Cash buyers are scooping up homes like mad

Housing Wire

JULY 16, 2021

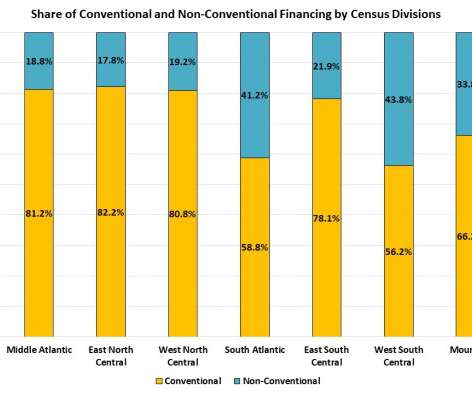

Cash buyers are pouring into the housing market this year, and they’re picking off more than half of available inventory in certain areas in Florida and New York. As of July 14, nearly one-third of U.S. home purchases this year were paid with just cash — 30%, specifically — according to a recent Redfin study. That represents the largest share since 2014, when 30.6% of homes were purchased with all cash.

Let's personalize your content