No seasonal slowdown this year as real estate agents report a busier-than-usual fall

Housing Wire

SEPTEMBER 30, 2020

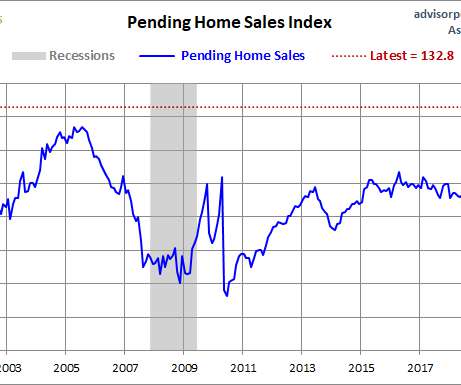

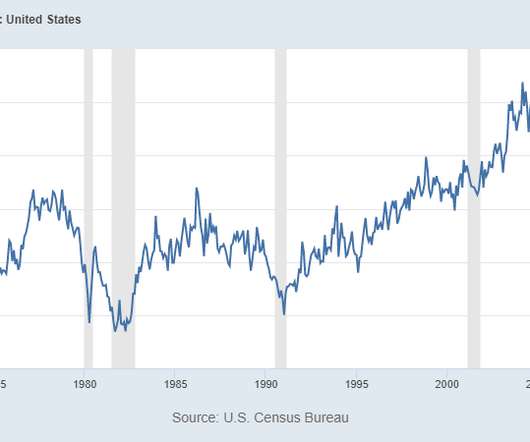

Realtors can usually count on their biggest season being spring, followed by summer, but nothing about 2020 has been normal, including home-buying patterns. With shut-down orders in the spring, summer became the new home-buying season, but homebuyers were still incredibly active in August. Now, believe it or not, fall home-buying season is in full swing.

Let's personalize your content