April Newsletter-All Time Low Supply Creating Bidding Wars

It has certainly been an interesting and busy spring! We are still seeing impacts from the winter storm in February. Many are still having repairs done to their homes due to the massive amount of damage that occurred from frozen pipes. They are still gathering the death toll but it is currently at 111 deaths. Our hearts go out to those with great losses from this catastrophic event. Of course, now it’s spring and we get to enjoy the beautiful bluebonnets in Texas. If you want to see some great places in North Texas check out this list but watch out for the dark side of the bluebonnets.

Housing Markets

Neither the winter storm nor the pandemic has slowed down the housing market as the demand is far greater than the supply of homes. The current supply of homes is as low as we have seen as far back as our data goes. Buyers that can’t find existing homes. Many are looking to purchase new construction and it is having a boom. Prices continue to climb and the cost of construction is rising and projected to keep rising. The price of lumber is up 193%.

Because the number of buyers is so much higher than the number of sellers, it’s a crazy seller’s market. One of our sons is currently looking for a house to buy and is experiencing bidding wars at every offer. Houses are not staying on the market longer than a week. It can be so discouraging when every time you make an offer you get outbid. Here’s a great illustration of what many are feeling when trying to buy a home in the current market conditions:

@johnsonfiles Anybody else in this crazy fight for a home?? ##realestate ##housingmarket ##comedy ##funny ##realestatetiktok ##realestatehacks ##houseshopping ##fixerupper

♬ original sound – The Johnson Files

What’s the Impact on Appraisals?

As appraisers, we understand how frustrating the home buying process may seem at this time. Please know, however, that in most transactions, the appraiser is working for the lender and providing the value of the collateral for the loan. Although appraisers do take into account that there were multiple offers on a property, we have to value the property with the current market support which includes analysis of the recent sales and using accepted appraisal methodology for our appraisals. However, there are ways to rebut the appraisal if you are dissatisfied. See here.

What’s Taking So Long?

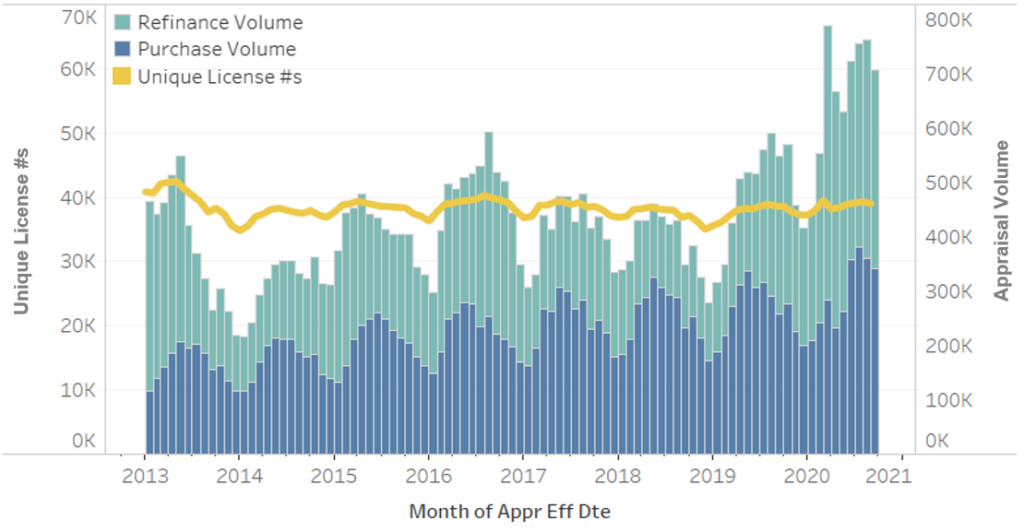

Appraisers are busy. Since mortgage rates at historic lows and the great demand for housing, the demand for appraisal services is at an all-time high. The chart below from Freddie Mac really illustrates the reason appraisers are so busy. There might be a few other reasons for the delay, see here.

Current Markets

Median Sales Price

Denton County

$370,500 | +16.1%

Months of Supply

Denton County

0.6 | -76.0%

Days on Market

Denton County

6 | -76.9%

Volume

Denton County

1,221 | -10.9%

Sale to List Price %

Denton County

101.2% | +3.3%

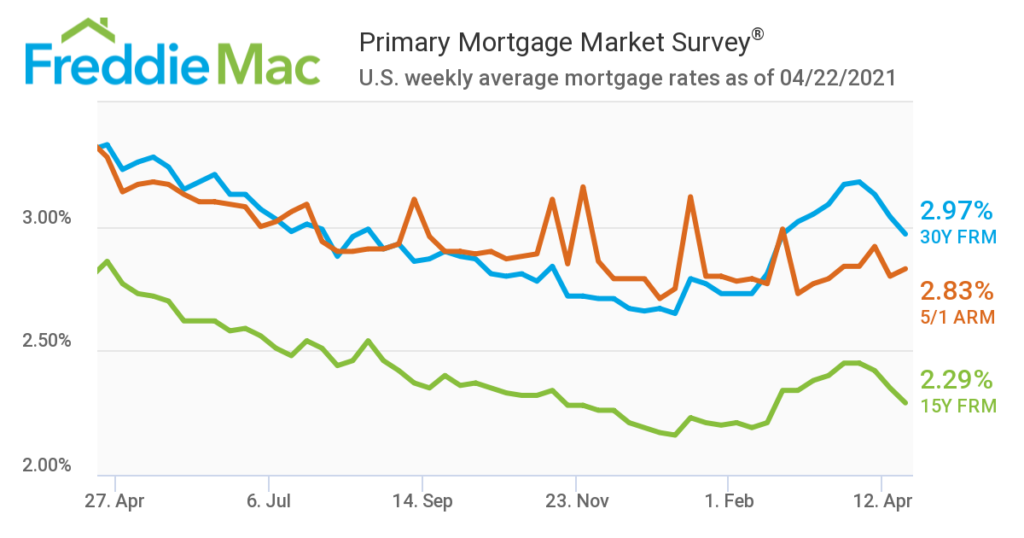

Mortgage Rates

Mortgage rates had been inching back up but just this week they went back down below 3% which is still fueling the high demand in mortgage volume.

Takeaways

We were already in a housing market with tight inventory and high demand and the pandemic has exacerbated the situation. The driving factors are:

- Demand for larger work from home space

- Demand for suburbs as millennials are moving out of the cities

- Historically low interest rates

- High cost of construction and labor shortages

- Mortgage forbearance has caused a shadow inventory

If one of these factors changes, it will impact the markets. If mortgage rates go back up or the supply of homes increases or foreclosures begin entering the markets, these could begin to balance out the markets. In the meantime, we will continue to watch our local markets to see what changes may occur as the Texas economy is rebounding as we make our way out of the pandemic. Please let us know if you have questions, topics for discussing, or need our services. Thanks for reading this newsletter and we look forward to reporting the market updates next month as we head into summer.

Great job. Your graphs look just like my market in terms of the direction of things. What a time.

Thank you! Yes interesting times indeed. I am now waiting to see what will be the impetus to start balancing the market.