Talking about the economy can be as exciting as watching the Best of the Yule Log Channel (no, that’s not really a thing … is it?). Except the economists I follow are sending up some red-flag warnings for the months ahead.

We have all heard about this pent-up energy to get out of the house and live/breathe again – literally and figuratively. Like watching thoroughbreds being placed into the gate before a race, there is that moment of anticipation just before the doors open … and then, they’re off! Picture the same scenario for Americans eager to enjoy the warm temperatures and be anywhere but inside the home.

“The outlook for the next two to three months is really, really rough,” predicts Marci Rossell, an economist with LeadingRE, an international luxury real estate portal that includes John L. Scott as a founding member. “[But] I think it’s going to last [only] about six weeks.”

Rossell sees this as a case of extreme demand pushing prices into inflationary zones for items ranging from hotel rooms, tickets to theme parks, flights and “all kinds of little weird, funky markets we haven’t even thought of at this point.”

Take gas for the car. The roads will likely be stuffed with vacationers in the coming months, applying pressure on demand for fuel. You can already see prices rising in Washington. The average cost for a gallon of regular unleaded was $2.67 this time last year. It’s $3.33 (as of this writing), up from $3.16 a month ago – and we’re not even close to peak season.

The price of lumber to build homes and add decking, as well as metals for buildings and appliances has shot up. “If you can put off buying a new refrigerator, do it in six months,” Rossell offers. “If you can put off buying new patio furniture, do it in three to four months.” Great advice because everyone will appear to be thinking the same way as you and I.

The Federal Reserve recently revised its forecasts for this year, saying it expects the economy will expand 6.5%, up sharply from its forecast from December of 4.2%. The Fed also projects inflation to jump to 2.4% by year’s end after an original expectation of 1.8%.

“I’ve been calling it the fireworks economy,” Rossell says, anticipating explosive growth that triggers a pop in inflation, interest rates and shortages for all sorts of things. “A fireworks economy isn’t that gradual movement where everybody has time to adjust. This is going to be completely different,” Rossell adds.

Hold on for a bumpy – and inflationary – ride!

BY THE NUMBERS

More buyers are making larger down payments. The median down payment on single-family homes and condos purchased with financing jumped 19% in Q4 of 2020 from the previous quarter. Buyers in the U.S. were putting down $24,500 in the most recent survey, up a whopping 82% from Q4 2019 ($13,441).

The median down payment represents 7.7% of the median sales price for homes purchased with financing, up from 6.6% from the previous quarter. The median sales price of a U.S. home was $313,000 through February, a sharp 16% higher from a year ago, according to the National Association of Realtors® (NAR).

Of course, most of these figures pale in comparison to our market, where median home prices across King County are more than twice the national average (see the market report for March further down).

>> Once you own a place, watch out! Home appreciation is skyrocketing. Homeowners, nationally, gained a collective $1.5 trillion in equity in 2020 from a year earlier, according to S&P CoreLogic, a property information and analytics business. The boost in equity was helped most simply by saving more while in “pandemic hibernation” and from many homeowners refinancing mortgages amid generationally low interest rates.

>> In a survey of the largest 132 metro areas, western states are reaping the highest returns on investment. ATTOM Data Solutions, a real estate data-research firm, reports the top 10 areas with the highest ROIs in the U.S. were all on this side of the Rockies. San Jose, Calif., led the way with an 87.3% ROI on an average home sale and Seattle was No. 2 at 72.1%, followed by Salem, Ore. (69.6%), and Spokane (69.2%). The ROI is determined after the sale of a home.

>> In a separate study from ATTOM, price appreciation is now outpacing wage appreciation in 90% of U.S. housing markets. The national median family income rose just 4% from 2019 to 2020, according to the Department of Housing and Urban Development, while most home prices are jumping each year by 10% or more. This, of course, is making it far more challenging for many to get on the property ladder.

>> And in a different metric, Seattle-area home prices have risen 55% from December 2015 to the start of this year, according to Case-Shiller, a home-price index from S&P CoreLogic. Case-Shiller says Puget Sound-area (King, Pierce and Snohomish counties) homes priced under $490,000 were up 17% year-on-year while prices costing more than $741,000 rose about 13%.

>> Through February, the number of existing home listings across the U.S. stood at a record-low of 523,244, or 49% fewer than a year ago (just before the impact from the pandemic), according to realtor.com. There were an average 4.1 offers made on every sold home in February, NAR reported, and properties across the nation are currently finding a buyer in a record-low 20 days on average.

>> Counting both the demand for single-family and multi-family housing needed to meet current needs (plus factoring in demolished or lost housing), NAR projects we have a backlog in construction of 3.2 million new homes as of the start of this year.

STATE CAPITAL UPDATE

Among the many pieces of legislation being discussed in Olympia is one that will ease restrictions on ADUs, accessory dwelling units. To help increase affordable housing inventory, lawmakers are reviewing whether to remove requirements that homeowners must live on-site.

If enacted, city and county governments could still maintain owner-occupancy requirements on lots containing an ADU but also provide for exemptions, such as age, illness, financial hardship or disability. Local governments would have two years to adopt a system for reviewing hardship cases or lose the right to require owner-occupancy status.

The legislation would also remove limits on the number of unrelated people who can occupy a dwelling, if established health and safety guidelines are maintained.

The proposal passed the state Senate and is currently being reviewed in the House, where it is expected to pass and win the governor’s signature.

FOREBODING FIGURES?

The numbers appear foreboding. There are 2.54 million loans in forbearance – mortgage payments on pause, most likely for financial reasons during the pandemic. That sounds like a lot.

Since the start of the pandemic, 86% of forbearance loans exited successfully and mortgage holders returned to paying on schedule and, in many cases, deferred the missed payments to the end of the term. If the balance, 14% of the forbearance loans, fail to rebound, a total of about 355,600 loans could face foreclosure in the U.S.

That figure is roughly 0.7% of all mortgages in the country. By comparison, the Great Recession foreclosure rate peaked at slightly above 4%.

Here’s the key difference between now and 2008-2010: Homeowners have record levels of equity and should be able to tap into that to sell their homes – probably for a profit in this sellers’ market – and avoid foreclosure.

Experts believe these pre-foreclosure sales will be the predominant form of distressed property transactions as the pandemic slowly wanes and government foreclosure moratoria and mortgage forbearance programs expire. Those options are scheduled to end June 30 but may be extended.

Amid this home-equity silver lining, the Consumer Financial Protection Bureau (CFPB) is warning loan servicers of the imminent surge of homeowners seeking help navigating the process: ”Responsible servicers should be preparing now. There is no time to waste, and no excuse for inaction. No one should be surprised by what is coming,” said CFPB Acting Director Dave Uejio.

An estimated 155,800 households in our state, or about 6.5% of those paying mortgages, are not caught up, as of February.

Washington state expects to get at least $50 million for mortgage assistance from the latest federal stimulus bill, said Margret Graham, a spokesperson for the Washington State Housing Finance Commission. It is likely to take at least three months for that assistance to be available to homeowners, according to a report in The Seattle Times.

Homeowners who are behind on their mortgage payments can find counseling and other help at homeownership-wa.org or by calling 877-894-4663.

This month’s main photo is of course of the Space Needle and the newly named Climate Pledge Arena (center left). The image was taken from a drone above The Parc, a condo in Belltown, where I am promoting one of my new listings. Check out the details of this wonderful home at parc606.com.

MARCH HOUSING UPDATE

The screws are tightening on an already tight housing market. The March report from the Northwest MLS, released April 7, showed the number of new listings and Pendings (mutual acceptance) rose at about the same rate across King County, indicating buyers are making deals on homes as soon as they hit the market.

The inventory numbers bear that out, as each area of the county experienced a decline in available homes even while listings rose by about 42% month-to-month for all home types. Total inventory (including single-family and townhomes, condos and manufactured homes) shrank in King County to 0.6 month (or 18 days of inventory), down from 0.9 in February.

Single-family home inventory alone sank to 0.4 month in the county – essentially all listings would be gone in 13 days if no others came on the market. Every key submarket saw the monthly figure drop from February: Eastside declined to 0.4 month (from 0.6), Seattle dropped to 0.6 (0.8) and the area around Dash Point/Federal Way declined to only 0.2 (6 days), half of its February figure.

New listings of single-family homes (SFH) in King jumped 48% from February while Pending sales rose 44%, leaving little excess on the market (976 total SFH listings available in King County by month’s end compared with about 2100 listings in March 2020 and 3300 the year before). It’s impossible to beef up inventory when there is a 61% increase in new listings on the Eastside, as was tabulated in March, and a 63% rise in Pending sales from the previous month.

James Young, director of the Washington Center for Real Estate Research at the University of Washington, said March marked the first post-Covid/pre-Covid comparison in housing data. “It is very difficult to compare year-on-year results once lockdown started in late March 2020,” he was quoted in the monthly MLS press release. (Month-to-month or 2021 vs. 2019 comparisons are the best options.)

Median prices continued to climb for SFHs, now at $824,997 across the county, up 10% from February. North King County led the charge, with a 15% month-to-month increase in median prices to $805,250 (yes, in one month!). Home prices also rose a steady 6.7% in a month in Southeast King – including Enumclaw and Maple Valley – to $640,250, and Seattle prices gained 3.4% from the previous month to a record $825,000.

The shortage of homes coupled with a sign that low interest rates are inching higher have prompted bidding wars on almost every listing in our area. Many buyers are looking at the list price as a starting point in their offers, which means they should be looking for homes 5%-10% below their affordability limit.

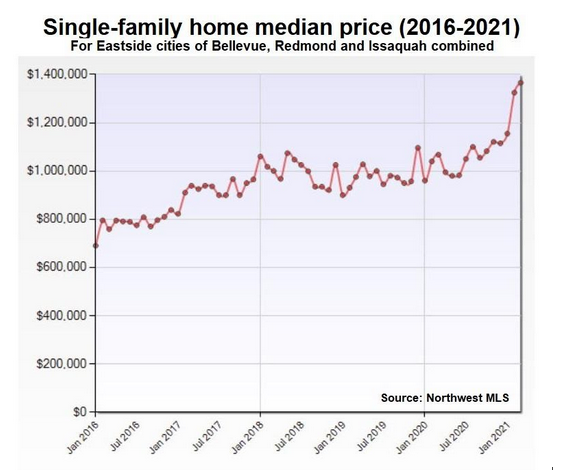

The number of luxury sales (homes priced at or above $2M) across all Western Washington has surged this year to 400 compared with 178 last year, making it the highest figure for a first quarter in the past 5 years. The median price for a home on the Eastside has jumped 30% since this time last year, and the area comprising Bellevue, Redmond and Issaquah has surged 23% since the start of this year. It is now, by my math, at $1.366M:

The condo market is improving across the county, where it saw a 25% increase in new listings from February – including a 33% jump in Seattle to a level (431) not seen for the month of March since 2010 (543). At the same time, more condos reached mutual acceptance, with the number of Pending listings jumping 34% from February. This has led to a continued narrowing of inventory, down to 1.1 months across King, from 1.5 the previous month and 2.0 months in Seattle from 2.8.

“We’ve seen a gradual improvement,” noted Erik Mehr, whose company markets new construction projects across the area, including Seattle condos Nexus and KODA. “Starting the first quarter of this year, we’ve seen inventories continue to slowly trickle down across the downtown market. We are going to see slow, steady progress and demand continue to escalate over Q2.

“By Q3, you’ll really start to see things ticking along as people come back to the offices and vaccines are pretty well prevalent,” Mehr said.

Median condo prices added 7.1% ($470,000) from February in King as well as on the Eastside ($575,000) and gained 4.2% ($495,000) in Seattle. Downtown/Belltown saw prices decline 0.4% from February to $615,000 and down 10% from the start of the year.

Elsewhere, home prices were on the rise. In addition to King County’s 9.0% median price increase on all home types compared with February, Snohomish (5.5%), Kitsap (5.3%) and Pierce (3.3%) also saw gains. Single-family home prices climbed more sharply in King (10%), and less so in Kitsap and Pierce (both 3.9% increases from February) and Snohomish (2.6%). SFH prices in Snohomish have appreciated the most in our region this past year, rising 22%, with Pierce right behind at 17%.

Click here for the full monthly report.

CONDO NEWS

There is renewed optimism at The Gridiron, the 107-unit condo just a football toss from Lumen (nee CenturyLink) Field. The 107-unit structure – former home to Johnson Plumbing – opened in 2018 with fanfare but sales fell off sharply in 2020. One insider told me the number of new-home sales last year could have been counted on one hand. And that’s not a surprise.

The effects of the pandemic on the city – and Pioneer Square in particular – have been “horrific,” this person said. The city essentially closed for about year and there is no telling when street-level businesses will return in earnest or exactly when workers – and how many – will come back to their offices.

The Gridiron even had its retail lineup settled on the ground floor, with plans to open a pizza kitchen, bar, high-end restaurant and coffee shop. That all fell through for a variety of reasons.

We do know fans will be returning – in lower numbers at first – to see the Mariners play just down the street from the condo. And this is likely to extend to the Sounders and Seahawks, a chance to reinvigorate interest in the area for home-shoppers and -investors.

About 30 units are on the market – mostly new, never occupied homes. Prices on the MLS range between $850 and $1000/sq. ft. A few other units are available for rent. What is also true: There is no urgency to cut the price for the sake of finishing the project.

“We are not doing a fire sale,” the insider told me. “Price is not the issue. It is the unknowns in our city.”

——–

The International District is anxiously awaiting the opening of its tallest condo. KODA, at 17 stories, will be more than double in height than any other residential tower in the immediate area. The project marketing director told me KODA is on track to open in May and has pre-sold about 64% of the 201 units.

Home prices start in the lower $400,000s and I am happy to show you around the building. It is open for guests and select brokers to tour – with social distancing always in mind.

——–

The Graystone completed the first five floors of the 37-story luxury condo and expects to be opening the doors by the fall of next year – an ambitious goal. The sales team is promoting select units, including #608 at just under $600K. Parking starts at $75K, or $87K for an electric-charging space.

Amenities for the First Hill tower include a top-floor, indoor/outdoor lounge with fireplaces, exhibition kitchen with private dining, and grilling stations, as well as lower-floor fitness center, yoga studio, dog lounge/run, pet wash and bike storage/bike-share area. Interested buyers can make a risk-free, fully refundable $5,000 reservation. Let me know if you need representation.

——–

Just before we hit “send” on this monthly email, Spire, the 41-story luxury condo where Denny Way meets 6th Avenue and Wall Street, announced the waiving of Homeowners Association dues for two years. Wow!

How much can a buyer save? A 1007 sq. ft., 1-bed, 1-bath and den would typically charge $977 a month for HOA dues. If my math is correct, that’s a potential savings of $23,448, or up to $45,000 off a purchase of a 3-bed home. Homes start in the high $400,000s. The offer expires April 30.

LUXURY LIVING

The quality and variety of our region’s luxury home listings have even me grasping for words. How many times can I write “Simply Stunning!”?

Take this 3-bedroom, 2.25-bath, 2610 sq. ft., multi-level, modern mansion with rooftop deck in the Blue Ridge section of Northwest Seattle. Please take it! The 1977-built home, designed by local architect Wendell Lovett, features rounded corners at nearly every turn – and even a spiral staircase. It’s perched high on a cliff that overlooks Puget Sound with the northern tip of Bainbridge Island in the distance. Plus, the community offers a private beach, pool, tennis courts (though HOA dues are $1488/year). List price: $2.75M ($1054/sq. ft.). See for yourself!

The Lakemont section of unincorporated Bellevue offers an award-winning estate on a half-acre in the shadows of Cougar Mountain. Feast your eyes on this 4-bed, 5-bath, 6055 sq. ft. Northwest contemporary one-story home with basement. The 1996-built home, from Bellevue-area designer Curtis Gelotte, includes custom stonework, an indoor “skybridge” overlooking the great room and indoor garden with a real stream running through. You must see it to believe it. Owners are asking $3.425M ($566/sq. ft.).

Don’t judge a book by its cover. When visiting this 4-bed, 3.75-bath, 4007 sq. ft. Madison Park home, you might think from curbside that it’s nice but nothing amazing. That’s why we wanted to share this immersive, 3-D tour and photos of the Boehm designed home (with elevator!). Soak it in and open your checkbook: $3.5M ($873/sq. ft.).

We take you near the top of Seattle, towards the clouds, and one of the rarest of finds – a 3-bed, 2.5-bath, 2284 sq. ft. penthouse, the largest West-facing condo unit at Insignia’s North tower. Surprisingly, this marks the third time the home has been for sale since the tower opened in 2016. The views on the 40th floor are unobstructed … and breathtaking. Look toward Elliott Bay, Bainbridge and beyond – anytime you like! Asking price: $3.688M ($1615/sq. ft.). For more information on the twin towers, check out my special report on Insignia at ILoveInsignia.com.

Finally, gape at this outstanding Redmond luxury home, which went Pending in just three days despite a hefty $7.95M asking price. Spanning 8580 sq. ft. on a just-shy 9-acre lot, this custom-built, 5-bed, 6.25-bath stunner in Novelty Hill is arguably worth every penny (okay, every $1000 bill!). The list of features is too numerous to share: chef’s kitchen, black-walnut flooring, stone-clad fireplace, bar and game room, 2500-bottle wine cellar, zero-edge outdoor pool, and home theater with stadium seating. Check out the narrated listing video!