Mortgage rates jump to 3.92% amid high inflation

Housing Wire

FEBRUARY 17, 2022

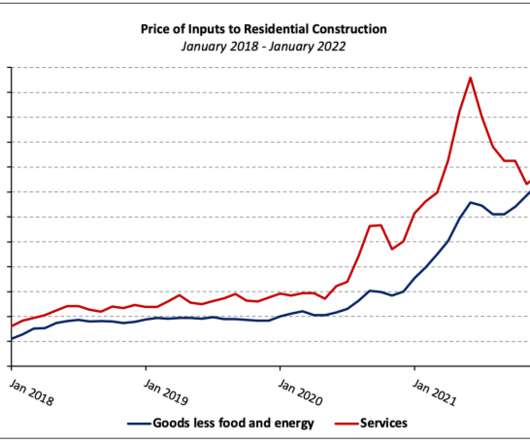

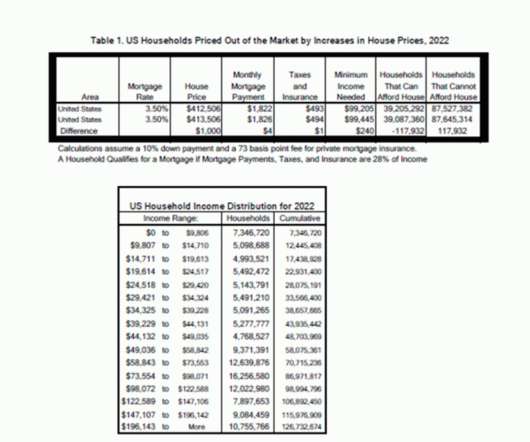

The average 30-year-fixed rate mortgage climbed to 3.92% for the week ending Feb. 17, up 23 basis points from the previous week. It’s the highest level since May 2019, according to the latest Freddie Mac PMMS Mortgage Survey. A year ago, the 30-year fixed-rate mortgage averaged 2.81%. The PMMS report is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20% down and have excellent credit.

Let's personalize your content