Are home prices about to fall?

Housing Wire

JUNE 8, 2022

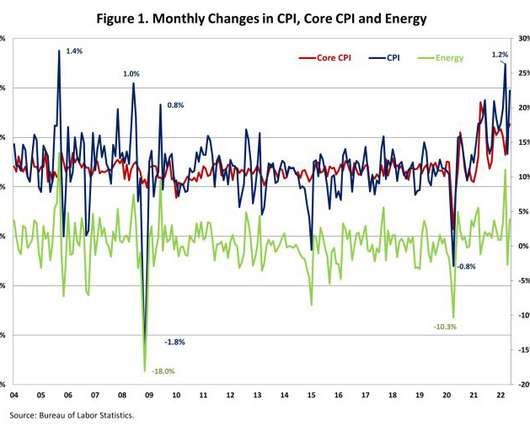

We are at the point of the economic cycle where I really just get two questions: Are we going into recession and are home prices about to fall? I am going to do my best to try to make sense of what is happening with the housing market right now, since the years 2020-2024 have been a talking point of mine for years and my biggest concern since the fall of 2020 has been prices overheating — not having a deflationary collapse. .

Let's personalize your content