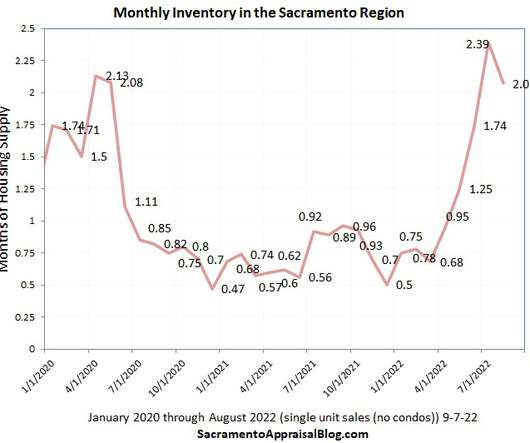

Buyers & sellers feeling stuck in the housing market

Sacramento Appraisal Blog

SEPTEMBER 9, 2022

I love the original Back to the Future movie. Do you too? Well, I can’t help but think of today’s housing market compared to the film. Sellers have tended to be stuck in the past expecting the market to be hotter than it actually is right now. And some buyers are stuck in the future, […].

Let's personalize your content