What does another good job report mean for a recession?

Housing Wire

JULY 8, 2022

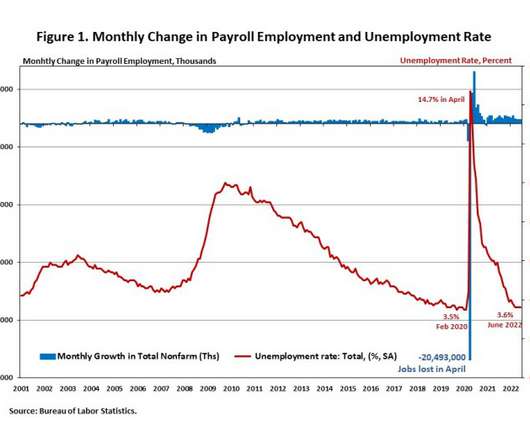

What does it mean to get a positive job report with all the talk about a recession, which ramped up starting in January 2022? Let’s look at the U.S. jobs and economic numbers as five of my six recession red flags are up today. The June data shows that we added another 372,000 jobs as we get closer to the employment numbers before COVID-19. We did have 74,000 negative revisions to the previous reports, however, the internals of this jobs report is the most interesting aspect.

Let's personalize your content