Office vacancies in U.S. urban centers remain mostly higher than in 2019 and transit ridership continues to struggle to regain consistent levels. If we are supposed to be back in the office, you can be forgiven if you don’t believe it.

The national office vacancy rate stands at 16% through March, up from 11% at the end of 2019 – just before life changed for you, me and the world. That figure is a whopping 24% today across Seattle/Puget Sound, triple from pre-pandemic levels. Yes, essentially one in every four Seattle office buildings sits vacant. [Data courtesy global services and investment company Colliers.]

The work-from-home lifestyle has changed the way we go about our lives. In Seattle, 62% of workers come into the greater downtown area at least three days a week. That’s according to an April survey of 221 city businesses tabulated for Seattle Metropolitan Chamber of Commerce before Amazon employees returned to the office on May 1 for at least three days a week. Measured differently, monthly worker foot traffic in downtown is 48% of 2019 levels, the highest rate of activity since the start of the pandemic.

Downtown Seattle – which includes a workforce of about 340K – has been far slower to recover from the health crisis than most U.S. cities. Our area’s predominantly tech-centric businesses adapted quickly to the pandemic and employees became comfortable working from home while leaving the city looking somewhat desolate. Credit city leadership for taking positive steps this year, with Seattle Mayor Bruce Harrell announcing a so-called activation plan that aims to boost numbers in downtown – though, like all grand visions, they come with detractors.

“I don’t care what mayors say,” Marci Rossell, noted economist, commented about the changing urban work dynamic. “You are not going to get people to come back into the office to the same degree as they did before 2020.

“Workers are in the driver’s seat now because they are in such short supply,” said Rossell, speaking to an international group of real estate professionals. Rossell also expects “significant” losses to occur for commercial real estate holders and that the issue of low office vacancies could drag on for decades.

Moody’s Investors Service noted that banks hold approximately half of the $6T in commercial real estate debt, with the largest share maturing within the next three years, according to Reuters. Data from the Federal Reserve indicates Goldman Sachs has the highest exposure to commercial loan losses at 16% of its lending total due within the next two years, followed by Morgan Stanley (14%) and Citizens (12%).

Ridership on King County Metro public transit, meanwhile, remains down 26% between May 2020 and this past May. That’s as much as 125,000 fewer rides every weekday – a serious blow to commuter hotspots.

Our urban area accounts for about half of the city’s economic activity, and the Seattle Chamber noted that rising office vacancies coupled with less construction could lead to $2B in decreased revenue. In fact, the cost of office space on the Eastside surpassed downtown Seattle in Q1 (now at $57/sq. ft. on average vs. $54), according to CBRE, a global commercial real estate services company. Meantime, getting workers to feel good about returning to the office is a stiff challenge.

“For this to work, employees must feel that in-person days are intentional, purposeful and focused,” said Amy Coleman, Corporate VP of Human Resources at Microsoft. When it comes to “intentional,” Coleman said: “Employees really want to know the ‘why.’ What’s the research on when in-person [attendance] matters.”

The Seattle branch of CBRE recently moved into a new office on the 38th and 39th floors of U.S. Bank Centre. Instead of assigning cubicles and offices for each of its 300 staffers, CRBE now offers seating for up to 233 people – apparently without assigned desks. Even the company’s top executive for the Pacific Northwest comes into the office reportedly not knowing where he will sit.

The leading barrier to getting people back into the office is the commute and how to make it more flexible for workers, said Keena Kaye from the Bill & Melinda Gates Foundation. “No one likes a long commute or, worse, attending virtual meetings while still stuck on the road.

“Workers are finding that, since the pandemic, the challenges of daily life are greater – childcare, tutoring and other needs for school-age kids, multi-generational areas of focus, mental health needs [and] the commute. Flexibility and empathy are now core requirements,” added Kaye, a Sr. Program Manager with the foundation’s Cross Cutting Programs.

Coleman and Kaye spoke to members of the Seattle Chamber, whose president, Rachel Smith, offered her three biggest asks as the city and its people continue to rebound:

- City leaders: Make a plan for progress on homelessness, public safety and affordability – and partner with the business community. [See activation plan, above]

- Voters: Hold leaders accountable, ask the candidates where they are on the issues and cast votes in the August and November elections.

- Everyone: Keep advocating for sensible policies, keep patronizing favorite businesses and keep investing in the community.

To help address the housing-office mismatch, the city recently held a competition of sorts. Architects, contractors and building owners were challenged to reimagine a dozen stately structures. First place went to the team behind the Mutual Life Building, which opened in 1895 on the corner of Yesler Way and 1st Avenue in Pioneer Square. The proposal would convert upper floors into co-living spaces with 80 sleeping quarters and shared kitchens and bathrooms to help make residential living truly affordable.

Mayor Harrell did not announce any formal projects based on the proposals but gave hope that it will happen. “We’ll advance this based on this vision that you’re helping us form together – future legislation and regulatory modification to code changes and the permitting processes. We’ll have new incentives, and quite frankly, this will inform our budget,” he said.

We are charting new territory and success will be measured by creativity and collaboration. Local government, developers, architects and others will need to step up and take responsibility for the sake of our city.

“This is a time for leadership and for action,” Smith said. Her comments came before the senseless shooting death of a Seattle restaurant owner on a downtown street that also took the life of the woman’s unborn child and injured her husband – a tragic incident that further hinders Seattle’s return to normalcy … and possible return to the office.

SHORTAGES AND DELAYS

Supply and demand. That’s how our world rolls … or at least it tries. Without feeding one, we cannot quench the thirst of the other.

We certainly see that in all forms of residential real estate – from new construction to finding items for the home. The brighter news is that labor shortages and supply-chain disruptions are improving but it’s hardly “back to normal.”

In a recent survey by Houzz, 79% of construction and design businesses reported experiencing moderate to severe labor shortages. That’s an improvement from a year ago when the figure was 91%.

Supply-side struggles are at the root of the housing shortage, noted Robert Dietz, chief economist for the National Association of Home Builders. “I refer to these challenges as the 5 L’s. It is lack of labor, land/lots, lumber/materials, lending for builders and land developers and ever-costly legal/regulatory costs,” he said.

Dietz estimates 400K construction industry jobs are unfilled, with the biggest need for carpenters and framers. Because of an increasing number of retirements, Dietz believes there is a need for about 740K new construction workers every year to keep up with demand.

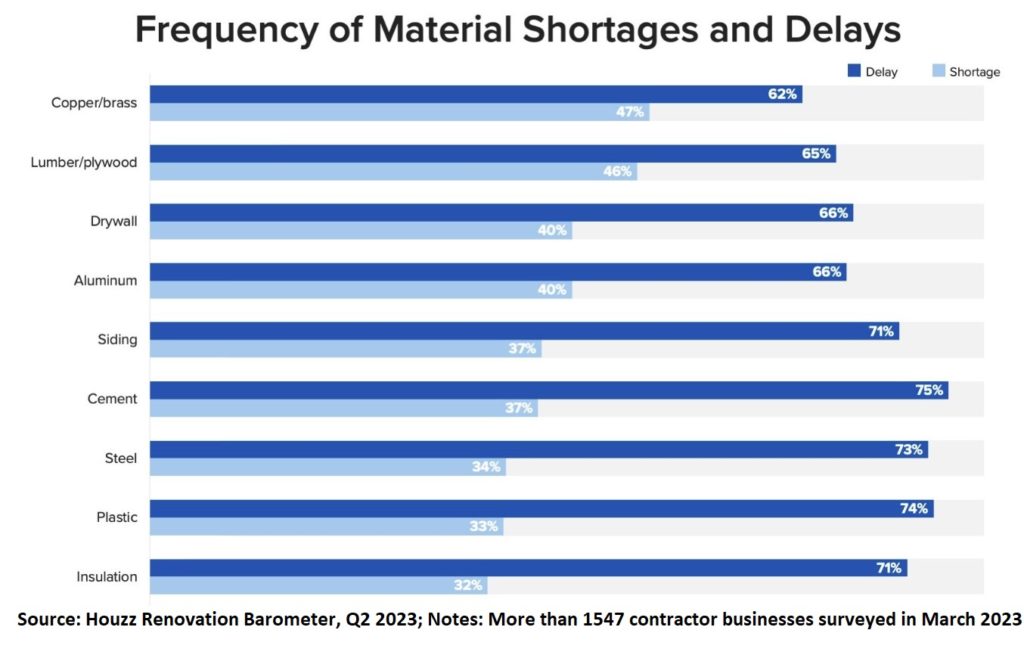

Skilled labor isn’t the only thing in short supply. Nearly half (49%) of businesses report moderate to severe shortages of products and materials, most notably copper and brass, followed by lumber and plywood.

In addition, 63% of businesses told Houzz that there remains moderate to severe delays in shipment of those materials once purchased. As this chart shows, products from cabinetry to furniture remain slow in reaching their final destination:

BY THE NUMBERS

>> A survey released in May by the Seattle Chamber shows 83% of city businesses have gone to a hybrid work model, with 34% requiring workers to show up in person at least three days a week. The survey, conducted in April, noted 9% of Seattle businesses are fully remote and 8% are fully in-person.

>> Seattle has fallen 28 spots in a year to No. 34 in a key index that ranks best-performing U.S. cities. The non-partisan Milken Institute believes Seattle is now a “Tier 2” city based on index criteria of job growth, wage gains and housing affordability. The city was No. 8 in 2020. An economist from the institute suggested the city needs to diversify from its tech-sector focus, which is about 30% of the region’s gross domestic product. Provo-Orem, Utah, earned the top ranking this year.

>> A report from ATTOM Data Solutions reveals that 311,508 residential properties in the U.S. are in the process of foreclosure, as of Q2, up 4.3% from Q1 and 20% higher from this time last year. A growing number of mortgage holders have faced possible foreclosure since a pandemic-related moratorium on lenders pursuing delinquent homeowners was lifted in mid-2021.

>> There were 1.25M mortgages created in Q1 – conventional, refinanced and home-equity loans combined – marking the eighth consecutive quarterly decline and lowest reading since Q4 of 2000, according to ATTOM. The ongoing decline in residential lending has been fueled by higher mortgage interest rates and consumer price inflation.

>> Seattle is rated the 11th-best place to raise a family in the U.S., according to an intensive report produced by WalletHub. The personal-finance site compared about 180 metro areas on 45 metrics that put family first, such as the cost of housing, quality of schools and health-care systems. Our area registered a score of 64.4, including a Top 10 ranking for “education and childcare.” Fremont, Calif., (73.71) finished first. Cities in California and Arizona took seven of the top 10 spots.

>> Seattle is No. 8 in the nation for the best urban parks system, according to the Trust for Public Land’s ParkScore Index. Parks in Washington, D.C., topped the list. Our city earned a perfect score for investment; Seattle injects $329 per resident a year toward its parks system. We have an array of places to enjoy the outdoors – lush forests (Seward Park), waterfront vistas (Golden Gardens), dog-friendly expanses (Magnuson Park) and simple – yet simply beautiful – historic greenspaces (Denny Park). Check out my blog post on the topic.

JULY HOUSING UPDATE

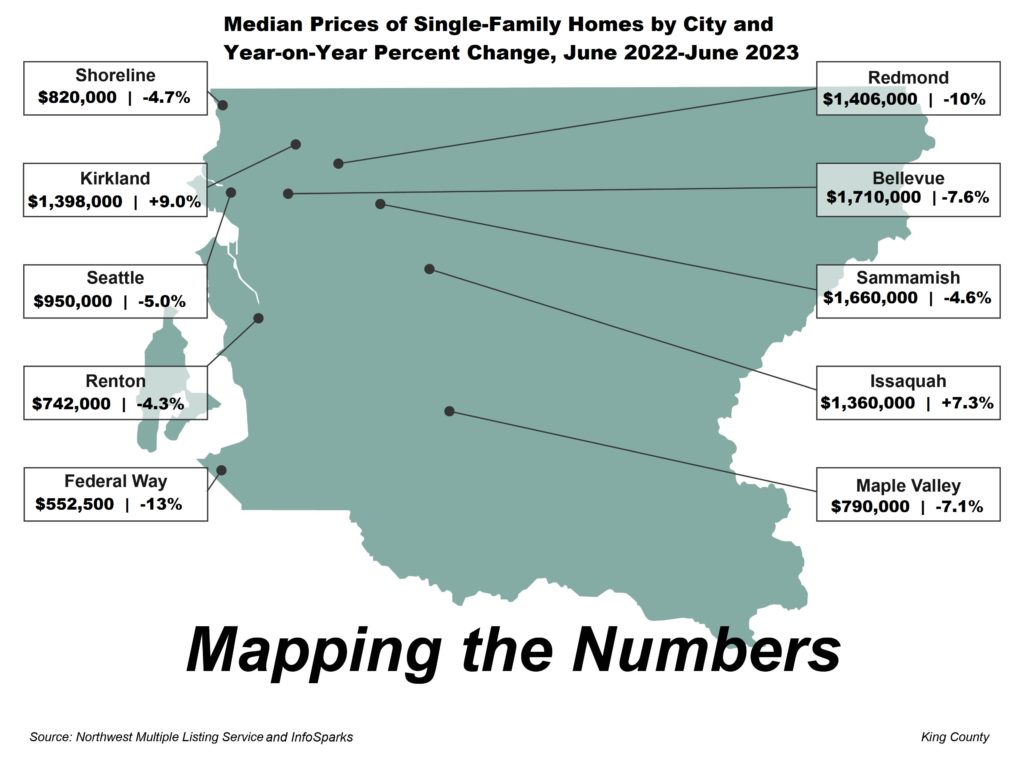

The Seattle/King County housing market inched forward – and a little sideways – as the number of new and unsold listings continued to expand in June while fresh signs of a slowdown approached. Home prices continued to confound buyers by climbing toward record highs as summer began.

The county saw the combined number of single-family, townhome and condo listings increase in June by 4.4% from May to 3242 units – the highest monthly figure since last September. While that percentage may appear strong, it’s nothing compared to the April-to-May rise of 18%, signaling a probable cooling of new listings going forward. Meantime, unsold listings rose a solid 12% for the month to 3013, including 11% (1344) higher in Seattle and 10% (815) stronger on the Eastside.

New single-family-home listings rose 3.8% month-to-month (2491) – a much slower rate increase than the 19% monthly surge in May – and climbed 13% for units unsold at the end of June (2181). Seattle (12%) and the Eastside (11%) drove the increase in single-family units sitting on the market as of July 1.

Read a detailed assessment of our housing market in my most recent blog post: Home Prices Rising Toward Record Highs – Again

CONDO NEWS

Seattle leads the nation in construction cranes. They’re seemingly everywhere but very few are building condominiums. Only three for-sale towers have opened in the city since the start of the pandemic in March 2020 and only one high-rise condo – Graystone – is slated to open this year in Seattle.

It begs the question: Where are all the new for-sale, high-rise homes in our city?

There’s a multi-layered explanation but the main answer is that it doesn’t “pencil.” In other words, it’s too difficult to make it work financially in today’s economy even with good demand amid a severe shortage of housing.

Multi-family construction is still moving forward but most of the residential buildings will become apartments. Some 15K rental units are expected to come online this year across Seattle metro and roughly 4K in the city itself. This may help lower monthly rents but the overall construction industry continues to face challenges.

All projects start with financing. This year’s banking crisis – where three U.S. financial institutions failed – and lingering economic unsteadiness has led some financing to dry up for construction projects.

Banks are concerned about what may lie ahead. Many of them hold mortgages from commercial/office landlords who are struggling through low occupancy rates in urban zones (see story above). We have seen shopping centers and some office buildings go into receivership which can burden financial institutions with unwanted property.

Developers are also facing the constraints of local government and their constituents. Zoning restrictions, strict building code regulations, NIMBYism and onerous environmental laws have damaged the flow of new housing. Builders also remain cautious about condominium construction liability which can keep many insurance companies from writing building-defect policies.

State legislators helped smooth out some of the bumpy building regulations with a series of laws this year. That includes lifting restrictions on converting structures for residential purposes, streamlining development regulations as well as the permitting review process, and allowing contractors the right to fix construction issues before facing litigation – all significant steps forward.

This last item should help reduce concerns from developers about defect liability and prompt more construction of market-rate condos of all sizes and price ranges. Lobbyists in Olympia tell us this so-called right-to-cure law will be a game-changer for condo development across the state.

In addition, the City of Seattle agreed to modify stifling environmental reviews for downtown projects that include no more than 200 units. The idea is to convince owners of underutilized buildings to consider conversions to housing.

———

Good news from West Seattle: Condo homes are now closing at Infinity Shore Club Residences, The first to sell was on June 12 – a 2-bedroom, 2-bath, 1244 sq. ft., fourth-floor home for $1.72M ($1387/sq. ft.). Another sale followed 11 days later and six others are under contract preparing to close.

The 37-unit condo near Alki Point has been through the wringer with delays: the pandemic, concrete workers strike, supply-chain constraints and, most recently, liens from building contracts. All matters slowed the six-story project from reaching the finish line until now.

We toured this stunning beachfront community earlier in the year and I would be delighted to give you the grand tour. Just give me a call.

———

The highest price ever paid in Washington for a condo home reportedly took place recently at Avenue Bellevue. A local buyer in the finance industry is the apparent new owner of a 3-bedroom, 4-bath penthouse with nearly 1000 sq. ft. of deck space on the 26th (top) floor of the Estates tower. The sales price: $14.35M, according to Puget Sound Business Journal.

Estates will also be home to an InterContinental Hotel, the first of its kind in the PNW. The community will include the Residences tower next door and in total deliver 365 homes as well as 208 luxury hotel rooms. Residences will likely open first in late summer followed about a month later by Estates.

LUXURY LIVING

This is the time of year when a residence could benefit from having a pool – and this month’s luxury real estate living segment includes an ideal option in leafy Clyde Hill. It’s a 4-bedroom, 2.75-bath, 3620 sq. ft., 1-story with basement – and in-ground pool. Sitting high on a ridge with lake and mountain views, the home is landscaped with flora and fauna as well as majestic Douglas firs. It’s the first time the residence has been on the market in 45 years. List price: $3.89M ($1076/sq. ft.), after a recent drop from $4.1M.

North to Kirkland, check out this 4-bed, 3.25-bath, 4430 sq. ft. 1 ½-story with basement – and 77 ft. of outdoor “pool” in the form of Lake Washington waterfront. This Northwest contemporary home seamlessly blends vaulted wood ceilings, walls of windows with Mt. Rainier views and stone fireplace with a covered patio overlooking a dock and water. A masterpiece, once owned by former Seahawks defensive end Grant Wistrom. List: $6.895M ($1556/sq. ft.)

On the opposite side of the lake and this 4-bed, 3-bath, 3650 sq. ft., 2-story, mid-century modern home in the Laurelhurst neighborhood of Seattle. The living room will take your breath away, along with the 50 ft of waterfront. Making this residence stand out is a 2-bed lake house accessible via a small funicular. Must be seen! List: $6.95M ($1904/sq. ft., excluding lake house sq. ft.).

The water theme continues with this small Pine Lake/Sammamish 2-story home, featuring 3 bedrooms, 1.75 baths, 1820 sq. ft. and 50 ft. of waterfront. The home was built in 1943 and appears to be well-loved – including wood beam ceilings – but the seller is willing to include floor plans and renderings of a potential new home on the just-shy half-acre lot. Not a lot of privacy with your neighbors, however. List: $2.7M ($1484/sq. ft.)

We finish with a Redmond stunner along West Lake Sammamish. This 4-bed, 4-bath, 6640 sq. ft., 2-story contemporary home with basement comes with 160 ft. of waterfront. Big. Bold. Beautiful. Rich hardwood flooring. Cathedral ceilings in a spacious living area. So much to appreciate: wine cellar, theater, music room, sauna, steam room … and sandy beach. One of my favorite listings this year. List: $6.8M ($1024/sq. ft.)

What else is happening in and around your Seattle?

Summer Outdoor Movies, through Aug. 25

This time of year is special with comfortable weather and outdoor activities, including free movie nights. Bellevue hosts screenings on Tuesday nights at Downtown Park (10201 NE 4th St.) and Thursday nights at Crossroads Park (16140 NE 8th St.). Watch your favorite family films on a 40-foot screen and pre-show entertainment from 7pm through August. Details. Movies at the Mural returns to Seattle Center (305 Harrison St.) on Friday nights through August. Bring your low-back chairs, blankets or bean bags. Details

Renton River Days, July 21-23

Come one, come all to a special weekend of family fun in Renton. River Days has food vendors, a beer & wine garden, entertainment, children’s activities, drone show (July 21, 9:30pm), parade (July 22, 10am), pancake breakfast and fun run (July 22) and car show (July 23). Free.

Bite of Seattle, July 21-23

Food, drink and tunes – a perfect combination for summer fun. About 200 vendors will showcase fantastic food at Bite of Seattle as the event returns after a pandemic break. Come to Seattle Center (305 Harrison St.) near the International Fountain and check out cooking demos, a beer & spirits garden and dozens of performances, including from Sir Mix-a-Lot and Polyrhythmics. Free to attend.

Capitol Hill Rocks, July 21-23

Sofi Tukker, Denzel Curry and Louis the Child headline the Capitol Hill Block Party. The annual music festival is expected to feature 80 bands, as well as DJs, craft booths, food trucks and beer gardens. Enter at 12th Ave. and E Pike St. Tickets.

Chinatown Parade, July 23

Chinatown Seafair Parade features lion and dragon dances, martial arts and the Chinese Girls Drill Team in the international district. The parade passes by Hing Hay Park (423 Maynard Ave. S.) 7-9pm.

Art Fairs, July 28-30

Two art fairs take place on the same weekend. The Seattle Art Fair showcases works from 77 galleries around the world at Lumen Field Event Center (800 Occidental Ave. S.) (Tickets) and The Bellevue Arts Museum Arts Fair includes free projects for children (11am-5pm). Bellevue Square mall hosts the top curated artists in its west parking garage and offers two entertainment stages – in the mall and outdoors at the east entrance. (575 Bellevue Square). Free.

Torchlight Parade, July 29

Colorful floats, drill teams and pirates move south on 4th Ave. (from Seattle Center to Westlake Park) in the Seafair Torchlight Parade. Free or buy a reserved seat. Note this year’s early start: 3pm

Ships, Sailors and Seattle, Aug. 1-6

Seafair Fleet Week includes free ship tours, displays, demonstrations and entertainment on the Seattle waterfront. Tours are at Pier 66 on Aug. 3 and Piers 46 and 69, Aug. 3-6.

Bike Festival, Aug. 4-5

Gigantic Bicycle Festival has live music, hand-built bikes, art, food, workshops, Friday night films and Saturday rides at Centennial Fields Park (39903 SE Park St.) in Snoqualmie.

Seafair, Aug. 4-6

Seafair Weekend Festival features hydroplane racing on Lake Washington, the Blue Angels air show and classic cars parked on the lakeshore at Stan Sayres Memorial Park (3808 Lake Washington Blvd. S.), Plus, the Museum of Flight (9404 E Marginal Way S.) will host Jet Blast Bash (Sat.-Sun.) with “fast planes, music, food vendors, and a beer garden with the closest seats to the thunder of the Blue Angels’ takeoffs and landings.”

Professional Golf Tournament, Aug. 11-13

Seventy-eight Champions (Seniors) Tour pros compete for $2M in the Boeing Classic men’s tournament at The Club at Snoqualmie Ridge (36005 SE Ridge St.). Opening and closing ceremonies include a jet flyover, weather permitting (Fri., 11:15am and Sun., ~4pm).

Events are subject to change. Please check with venues to confirm times and health-safety recommendations.

In case you missed it….

We touched on a wide variety of topics in the past few weeks on my Living the Dream blog.

To mark Pride Month, we examined the trends in LGBTQ+ homeownership and how the community is facing greater challenges – including accommodation – across our divided nation.

I also researched a topic near and dear to me – smart-home technology – and tips on how to get started. Plus, the article links to a booklet that covers the many facets of smart tech in the home.

And, I spent a sunny day visiting a storied landmark in Seattle. No, not the Space Needle or Pike Place Market. I walked throughout our city’s longest-operating burial ground to see the names from our storied past – Yesler, Renton, Denny, Bell – and some of our heroes from recent decades, including Lee and Russell. Check out my video blog post to see for yourself.

Please forward this newsletter to someone you think will enjoy reading news and insights from a former Wall Street Journal editor and now full-time real estate professional – or share a link for them to sign up for this monthly update. Thank you!