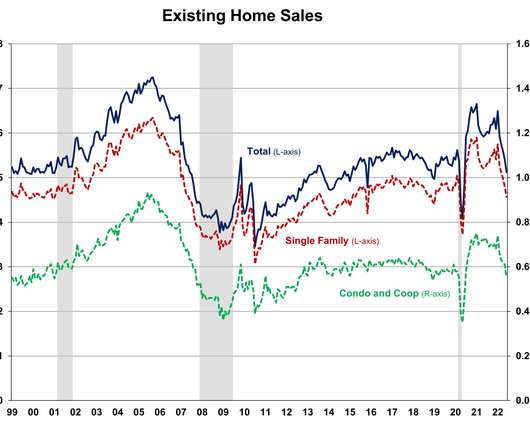

Existing home sales are still savagely unhealthy

Housing Wire

JULY 20, 2022

The savagely unhealthy housing market is continuing as we get closer to August. But, there is one bright spot — inventory is rising. We still have the unhealthy dynamics of noticeable sales declines, but prices are still growing year over year. This has been a concern of mine after the summer of 2020 as inventory levels were breaking all-time lows, facilitating unhealthy home price growth during a more prominent demographic patch in U.S. history.

Let's personalize your content