several measures to incentivize multifamily development with the potential for creating up to 45,000 units. The city of Seattle is inching toward starting the discussion by planning to rename zones from “single-family” to “neighborhood residential.”

In this year’s legislative session, Washington state lawmakers introduced financial incentives to cities if they opt to allow more homes by easing zoning laws. Cities generally embraced the carrot-and-stick approach, in stark contrast to their typical hostility for zoning-reform mandates. But all three bills – with variations on the incentives – failed to pass.

The federal government also has a role to play. The Biden administration’s so-called Build Back Better Act devotes $150 billion to housing. That includes a new “Unlocking Possibilities” program that would give $1.6 billion over 10 years to states, local governments and regional planning agencies to spend on “substantially improving” their housing plans, “streamlining regulatory requirements and processes,” and “reform[ing] zoning codes,” among other activities. The act remains in limbo, as of this writing.

“We need to embrace density, but this NIMBY-istic mentality that’s out there, it says that people don’t want change,” says Gardner. “That creates exclusivity and it’s remarkably prohibitive for people to come in … [so] we need to fix it or we’re just going to start losing that competitive edge.”

GOING THE DISTANCE

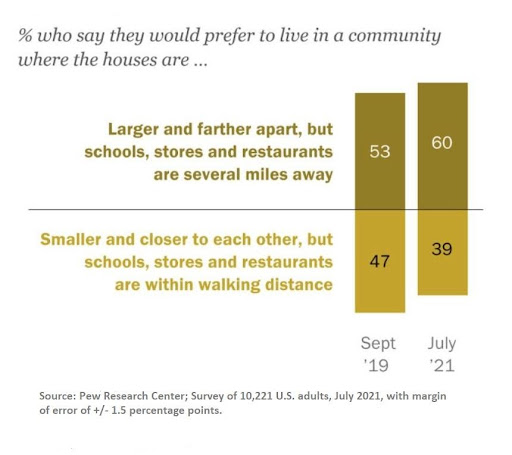

What a difference a pandemic can make in consumer preferences. A survey of Americans in 2019 showed a growing desire to live in smaller houses that were “closer to each other … [and] schools, stores and restaurants within walking distance,” according to the Pew Research Center.

However, a new Pew study finds a shift in home preferences with more consumers saying they want a larger home, even if it means local amenities are further away, as this chart shows:

SUPPLY-CHAIN DISRUPTIONS

Raise your hand if you have noticed longer delays in receiving consumer shipments or found favorite items missing from store shelves. Yep, me too!

From semiconductor chips for cars to holiday toys, artificial Christmas trees to specialty liquors, consumer goods are short in supply and taking longer to reach their destination. Also, affected by the disruptions: builders and homeowners seeking to construct or update homes.

A survey of builders in September said delays in receiving doors and windows are taking about three times longer. The average lead time for new windows, for example, jumped from about 10 weeks a year ago to roughly 6-7 months today.

As John Burns Real Estate Consulting reported in late October: “Window manufacturing – even in the most automated facilities – is very labor-intensive, which makes the industry even more susceptible to labor shortages and COVID precaution challenges. Most window manufacturing facilities rely more on labor and less on capital than other building material manufacturers.”

The South, where many petroleum-based products are made, suffered a double-whammy with two weather events that knocked out facilities for many weeks. Uri, the ice storm that hit Texas in February and disrupted power for weeks, halted production of resins needed to make vinyl for windows and doors, as well as critical parts for appliances and engineered wood products. Hurricane Ida followed in late August with damaging winds that shut refineries and chemical plants along the Gulf Coast.

This is in addition to a backlog of products at coastal ports and in warehouses awaiting delivery as many shipping and logistical companies struggle to keep up with demand. Patience is required, as climate extremes become one of the greatest intangibles to the future of production and delivery of goods.

BY THE NUMBERS

>> The new U.S. Census data shows Washington state becoming more diverse. Whites comprise 63.8% of the state population, down from 72.5% in 2010, the largest decline of any state. Washington is 13.7% Hispanic or Latino, up from 11.2% in the previous Census. The state is 9.4% Asian, up from 7.1% in 2010 and Blacks comprise 3.8% of the population, up from 3.4%.

>> We love our pets. A survey of 1600 pet-owning homeowners showed 68% prioritized their animal’s comfort when searching for new properties. A full 70% of U.S. households own at least one pet, and 77% of that group identified “ample square footage” as their primary consideration when searching for a new home.

>> New data confirms King County residents are some of the wealthiest in the nation. A report from the D.C.-based Economic Innovation Group claims non-work income pencils out to $24,100 per King resident (2019 data). That ranks eighth-highest in the U.S., behind counties in the Bay Area, Florida and tri-state area of New York City. The U.S. average is $8800 per person. Non-work income includes dividends, interest and rent revenue. King County’s median per-capita income is $57,124 (2019), with the U.S. figure at $35,672.

>> U.S. home costs soak up 25% of the average national household wage of $64,857, as of Q3, according to ATTOM Data Solutions. That is up from 22% from a year ago but still below the 28% threshold that economists believe homes become unaffordable to cover costs, such as mortgage payments, insurance and property taxes. However, a separate measure from John Burns Real Estate Consulting shows Seattle-area households spend an average of 40% of wages toward housing costs.

>> The number of foreclosure filings – default notices, scheduled auctions or bank repossessions – in Washington was among the lowest in the U.S., according to a Q3 report from ATTOM. Only 550 filings were made in the three-month period ending in September, down 25% from Q2 but up 60% from a year ago when federal and state moratoria prevented most foreclosure proceedings. Washington has one foreclosure filing per 5648 housing units in the state, the 37th worst ratio in the country. Nevada has the highest foreclosure rate, with one filing for every 1463 homes in the state. South Dakota has the fewest, one for every 22,857 homes.

>> About 13,600 people were victims of wire fraud in the real estate and rental sectors combined in 2020, according to new FBI data. That’s a 17% increase over 2019. Losses last year totaled more than $213M, ranking the category No. 7 in the nation for fraud. The leading type of fraud is “business email” and “email account” compromise at $1.8B, the FBI reports.

>> Investors purchased 15.4% of all U.S. homes on the market in Q2, compared with 11.5% a year before, according to RealtyTrac research. New Hampshire led the way with 23.2% of all purchases made by investors, while Oregon was at the bottom at 8.5%. Washington, with some of the priciest homes in the nation, was among the states with the fewest investor purchases, 10.2%.

NOVEMBER HOUSING UPDATE

After a strong start to October, the month’s housing activity cooled rapidly … along with the temperatures … to end generally weaker, with fewer listings and sales versus September and a year ago.

“There is a mini power surge of buyers wanting to purchase before rates go higher,” Lennox Scott, CEO of John L. Scott Real Estate, noted in the third week of October before activity fell off.

News from the other Washington attracted just as much attention for buyers (and real estate pros like me.) The Federal Reserve signaled that it would begin this month to reduce its mass purchases of securities, reportedly by about $15B/month, for now, a position the central bank held for more than a year while the economy struggled through the pandemic. Economists generally believe the Fed’s easing will increase bond yields and, in theory, send mortgage interest rates higher.

Those rates were hovering around 3.125%-3.25% for most mortgage shoppers in October. Many experts, including the Mortgage Bankers Association, are forecasting rates for a 30-year, fixed-rate mortgage to reach 4.0% by the end of 2022.

Meantime, the federal loan ceiling on a conforming mortgage will be revised upward for 2022. Currently, most buyers can get a traditional mortgage for up to $776,250 in our three-county region and that figure is expected to jump to about $850,000 starting Jan. 1 as mortgage underwriters acknowledge home prices here continue to rapidly appreciate. (Buyers with strong credit scores can obtain jumbo mortgages above the ceiling but those loans are typically secured by investors rather than the government.)

The pair of recent developments may be breakeven for buyers. While higher rates generally create larger monthly payments and weaken buying power, the higher loan limit for a conforming mortgage will soon allow buyers to purchase more expensive homes at still-favorable rates.

Home selection, with only 1952 units on the market throughout King County on Nov. 1, is at its lowest since May (1948 units). Only 275 homes are listed for sale on the Eastside, down 32% from September and 69% from this time last year, and 1071 units listed in Seattle, off 8.1% from the previous month and 48% last year.

Surprisingly, the lack of supply did not send prices higher – a trend we were used to seeing all spring/summer. Median home prices were generally flat across the county, 1.0% higher to $750,000, while up 3.3% in Seattle ($790,000) and essentially unchanged on the Eastside ($1.13M) versus a month ago. Year on year, prices remain higher, up 9.5% for all home types in King, 17% stronger on the Eastside and 5.3% higher in Seattle.

The message is similar for single-family homes (including townhomes), where active listings are down 22% in the county from September and off 44% from October 2020. Median prices were flat against September in King ($824,270) but 11% higher from last year. Seattle single-family prices were also little changed since September ($850,000) and up 6.3% year-on-year, while Eastside prices added 4.2% month-to-month ($1.37M) and – what headline writers focus on – up a whopping 30% from this time last year.

On the condo front, pockets of King County saw sharp price fluctuations from month to month. Median prices soared 28% since September in North King ($505,000) and an incredible 71% from 2020, however prices sank 27% in the past month on the Eastside ($550,500) and slipped 11% from a year ago. Seattle condo prices added 4.0% in a month ($525,000) and 5.6% over the past year.

Inventory across the county slipped after inching mostly higher a month earlier. Among all home types, there was 0.6 months of inventory in King, down from 0.7 in September. Seattle inventory was 0.9 months, down from 1.0, while Eastside total inventory declined to 0.3 months from 0.4 a month ago. Single-family-home inventory is worse, standing at 0.5 months countywide (from 0.6 in September), at 0.6 in Seattle (from 0.8) and 0.3 on the Eastside (0.4).

In addition to King County’s 1.0% median monthly price increase on all home types, to $750,000, Snohomish County saw the sharpest jump – a rise of 2.3% from September ($654,950). Pierce ($510,000) and Kitsap counties ($505,000) each added 2.0% on its median price in the past month. Single-family home prices in Snohomish jumped 3.0% in a month ($695,000), followed by Pierce, up 2.6% ($520,000), and Kitsap, up 1.7% ($508,250). Median prices in King were virtually unchanged since September at $824,270. Year-to-year, single-family median prices remained strong but off 2021 highs in our region, led by a 21% jump in Pierce, 20% in Snohomish, 16% in Kitsap and 11% in King.

A home is on the market in King County for an average of 15 days, 12 days in both Pierce and Kitsap counties, and only 10 in Snohomish. The average for the region was about 22 days a year ago.

Click here for the full monthly report.

CONDO NEWS

The biggest condo unveiling in 2022 will be the opening of Infinity Shore Club Residences in West Seattle. Picture guaranteed shorefront views for life, in a rare concrete-and-steel-constructed luxury condo at the tip of Alki Beach.

There are 37 large residences within the 6-story structure that features special folding glass walls, which seamlessly open the indoors to a generously sized private terrace and stunning, endless views of Elliott Bay. Highlighting the community is a two-story residents lounge that overlooks an infinity pool, spa tub and panoramic vistas of ferries, seaplanes and all the visual stimulus one could ask for just feet away.

Each home comes with one electric-vehicle parking spot; extra parking is available for purchase. Plus, units can be customized to accommodate smart-home technology and closet and storage areas.

Infinity Shore Club is expected to be completed in March and homes are available now with a 5% deposit. Prices start at $1.12M and rise to about $5M for units ranging from approximately 1160 sq. ft. (1-bedroom with den) to 2400 sq. ft. (3-bedroom with den). Interested? Contact me to learn more.

———-

The sales team at The Goodwin wanted me to share with you a significant drop in Homeowners Association dues at the new Belltown condo. The developer first penciled in dues at a rate of about 94 cents per sq. ft. in a home, a figure that is high for the few amenities available in the 8-story, 37-unit community. Now, dues are priced at 84 cents a sq. ft.

That means a sizable reduction in monthly expenses for homeowners. Instead of paying $1032/month in dues for a 2-bed, 2-bath, 1098 sq. ft., 5th-floor unit, owners will be on the hook for $922/month. That’s a savings of $1320 a year.

In addition to lower dues, The Goodwin offers a rooftop garden with lounge, grill and fireplaces; a ground-level library/waiting area; and a desirable location near restaurants, bars and more. For those sports fans, the building is a casual 20-minute walk to Climate Pledge Arena to the north and a half-hour stroll to the stadiums to the south.

———-

LUXURY LIVING

We start this month’s tour of luxury listings with one that is so stunning I had to share it with you even though the property is already under contract. Check out this 5-bedroom, 4.75-bath, 6943 sq. ft., two-story waterfront estate overlooking Lake Sammamish in Bellevue. The property includes a 5-vehicle garage, exposed wood-beam ceilings, smart-home tech set-up, chef’s kitchen and 126 feet of private waterfront with dock. There is so much to see. The sellers, who reportedly include one of the founders of Amazon’s Alexa, were seeking $8.998M ($1296/sq. ft.). A buyer was found after a month on the market and the sale is pending the signing of documents.

Staying on the Eastside, a trio of lots are stitched together to create an astonishing 8.4 acres in Redmond. A beautifully styled, 1963-built, 4-bedroom, 2.5-bath, 3170 sq. ft. home with large water feature currently sits on the land but the property is almost screaming for a creation that is new, big and bold. The large parcel of land also means county taxes are high ($22,358 in 2021, gulp!) but the long-term value of the property within a short distance of downtown Redmond and less than 30 minutes to Seattle offers a great investment. List price: $3.85M ($1215/sq. ft.).

Remember the old Southwest Airlines catch phrase, “Wanna to get away?”? Well, we have a place that will allow you to get away while staying at home. How does a 9-acre property with more than 1700 feet of waterfront sound? That is what’s on the market on Shaw Island, sandwiched between Lopez, San Juan and Orcas islands, and with a year-round population of about 300 residents. This 3-bed, 3-bath, 2048 sq. ft., two-story home offers contemporary stylings, vaulted ceilings, walls of windows and endless views from high on a hill. List price: $4.65M ($2271/sq. ft.). The sellers are even throwing in their boat as part of the deal. Fun fact: Shaw Island has one school that serves children between kindergarten and eighth grade. Known as the Little Red Schoolhouse, it has been in continuous use since 1891, is the oldest school of its kind in the state and on the U.S. National Register of Historic Places. Update: The home is now under contract, less than two weeks after hitting the market.