The housing market is a mixed bag

Sacramento Appraisal Blog

MARCH 21, 2023

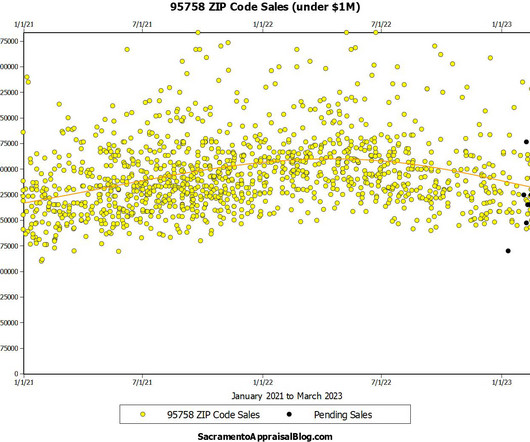

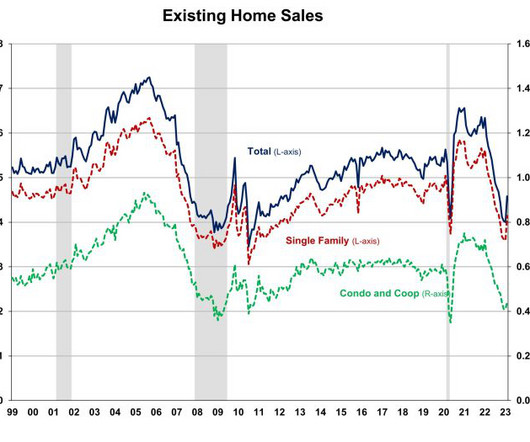

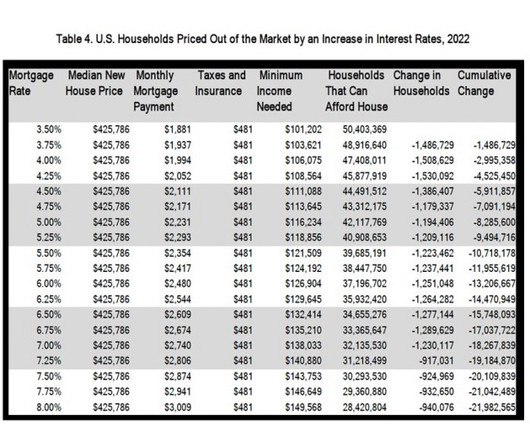

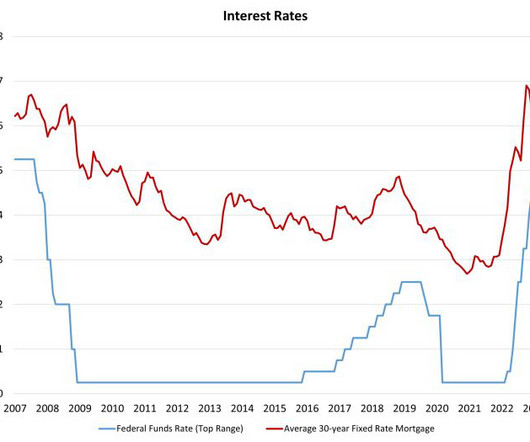

The housing market is a mixed bag. It’s not always easy to understand what the market is doing right now. Today I have some thoughts about prices, Zestimates, and cash buyers. Scroll by topic or digest slowly. UPCOMING (PUBLIC) SPEAKING GIGS: 3/24/23 How to Think Like an Appraiser (at SAR) 3/28/23 Downtown Regional MLS meeting 4/1/23 NAA […] The post The housing market is a mixed bag first appeared on Sacramento Appraisal Blog | Real Estate Appraiser.

Let's personalize your content