Is the Dallas Fed right to label this a housing bubble?

Housing Wire

MARCH 31, 2022

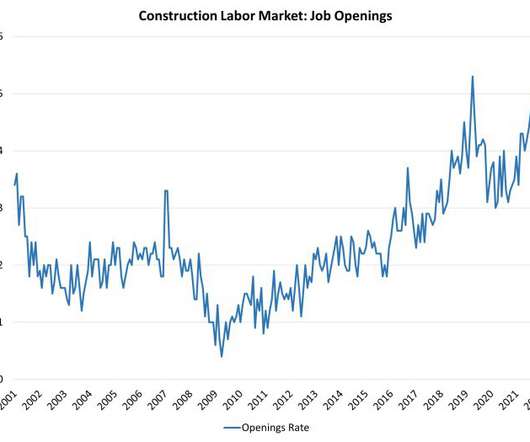

Are we headed to a housing bubble? The Dallas Fed on Thursday published an article titled: Real-Time Market Monitoring Finds Signs Of a Brewing U.S. Housing Bubble. The online reaction was immediate — housing must be about to crash. I disagree with this conclusion. That’s not to say that the data points the Fed used are incorrect — in fact, we are in a savagely unhealthy housing market , but it’s not a bubble.

Let's personalize your content